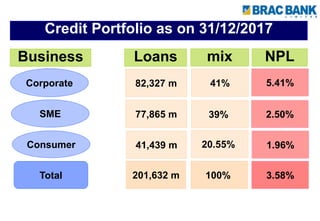

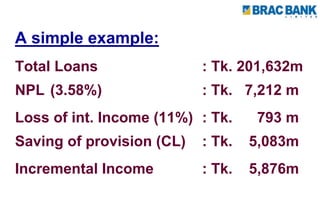

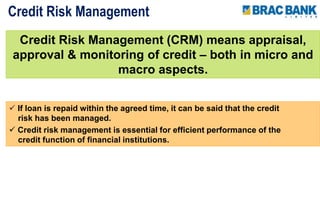

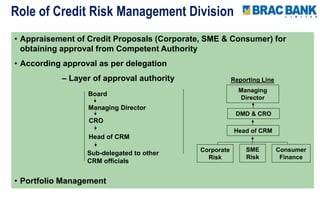

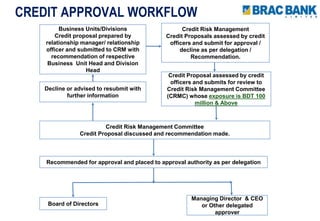

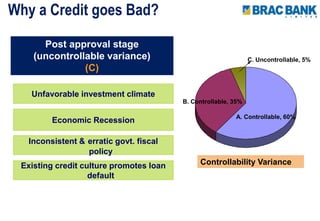

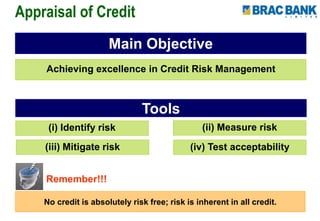

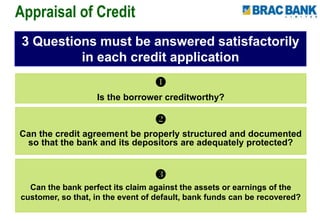

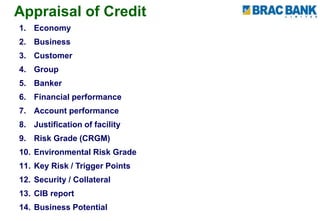

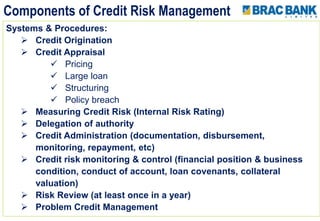

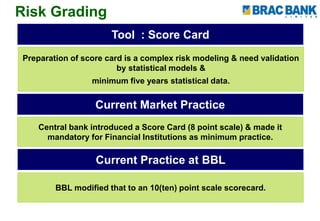

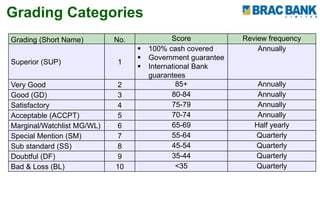

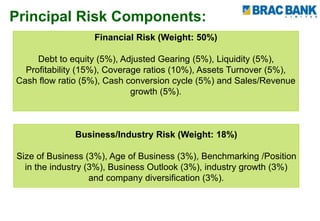

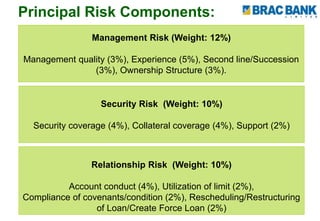

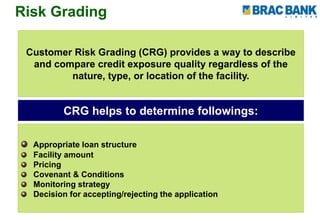

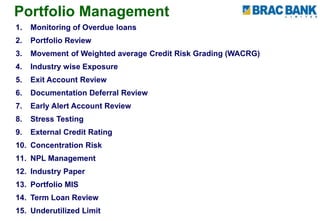

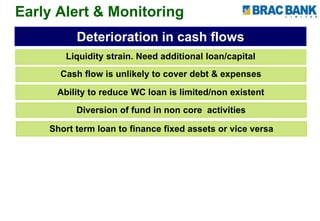

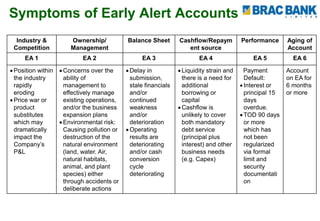

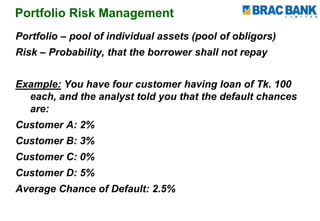

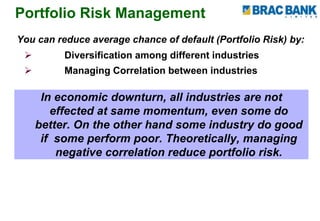

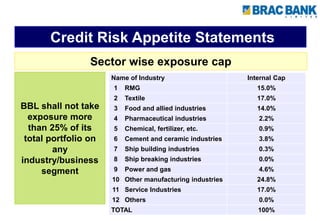

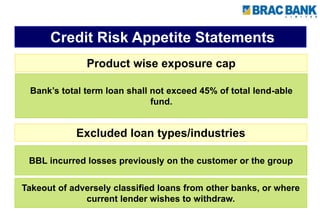

The document discusses credit risk management practices at a bank. It provides details on the bank's credit portfolio as of 2017, with most loans going to corporate and SME business. It then covers key aspects of credit risk management, including defining credit risk, roles and responsibilities, the credit approval workflow, reasons why credits may go bad, the appraisal process, risk grading system, portfolio management practices, and early alert monitoring. Key metrics like non-performing loans, interest income savings from lower provisions, and incremental income from better risk management are also presented.