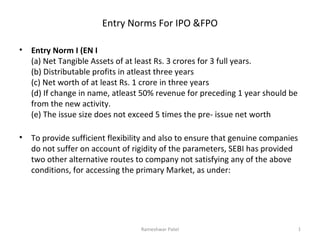

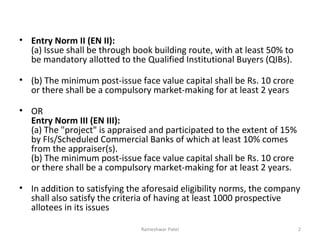

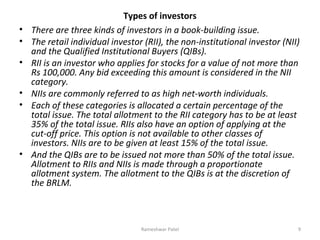

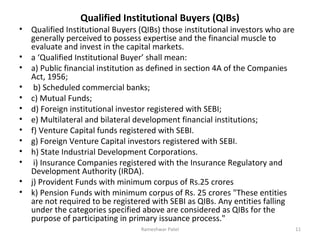

Entry norms for IPOs and FPOs in India require companies to meet certain financial criteria related to net tangible assets, distributable profits, and net worth over three years. For companies not meeting these criteria, there are two alternative routes using book building with a minimum 50% allotment to qualified institutional buyers and a post-issue capital of Rs. 10 crore, or using appraisal and participation from financial institutions with the same post-issue capital level. Qualified institutional buyers must meet certain qualifications like being public financial institutions, scheduled commercial banks, mutual funds, etc.