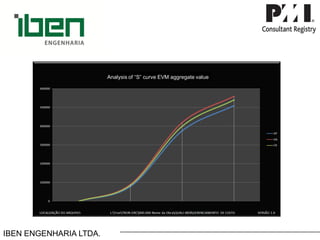

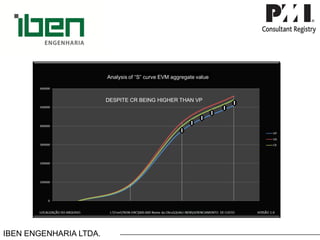

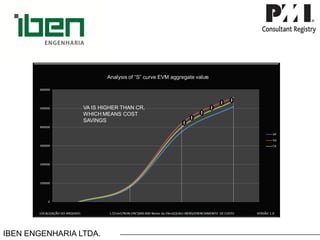

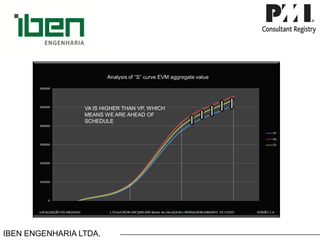

This document discusses earned value management and earned value analysis techniques for construction sector projects. It explains that earned value analysis can answer questions about whether a project is on schedule, within budget, and track deviations. It does this by comparing the planned value, actual costs, and earned value over time. Graphing these three values on an S-curve provides a visual representation of a project's overall status and helps identify cost and schedule performance. Comparing the relationships between planned value, actual costs, and earned value is important for determining if a project is under or over budget and ahead or behind schedule at any given time.