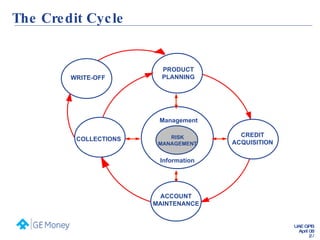

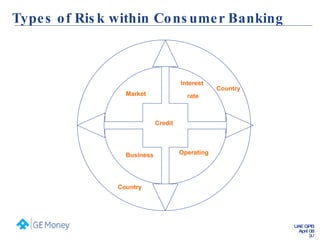

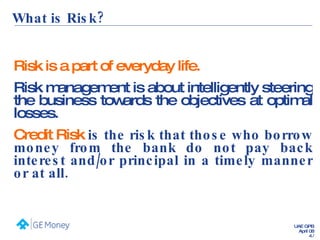

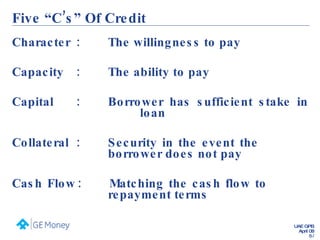

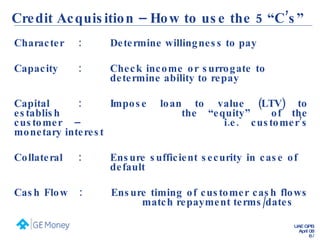

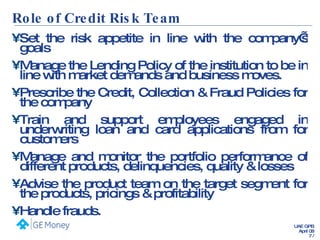

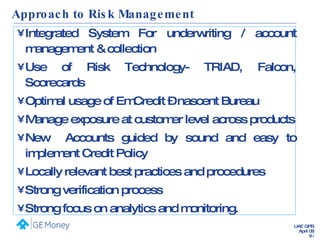

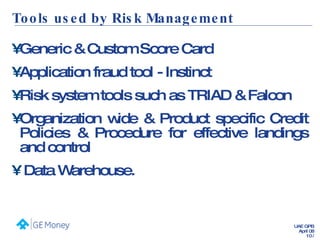

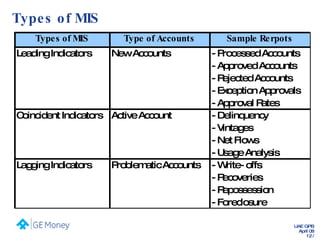

Sriram Natarajan provides an introduction to risk management within consumer banking. He outlines the main types of risk such as credit, market, interest rate, and operational risk. Credit risk, in particular, is the risk that borrowers do not repay loans in a timely manner or at all. He discusses the five "C's" of credit - character, capacity, capital, collateral, and cash flow - that are used to evaluate borrowers and make credit acquisition decisions. The role of the credit risk team is also summarized as setting risk appetite, managing lending policies, prescribing credit and collection policies, and monitoring portfolio performance. Specific challenges in credit risk management in the UAE are highlighted.