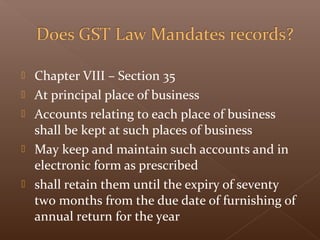

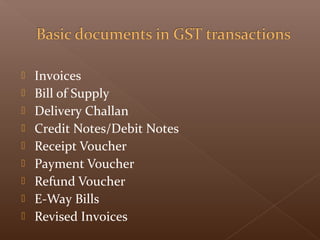

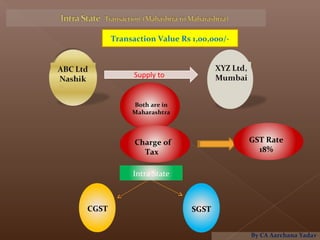

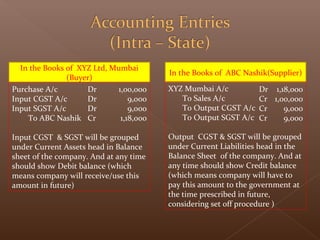

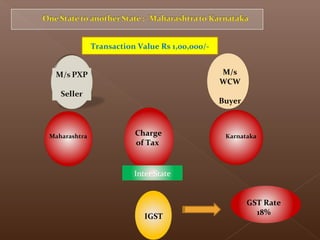

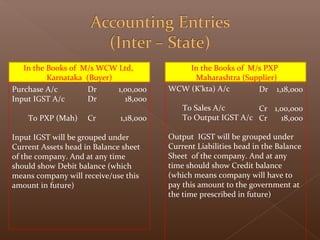

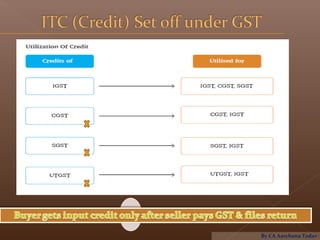

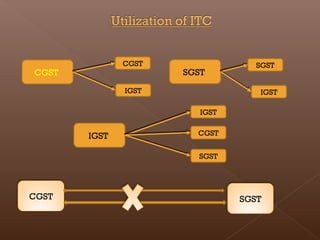

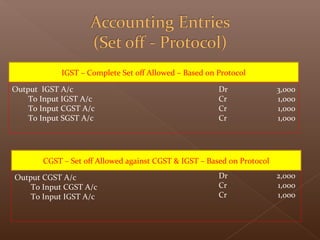

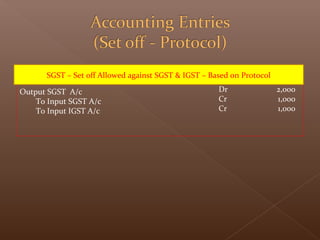

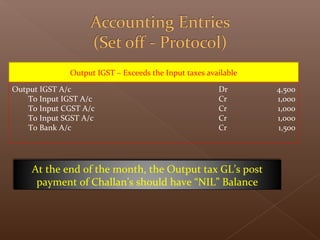

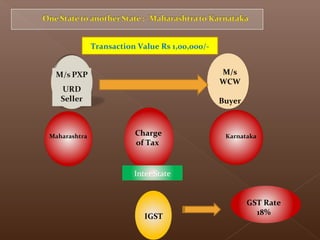

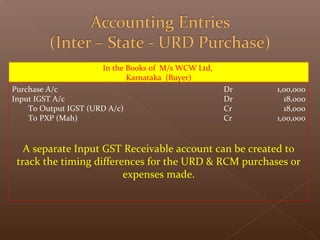

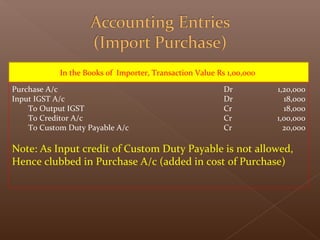

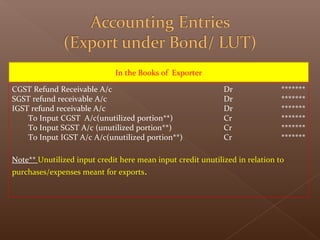

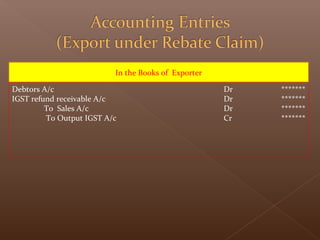

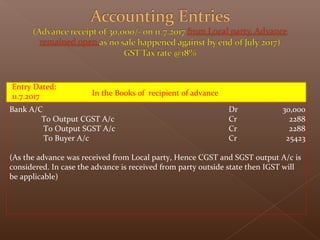

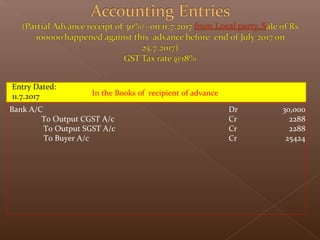

This document contains information about accounting for various GST related transactions including purchases, sales, input tax credit, output tax liability, refunds, and advances received. It provides accounting entries for intra-state and inter-state transactions under CGST, SGST, and IGST and explains concepts like set-off of taxes, separate ledgers for input and output taxes, and accounting for imports. It also covers accounting for tax refunds for exports and output tax on advances received.