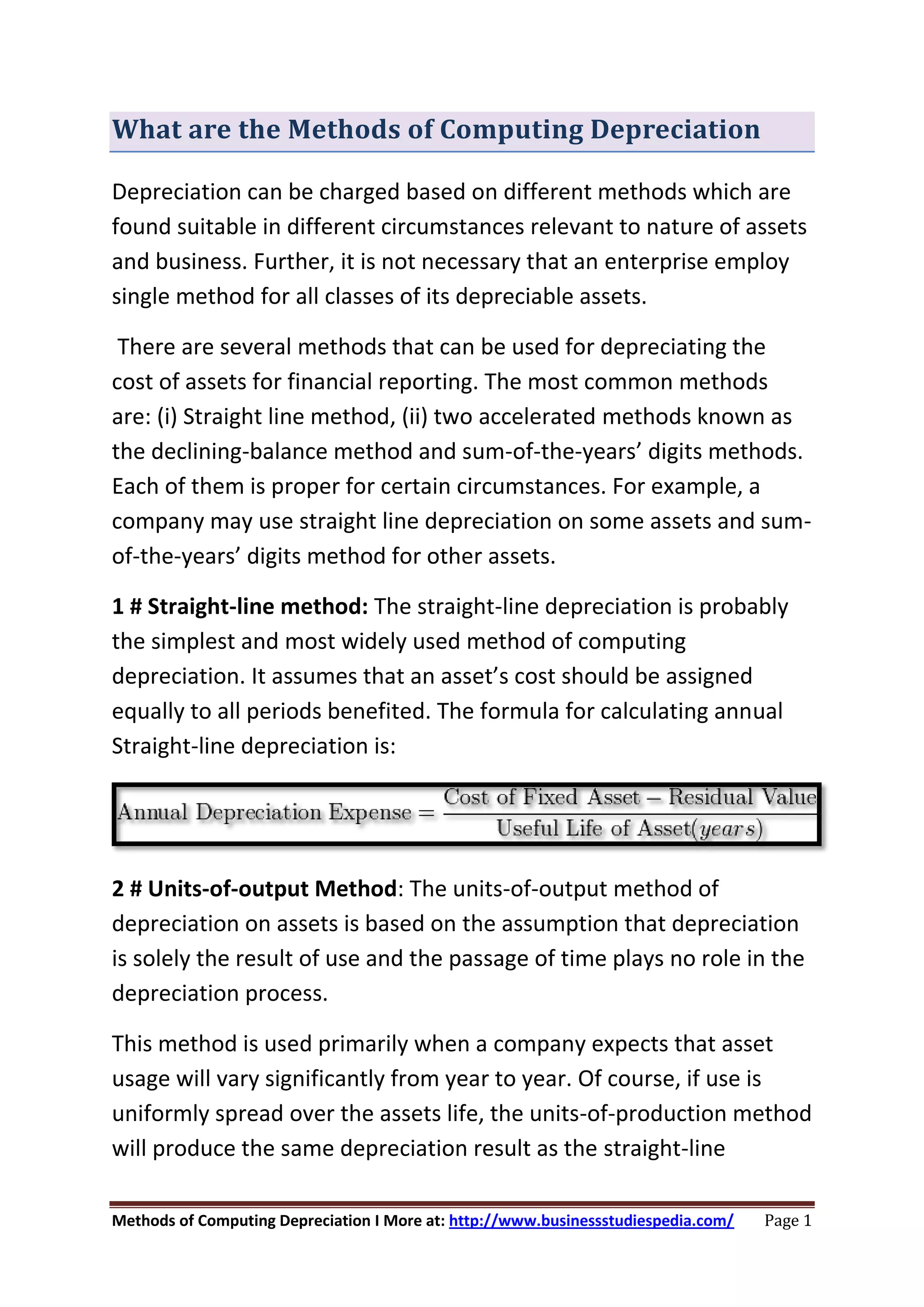

