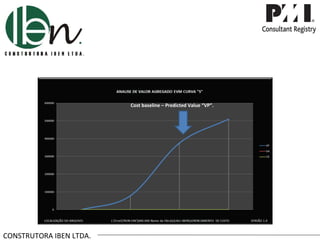

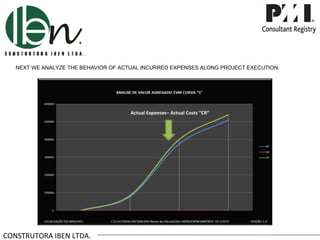

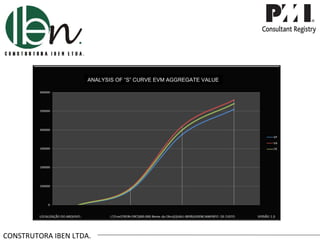

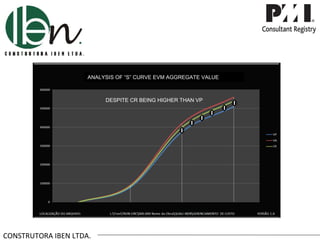

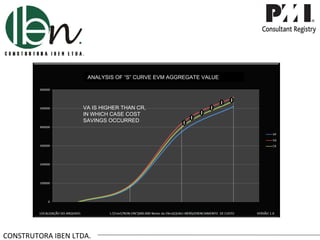

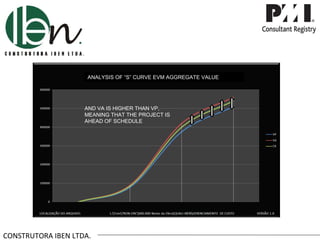

This document discusses earned value management (EVM) and added value analysis for construction projects. It explains that EVM provides accurate data on a project's status and progress by answering questions about schedule, budget, deviations, trends, and final costs. EVM involves comparing the predicted value, actual costs, and added value curves over time to analyze performance. By jointly analyzing all three values, important insights can be gained about whether the project is on schedule and on budget. Graphing the curves together clearly shows deviations and the overall project picture.