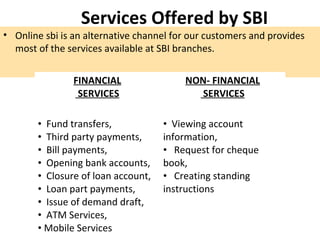

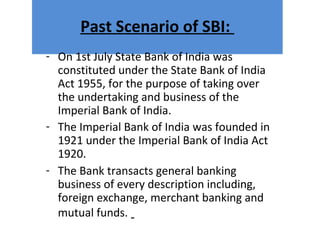

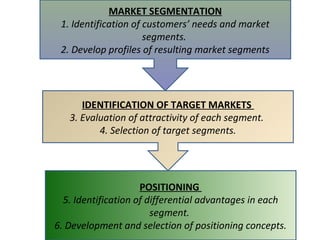

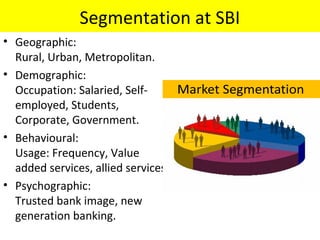

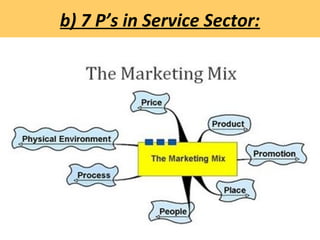

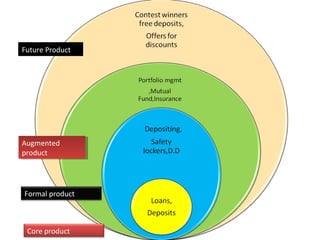

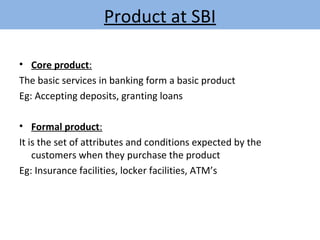

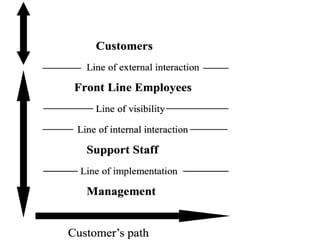

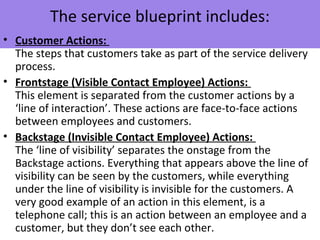

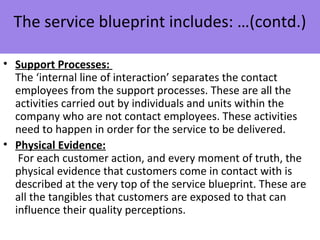

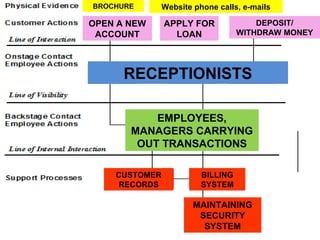

The document provides an overview of State Bank of India's (SBI) service sector management. It discusses SBI's introduction and history, past and present banking sector scenarios in India, SBI's products and services, and its marketing mix including segmentation, targeting, positioning and the 7Ps framework. It also presents a service blueprint mapping SBI's service delivery process from the customer and employee perspectives. In summary, the document profiles India's largest bank, SBI, and examines its management of services.