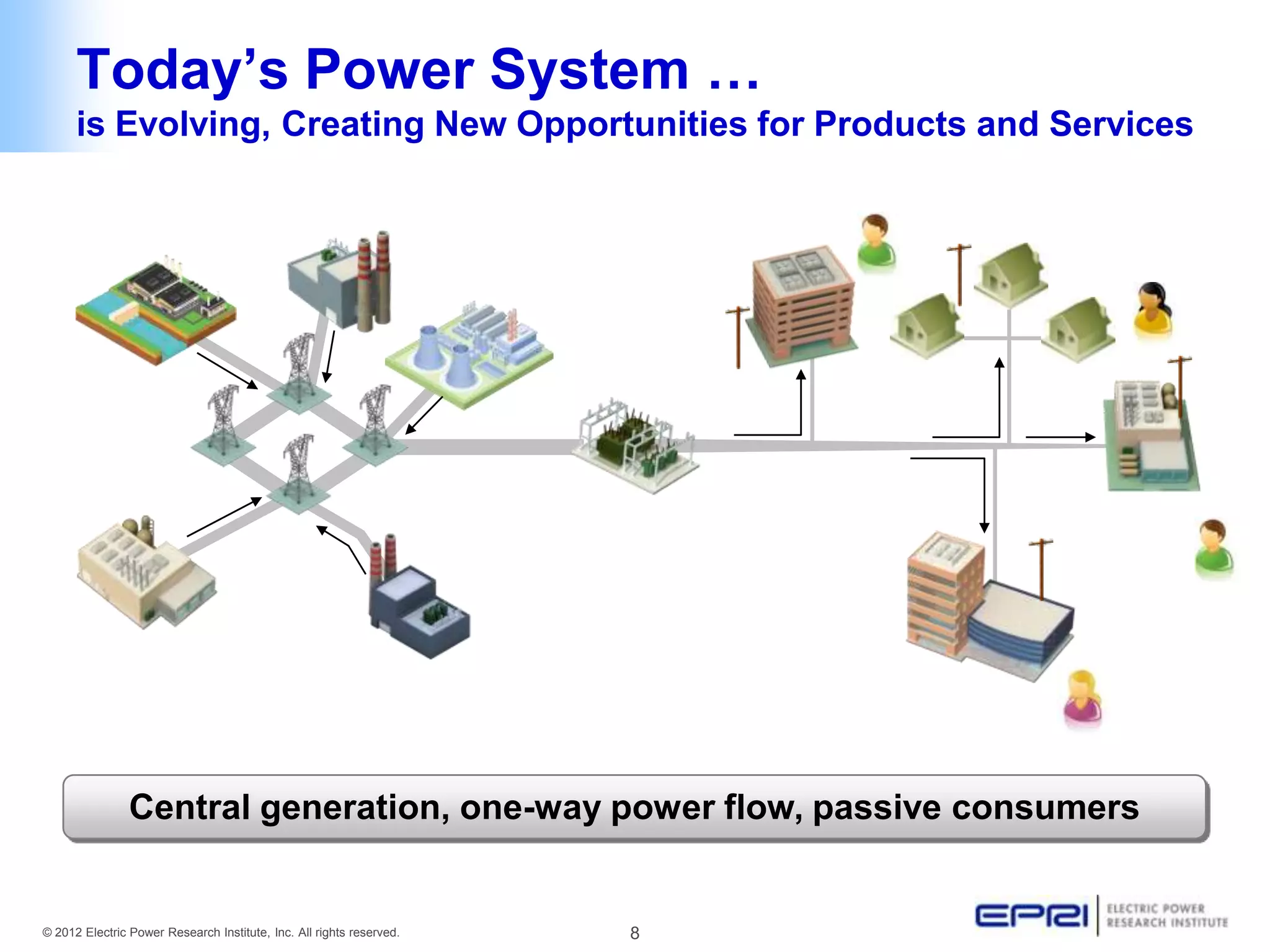

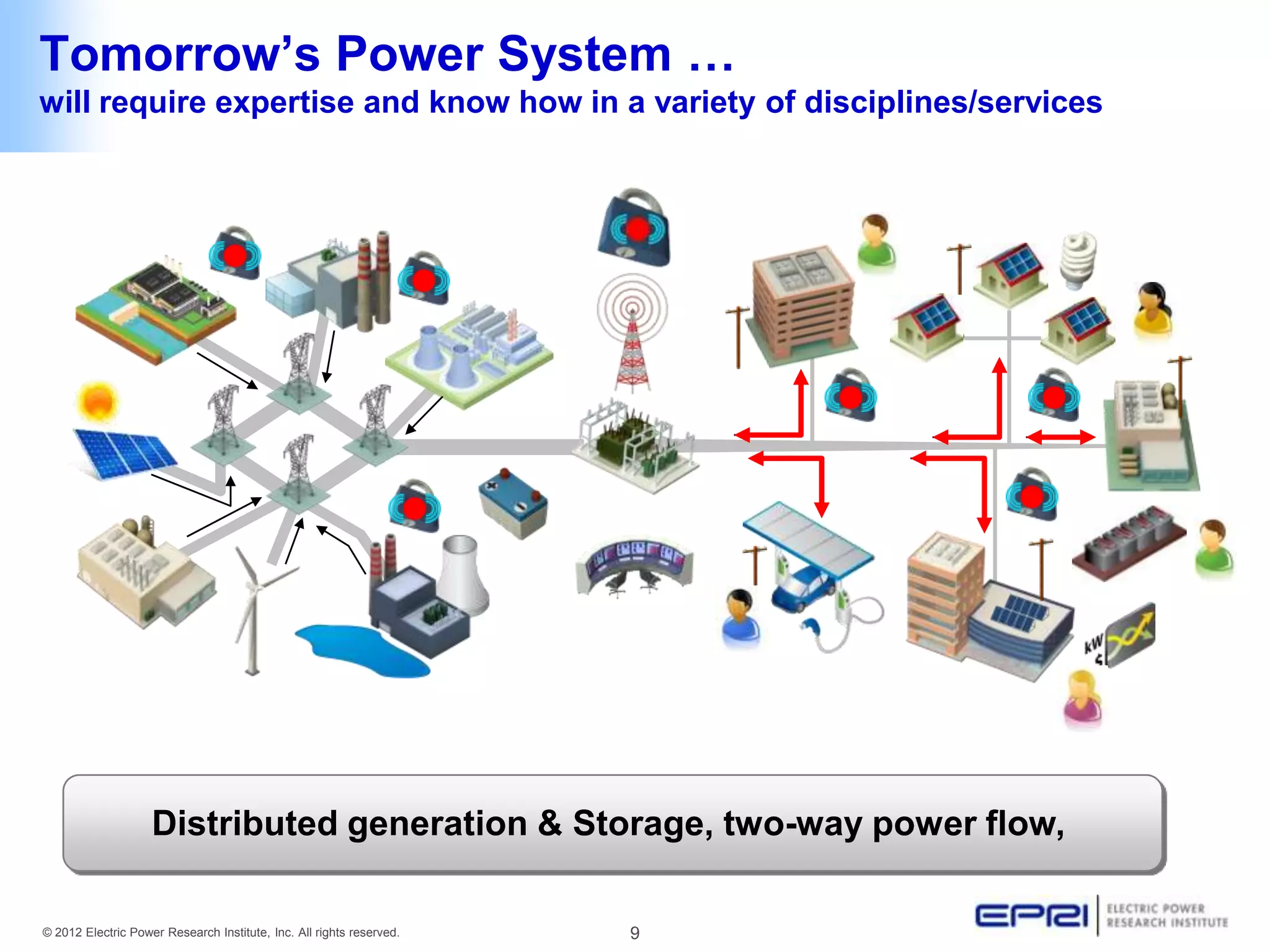

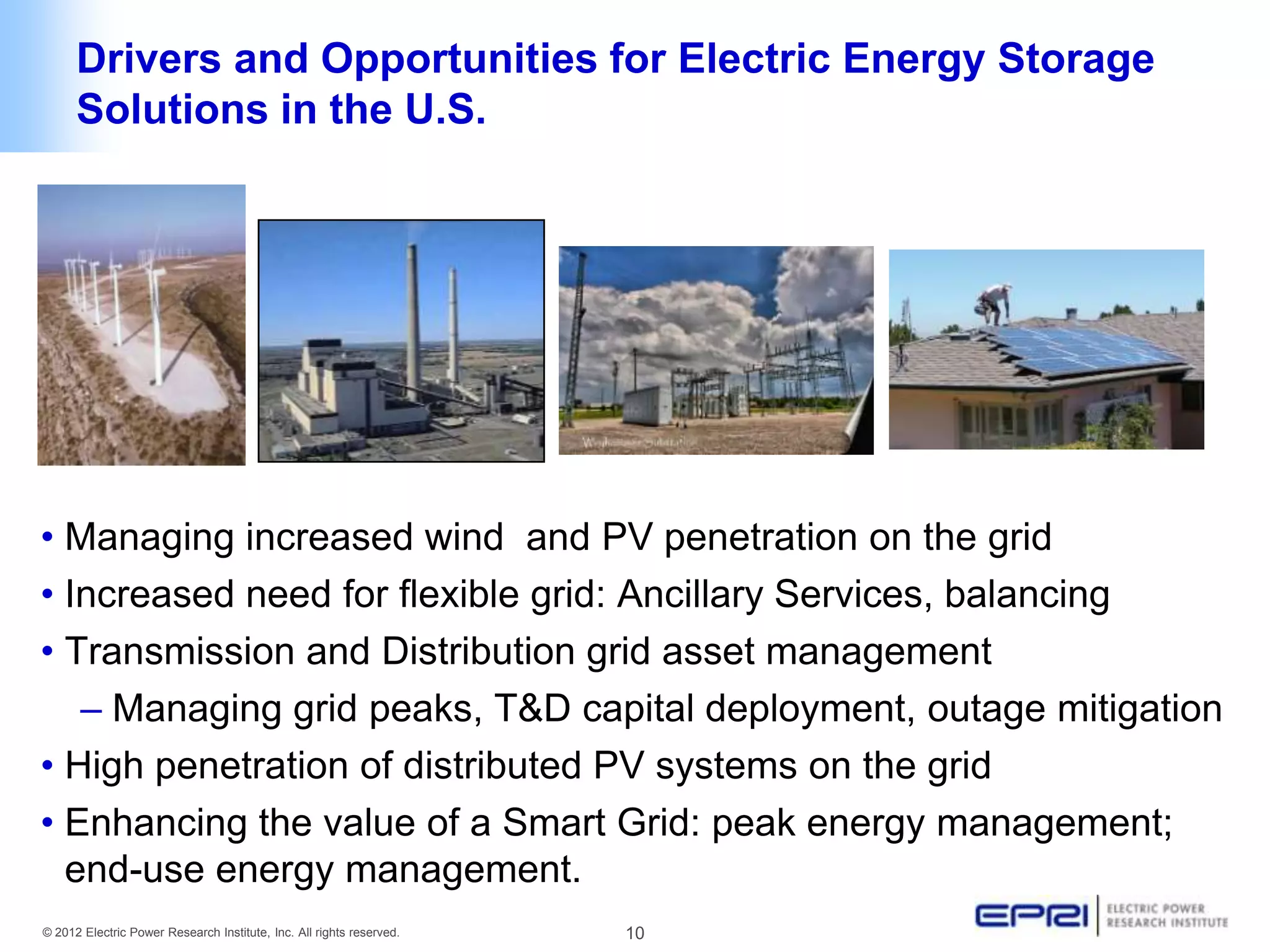

