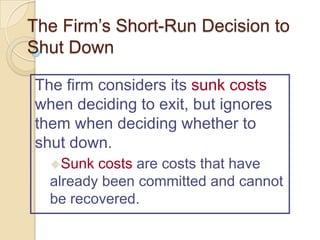

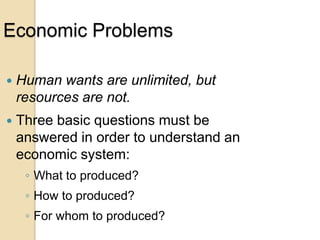

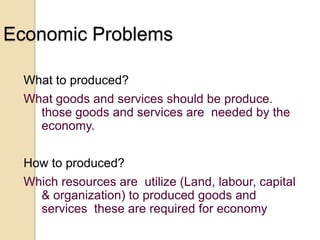

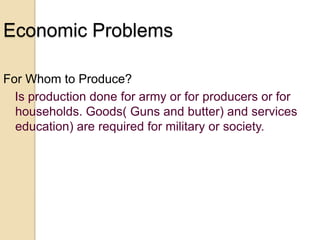

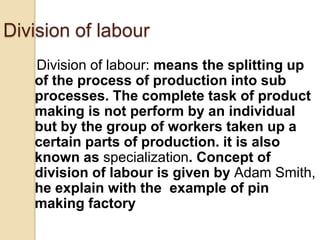

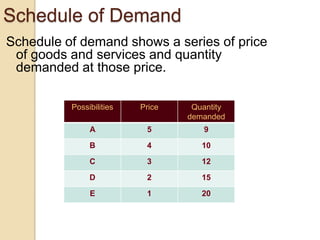

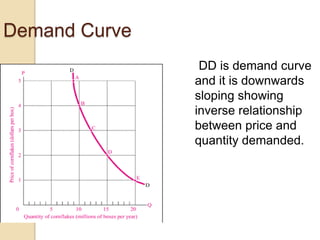

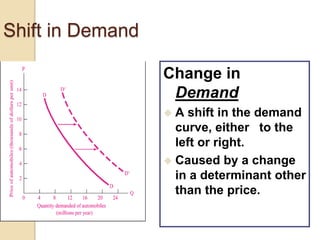

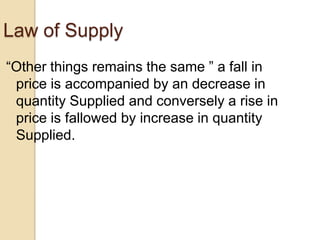

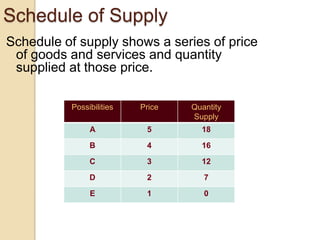

This document provides an overview of key economic concepts covered in chapters 1-3 of an economics textbook. It begins with definitions of economics and the founder of economics, Adam Smith. It then covers microeconomics and macroeconomics, scarcity, efficiency, factors of production, and the production possibility frontier. The document also discusses different economic systems, opportunity cost, demand and determinants of demand, the law of demand, supply and determinants of supply, and the law of supply.

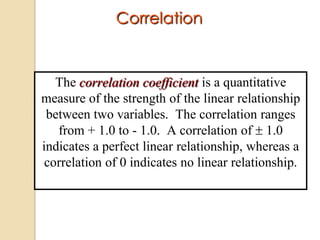

![An algebraic formula for correlation

coefficient

n

r

[ n(

2

x ) (

xy

x

2

x) ][ n(

y

2

y ) (

2

y) ]](https://image.slidesharecdn.com/economicschapter1-131204163010-phpapp01/85/Economics-chapter-1-53-320.jpg)

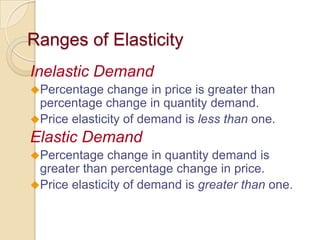

![Method Measuring Elasticity the

Average Formula

The Average (midpoint formula) is preferable when

calculating the price elasticity of demand because it

gives the same answer regardless of the direction of

the change.

(Q2 Q1 )/[(Q2 Q1 )/2]

Price Elasticity of Demand =

(P2 P1 )/[(P2 P1 )/2]](https://image.slidesharecdn.com/economicschapter1-131204163010-phpapp01/85/Economics-chapter-1-99-320.jpg)

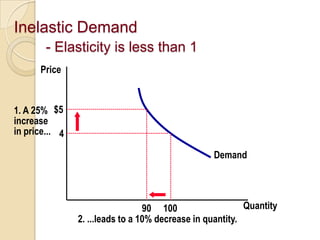

![Method Measuring Elasticity the

Average Formula

(Q 2 Q1 )/[(Q 2 Q1 )/2]

Price Elasticity of Demand =

(P2 P1 )/[(P2 P1 )/2]

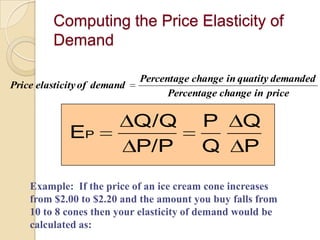

Example: If the price of an ice cream cone increases

from $2.00 to $2.20 and the amount you buy falls from

10 to 8 cones the your elasticity of demand, using the

midpoint formula, would be calculated as:](https://image.slidesharecdn.com/economicschapter1-131204163010-phpapp01/85/Economics-chapter-1-100-320.jpg)