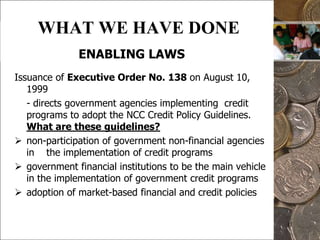

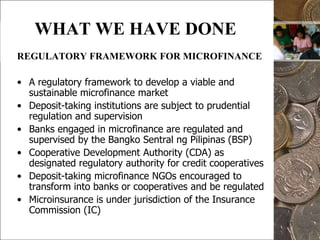

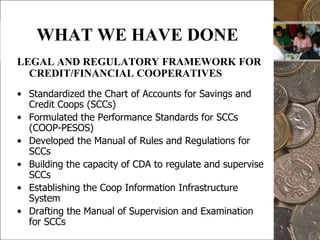

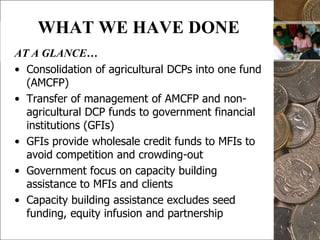

The document outlines the evolution and current state of microfinance policy in the Philippines, describing past government-directed credit programs that led to poor outreach and high costs. It details the establishment of the National Credit Council and a national strategy aimed at promoting a sustainable, private sector-driven microfinance market. Despite significant progress, challenges remain in expanding insurance coverage and developing innovative financial products for microfinance clients.