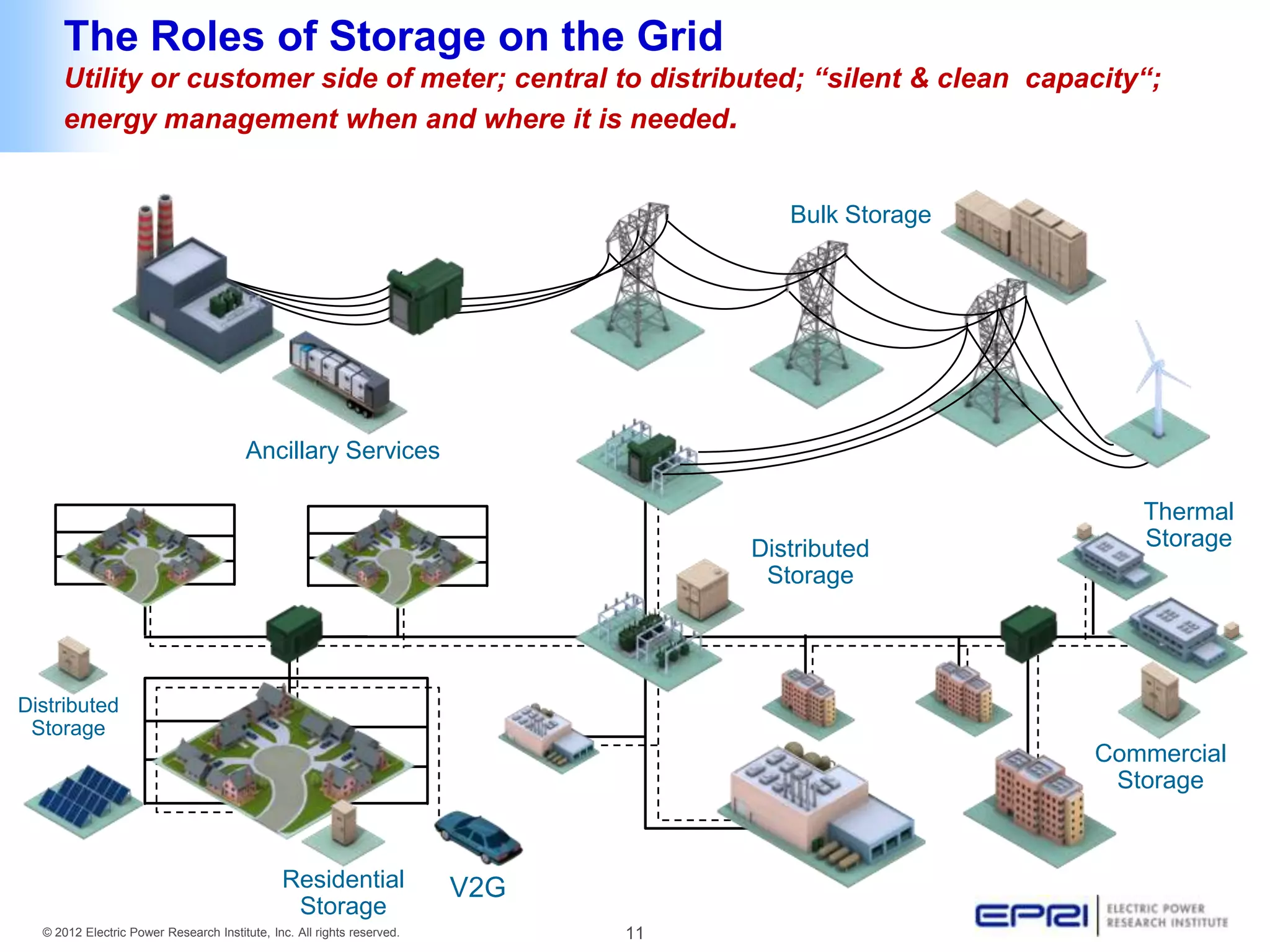

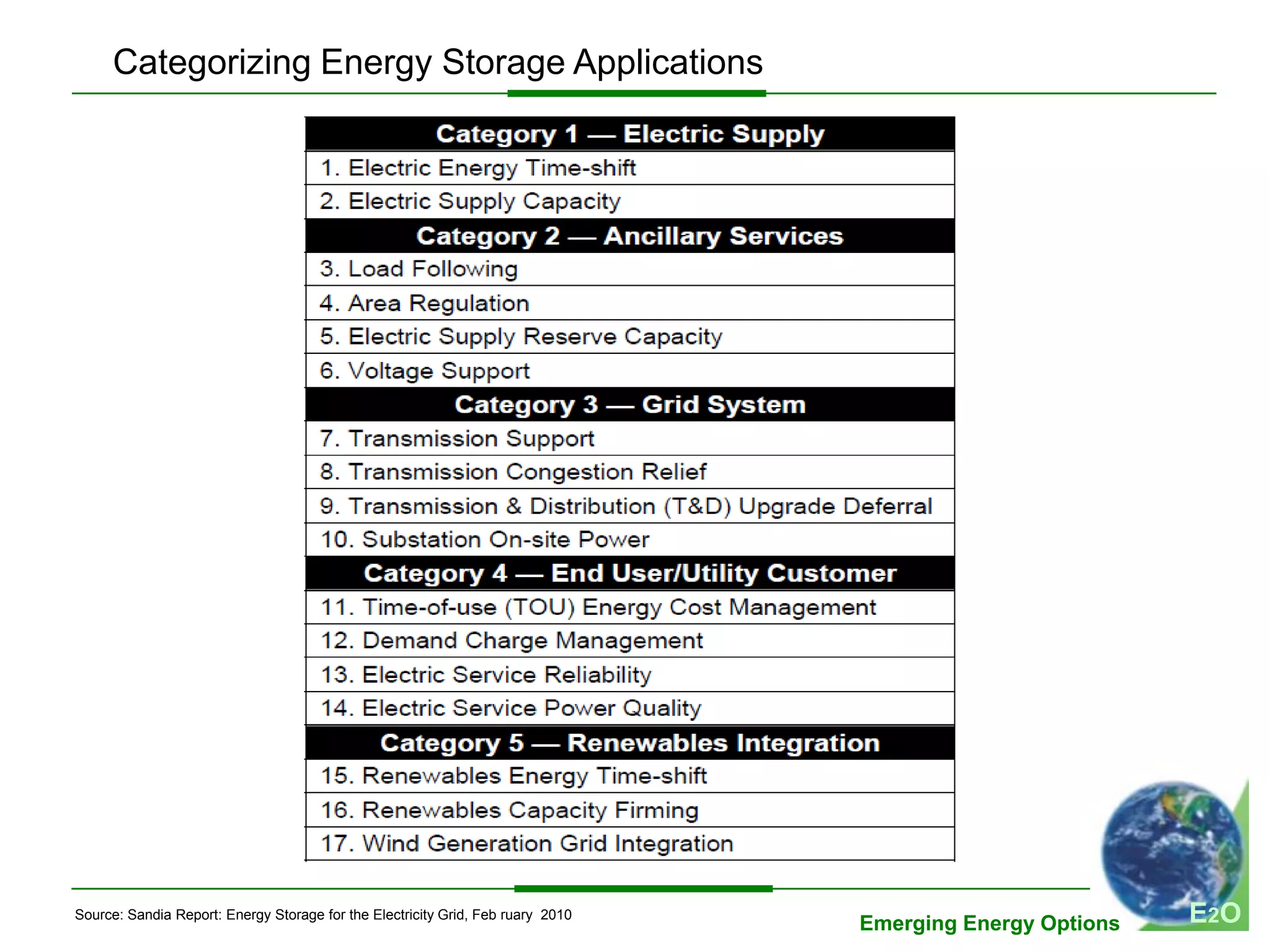

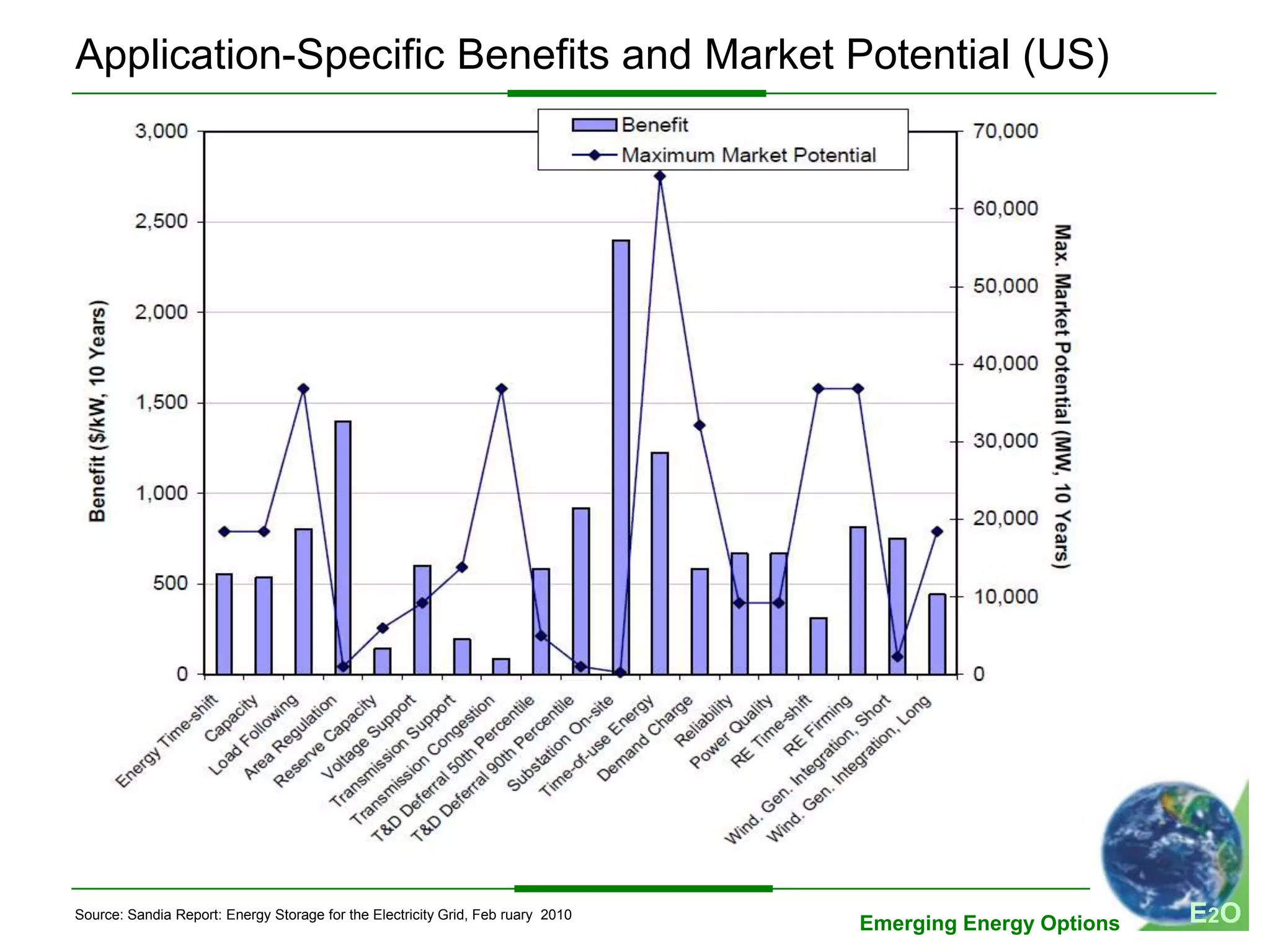

