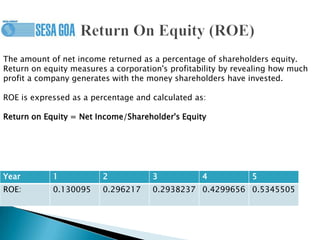

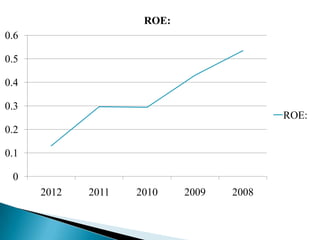

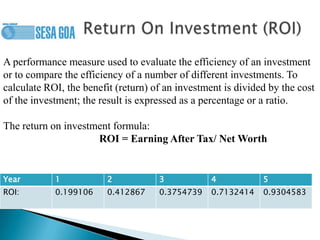

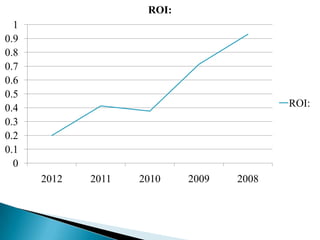

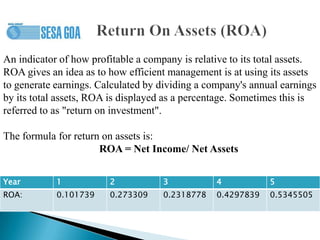

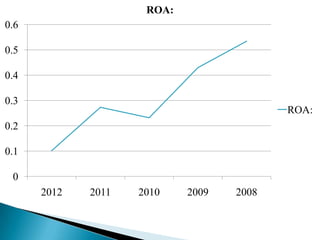

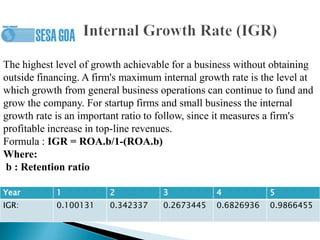

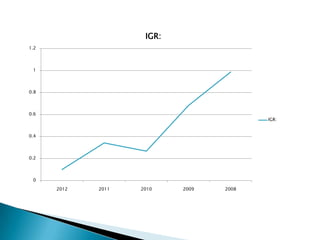

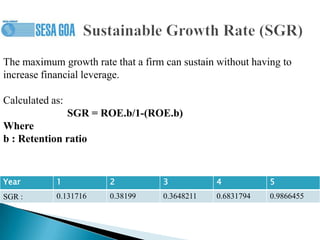

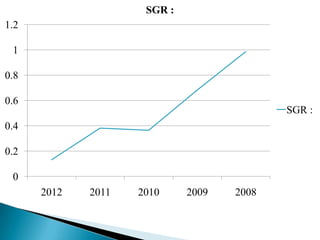

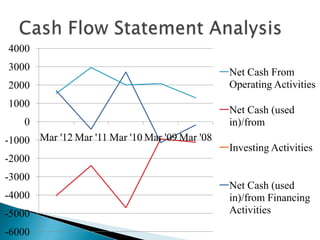

Sesa Goa Limited is India's largest producer and exporter of iron ore in the private sector. The DuPont analysis breaks down return on equity into three parts: profit margin, total asset turnover, and financial leverage. It helps identify which parts of the business may be underperforming if return on equity is unsatisfactory. Several financial metrics are presented including return on equity, return on investment, return on assets, internal growth rate, and sustainable growth rate from 2008-2012.