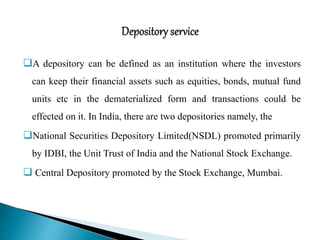

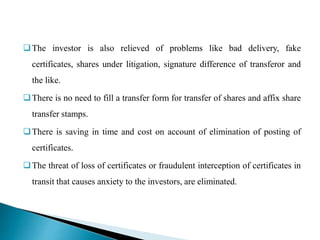

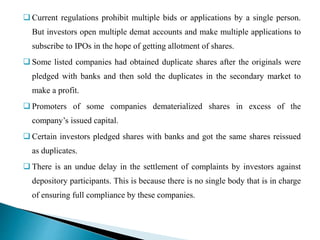

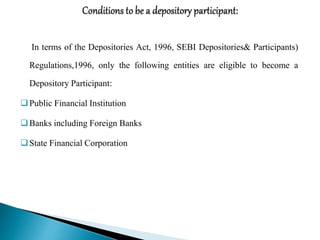

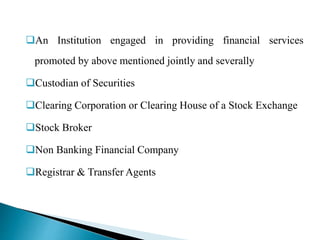

The document discusses depositories and their role in electronic trading of securities in India. It explains that National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL) are the two main depositories that maintain electronic records of shares and debt instruments after dematerialization. Depository participants act as intermediaries between the depositories and investors, offering services like dematerialization, rematerialization, and maintaining electronic records of security holdings and facilitating settlement of trades.