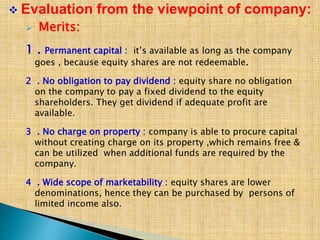

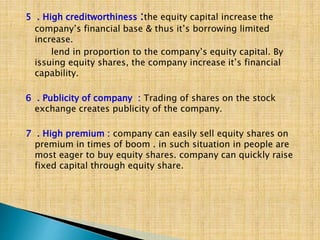

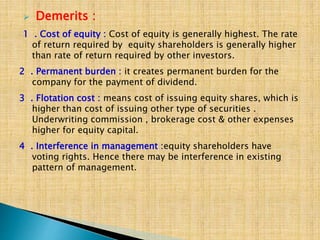

Equity shareholders are owners of a business and receive any residual profits after preference shareholders have been paid. They have rights to income, control, pre-emptive rights during new share issues, and residual claims over assets in liquidation. Equity shares provide permanent capital but have uncertain returns and are a residual claim. They offer higher potential returns but also higher risk than other securities.