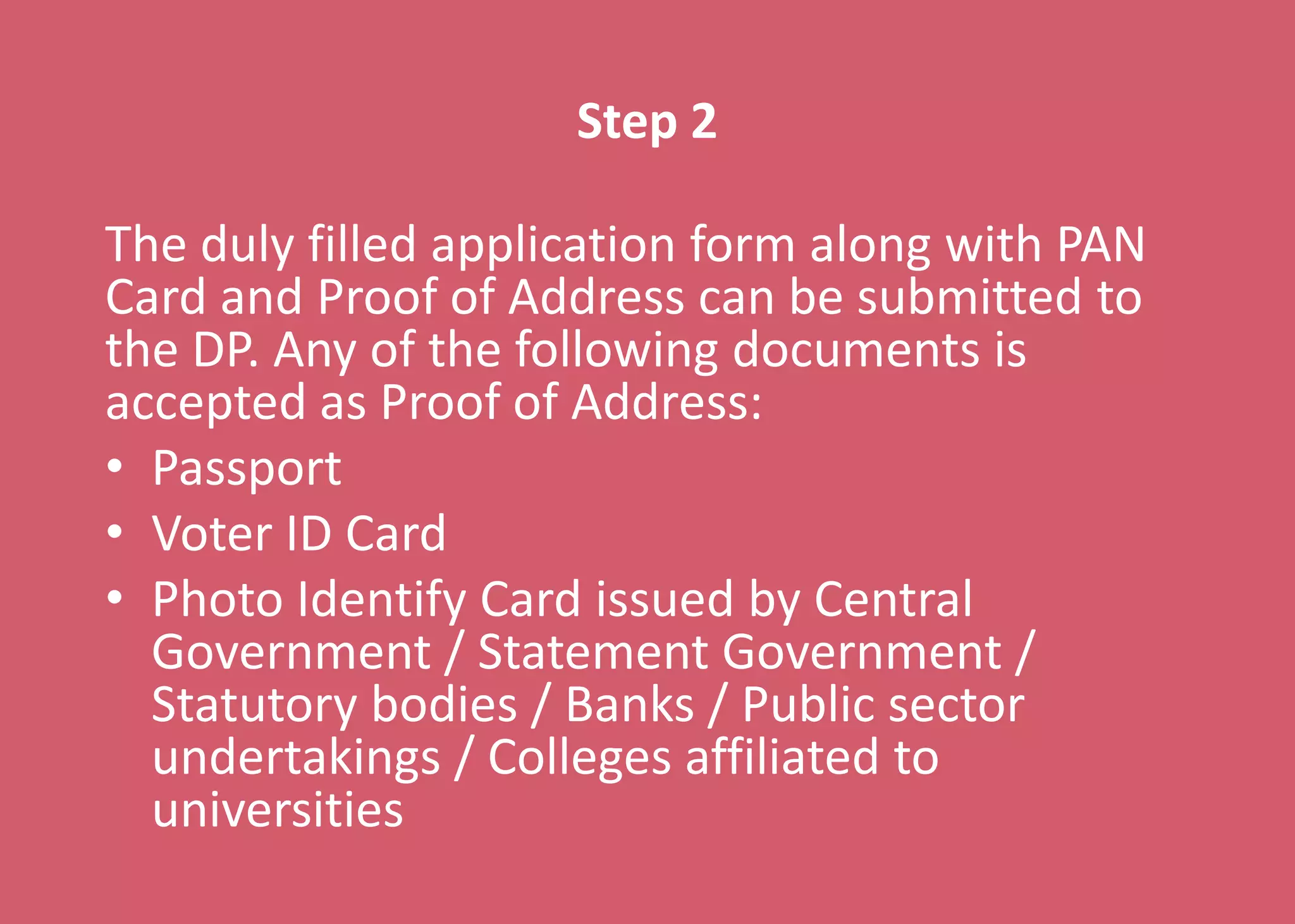

To open a demat account, one must obtain an application form from a Depository Participant registered with the Depository and SEBI. The application requires submission along with PAN card and proof of address. Upon signing an agreement detailing rights and duties, the DP will open an account and provide a 16-digit demat account number. This number allows purchases and investments to be added to the account, and sales to be deducted. Demat accounts allow paperless trading of securities in electronic form.