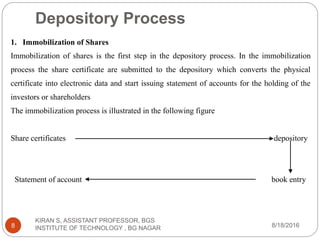

The document discusses India's depository system. It defines a depository as a central location for keeping securities electronically on behalf of investors. The two main depositories in India are National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL). The document outlines the objectives, activities, interacting systems, and advantages of the depository system. It also describes the process of immobilization of shares, depository participants, clearing and settlement through depositories, and regulations relating to depositories per SEBI regulations.