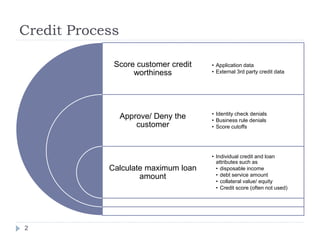

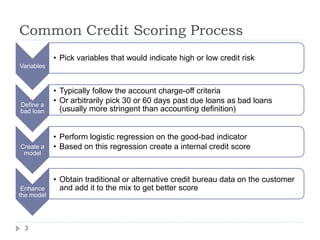

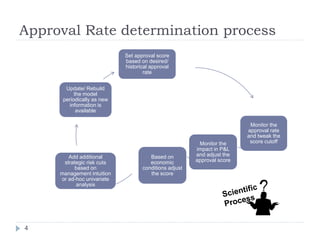

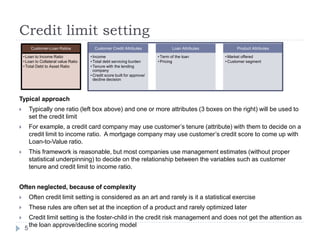

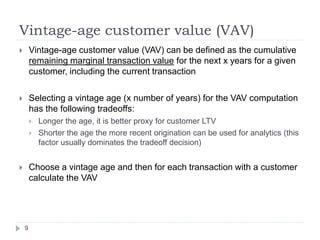

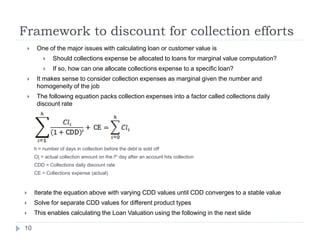

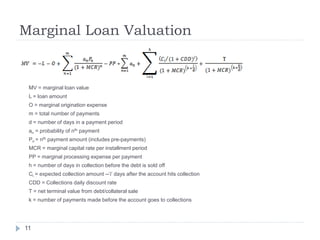

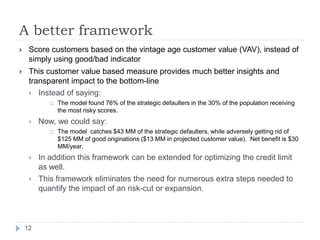

The document outlines a framework for consumer credit risk analytics, emphasizing the importance of customer credit scoring, approval rate determination, and effective credit limit setting. It critiques traditional methods, suggesting a shift towards using Vintage-Age Customer Value (VAV) for better insights into credit risk and overall customer valuation. The proposed approach aims to enhance decision-making processes in credit approval and limit setting by basing they on a more comprehensive analysis of customer value rather than simplistic good/bad indicators.