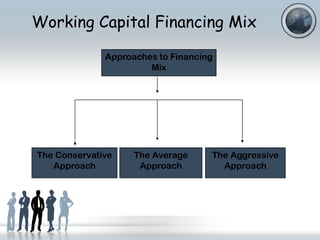

The study investigates the relationship between aggressive and conservative working capital policies and firm profitability and risk. It analyzes 208 public companies over 1998-2005 and finds:

1) A conservative working capital policy, with more permanent financing of current assets, is associated with lower risk but also lower profitability.

2) An aggressive policy, with extensive short-term financing of both current and fixed assets, is riskier but more profitable.

3) Firms' stock prices are influenced by their working capital management approach, with aggressive policies viewed favorably by investors.