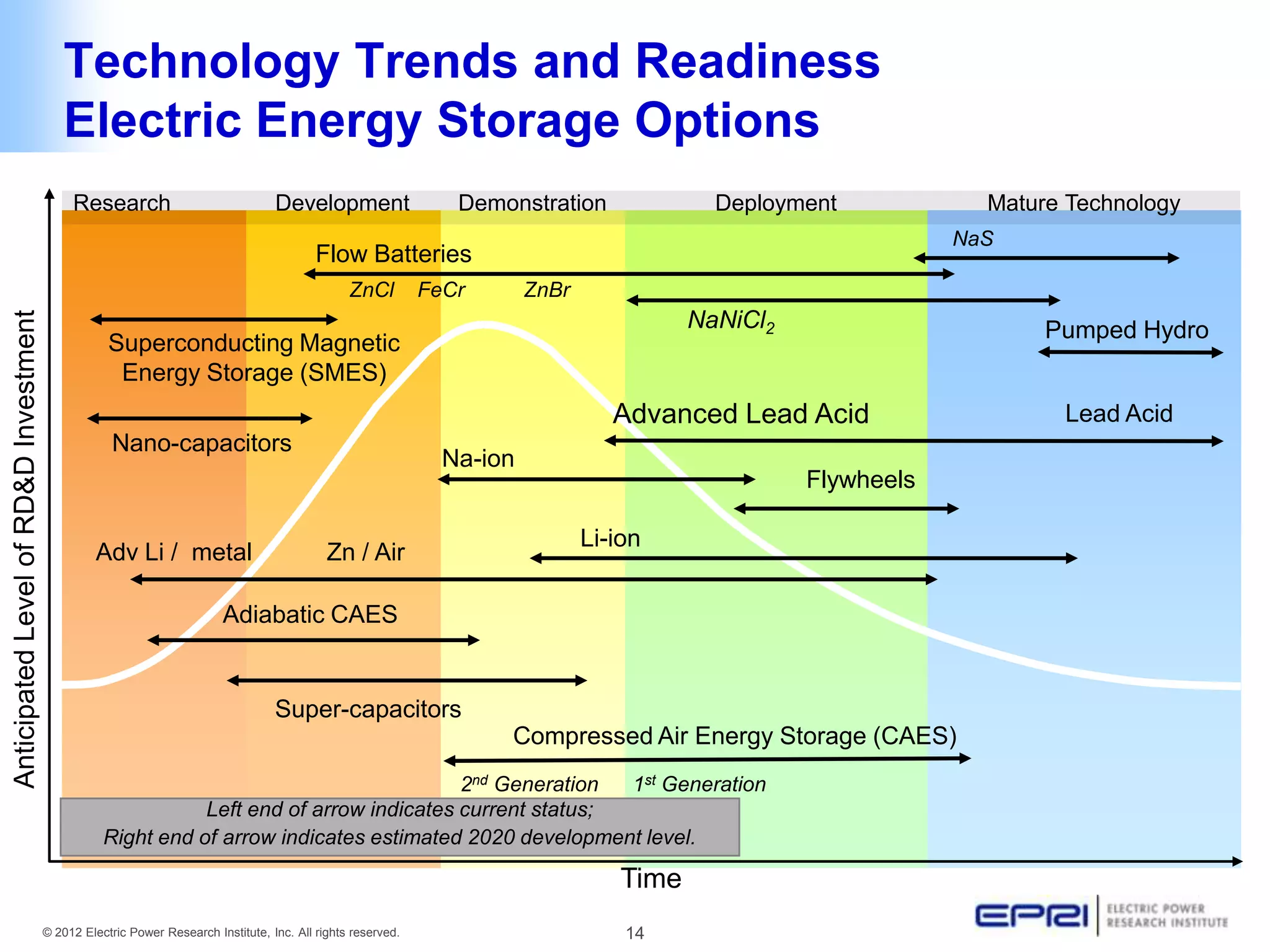

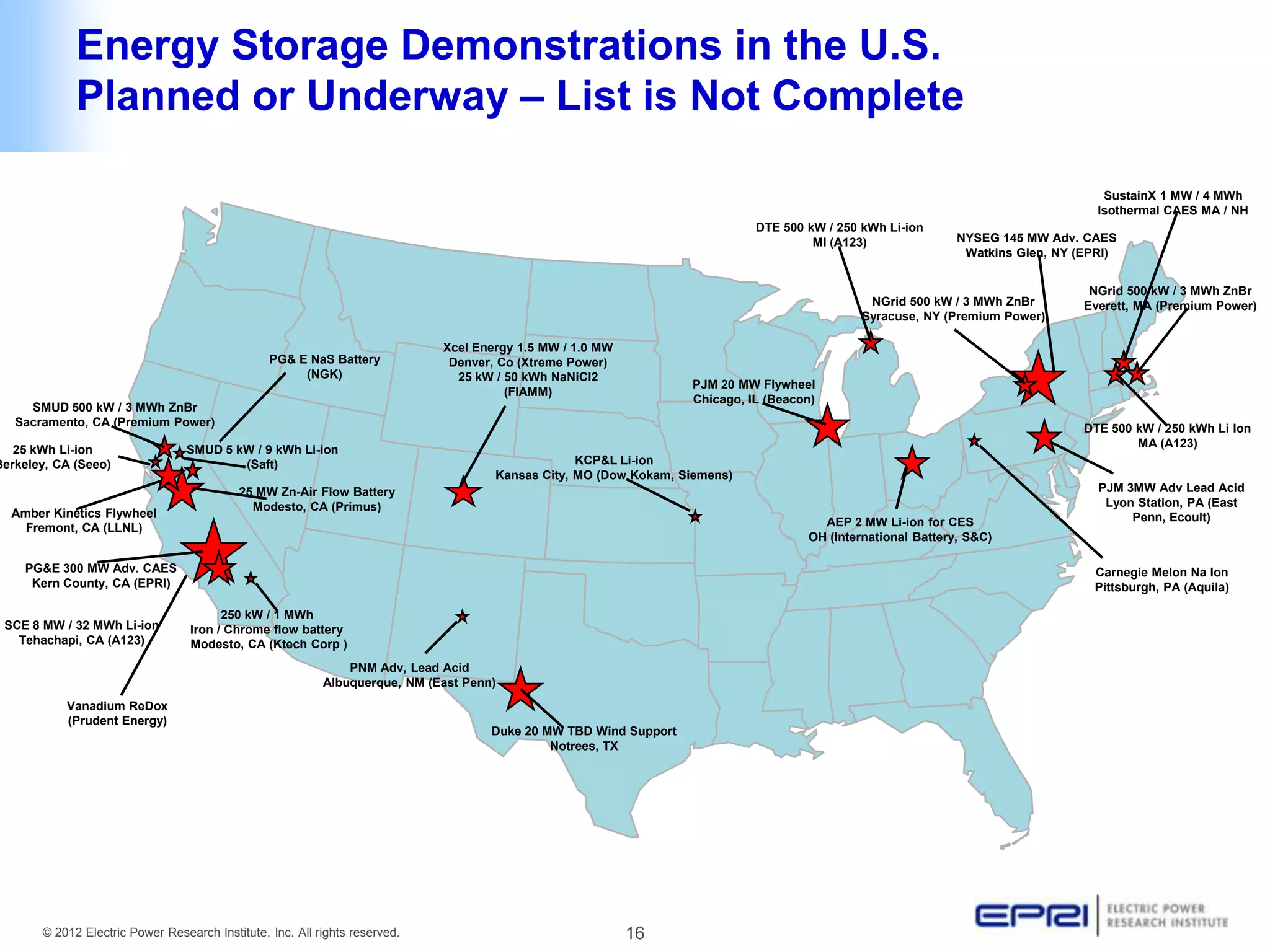

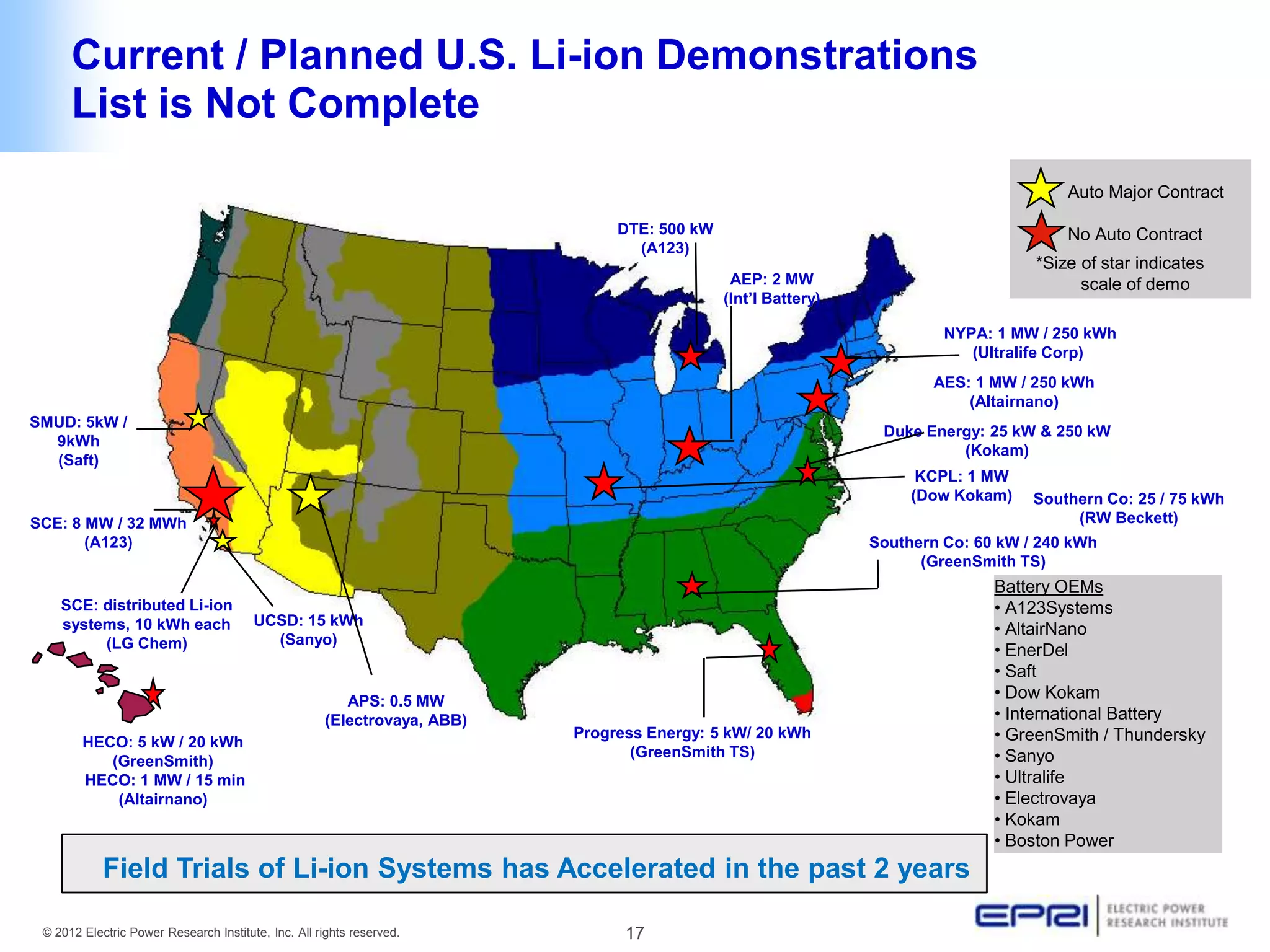

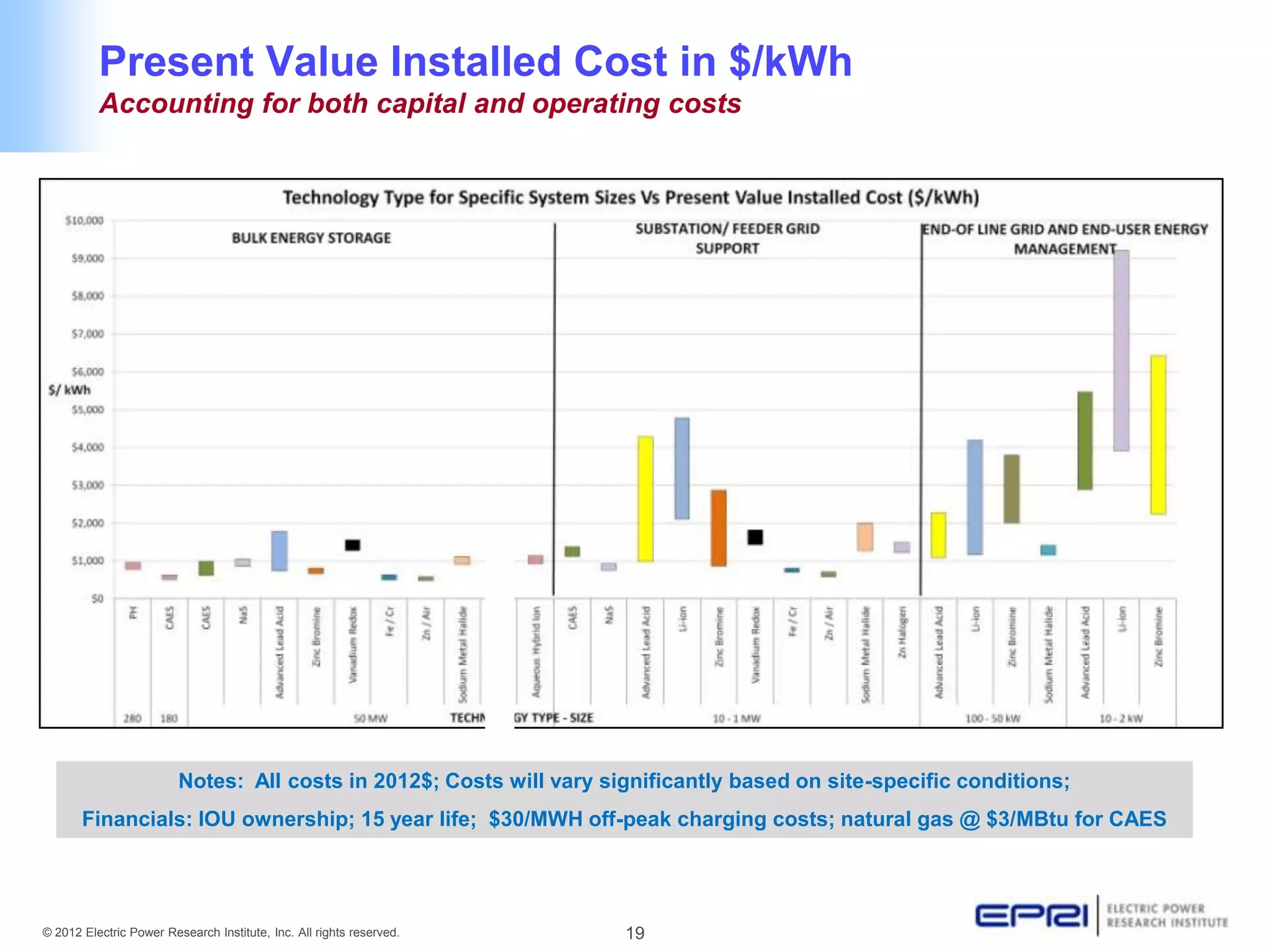

