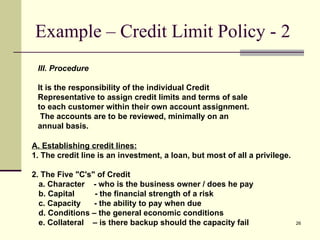

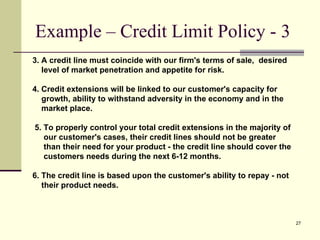

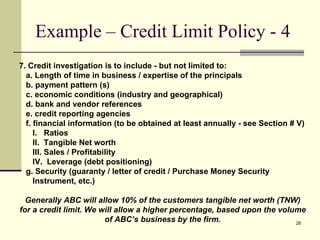

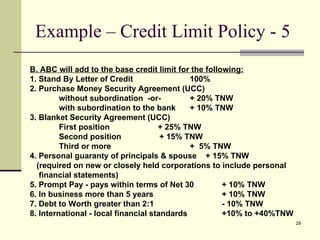

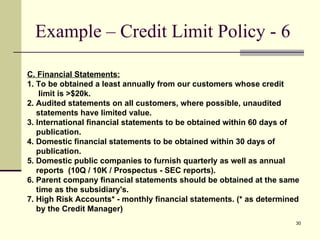

The document discusses establishing appropriate credit limits for customers. It recommends considering qualitative factors like a customer's character, capacity to pay, and capital, as well as quantitative factors from financial statements. A sample credit limit policy is provided that establishes criteria like granting 10% of a customer's tangible net worth as the base limit and adjusting up or down based on additional factors like security, payment history, and financial ratios. The policy outlines obtaining annual financial statements and reviewing accounts regularly.

![Setting Credit Limits © Presented by: Jim Menard, CCE email: [email_address] Webinar](https://image.slidesharecdn.com/settingcreditlimits-100804203544-phpapp02/85/Setting-credit-limits-1-320.jpg)

![Question time……….. Time to ask your questions… I can email you a copy of this policy if you would like… Thank you for joining us today…Jim Menard, CCE You can contact me at [email_address]](https://image.slidesharecdn.com/settingcreditlimits-100804203544-phpapp02/85/Setting-credit-limits-32-320.jpg)