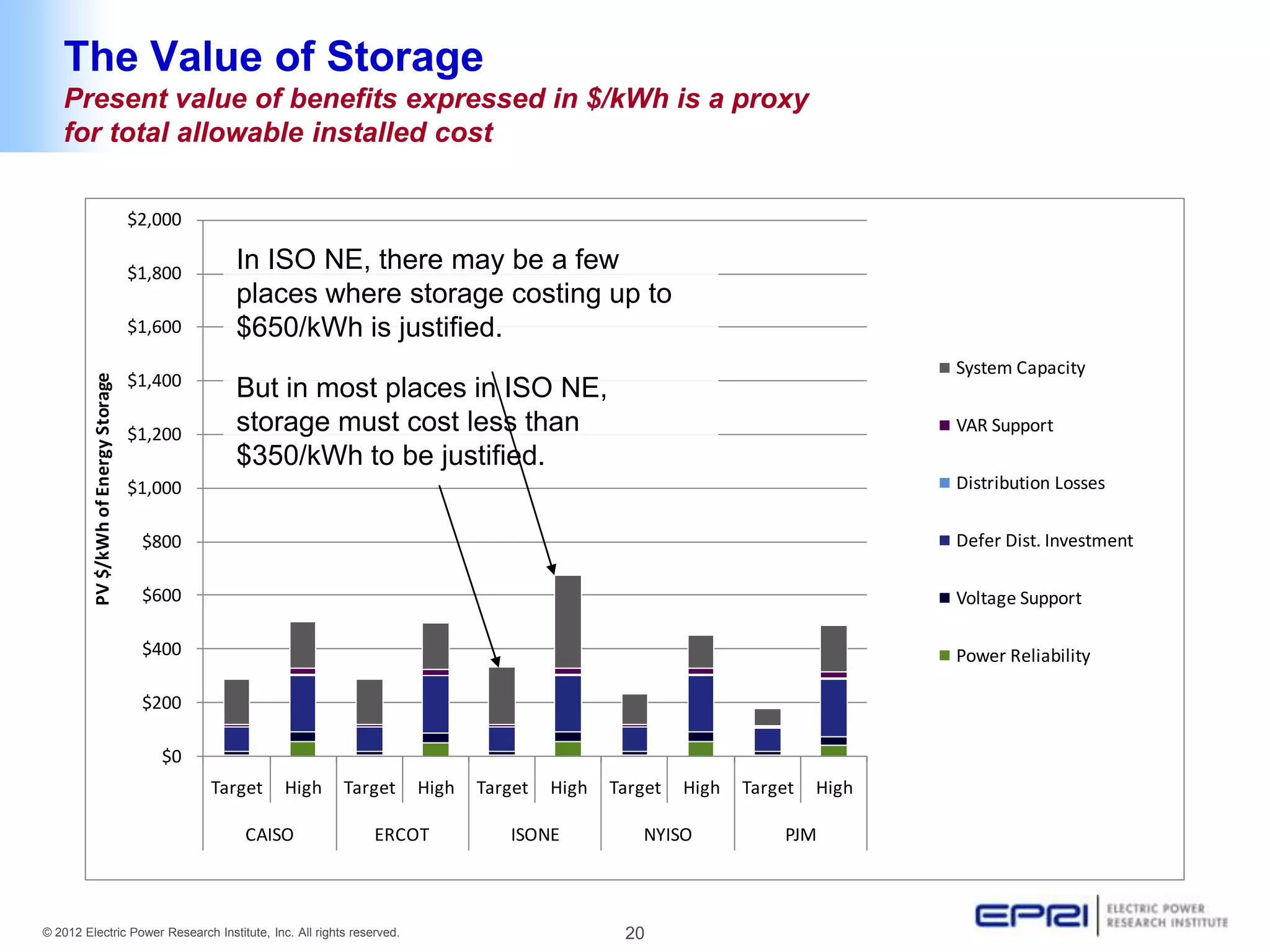

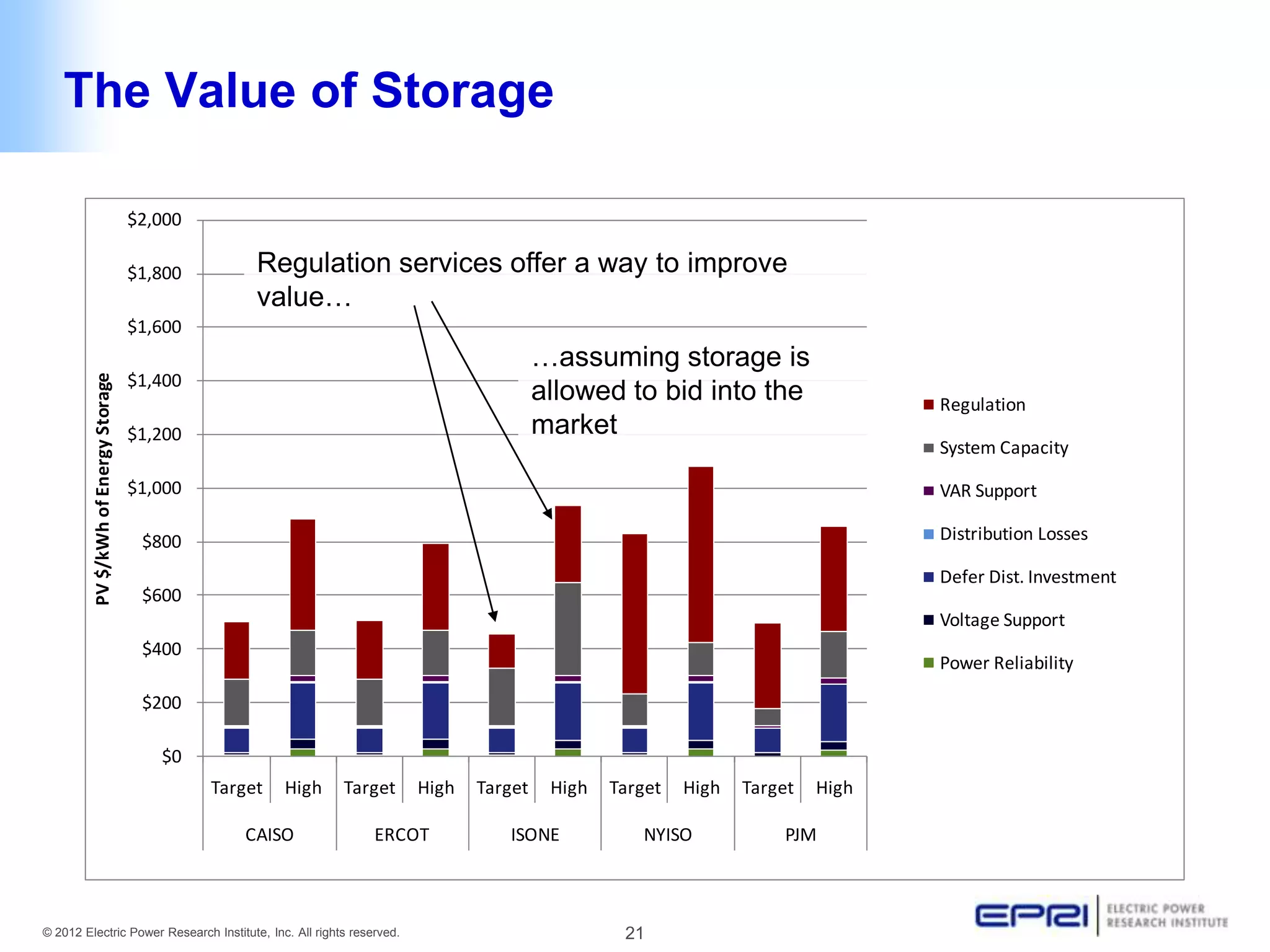

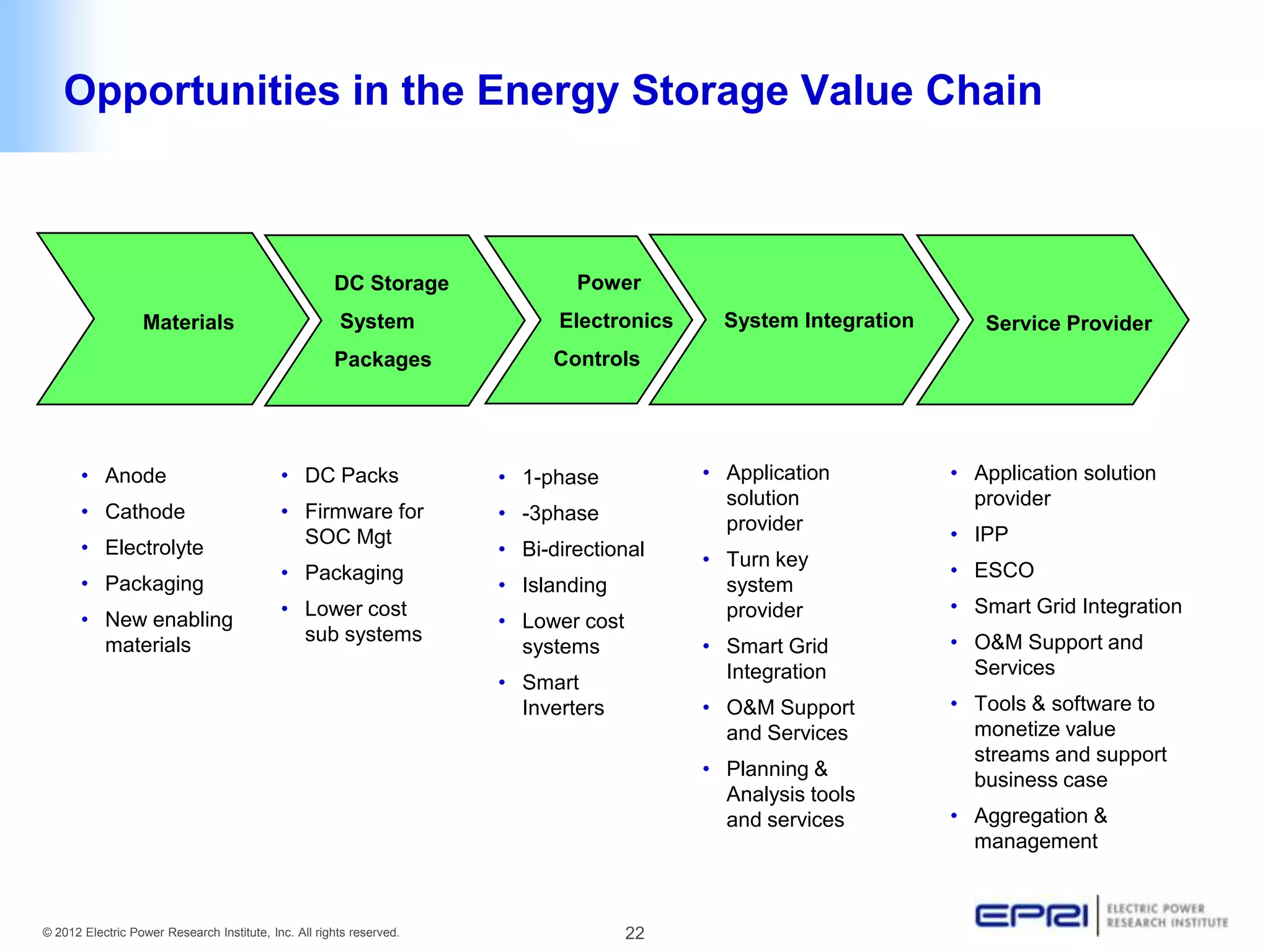

The document summarizes a presentation on electric energy storage systems and opportunities. It discusses how energy storage can help integrate renewable resources and manage grid assets. A variety of energy storage technologies are being demonstrated, but costs remain challenging. Opportunities exist across the energy storage value chain, including in materials, power electronics, and as service providers. Energy storage could maximize PV penetration and support customer energy solutions by providing non-storage options.