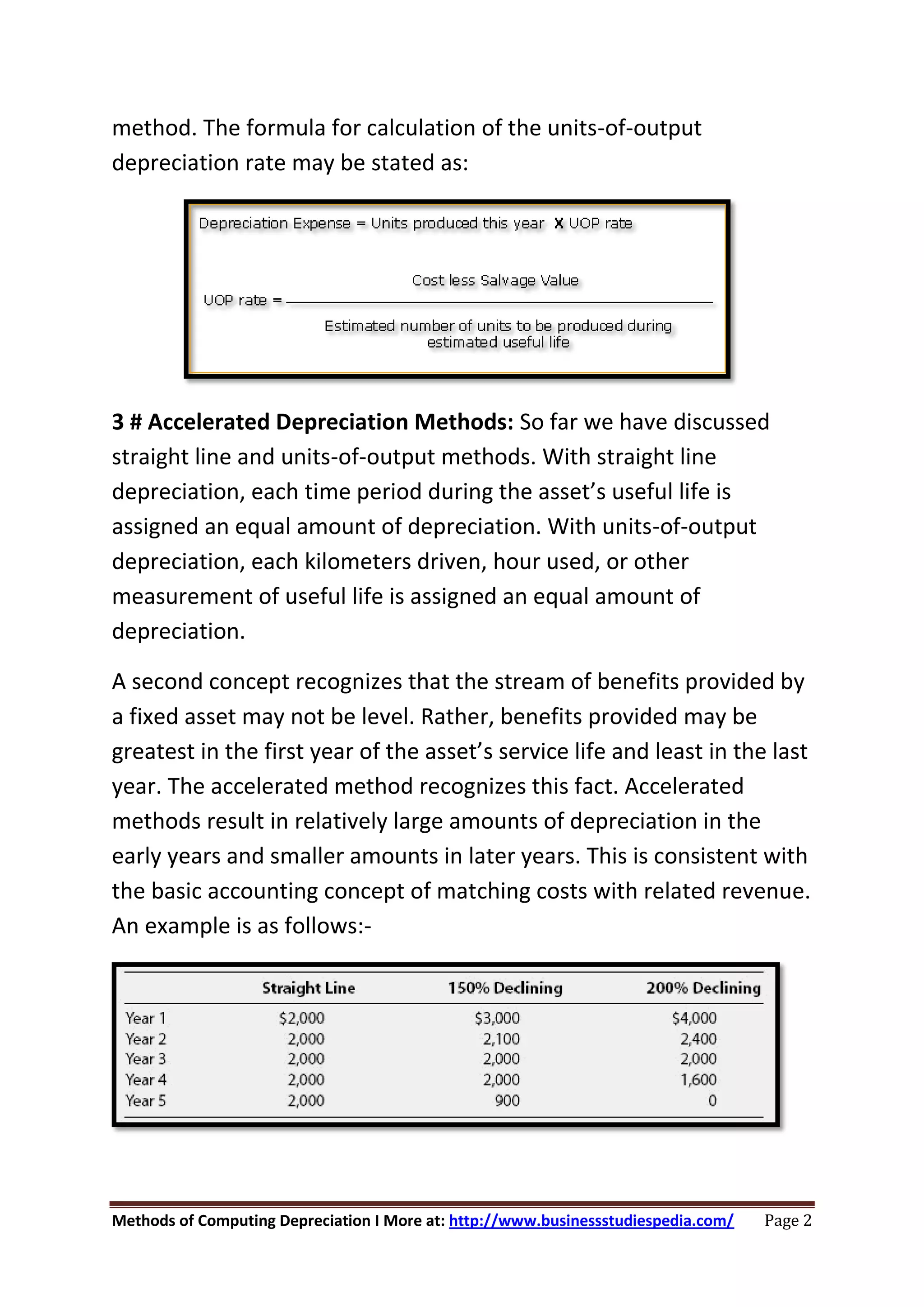

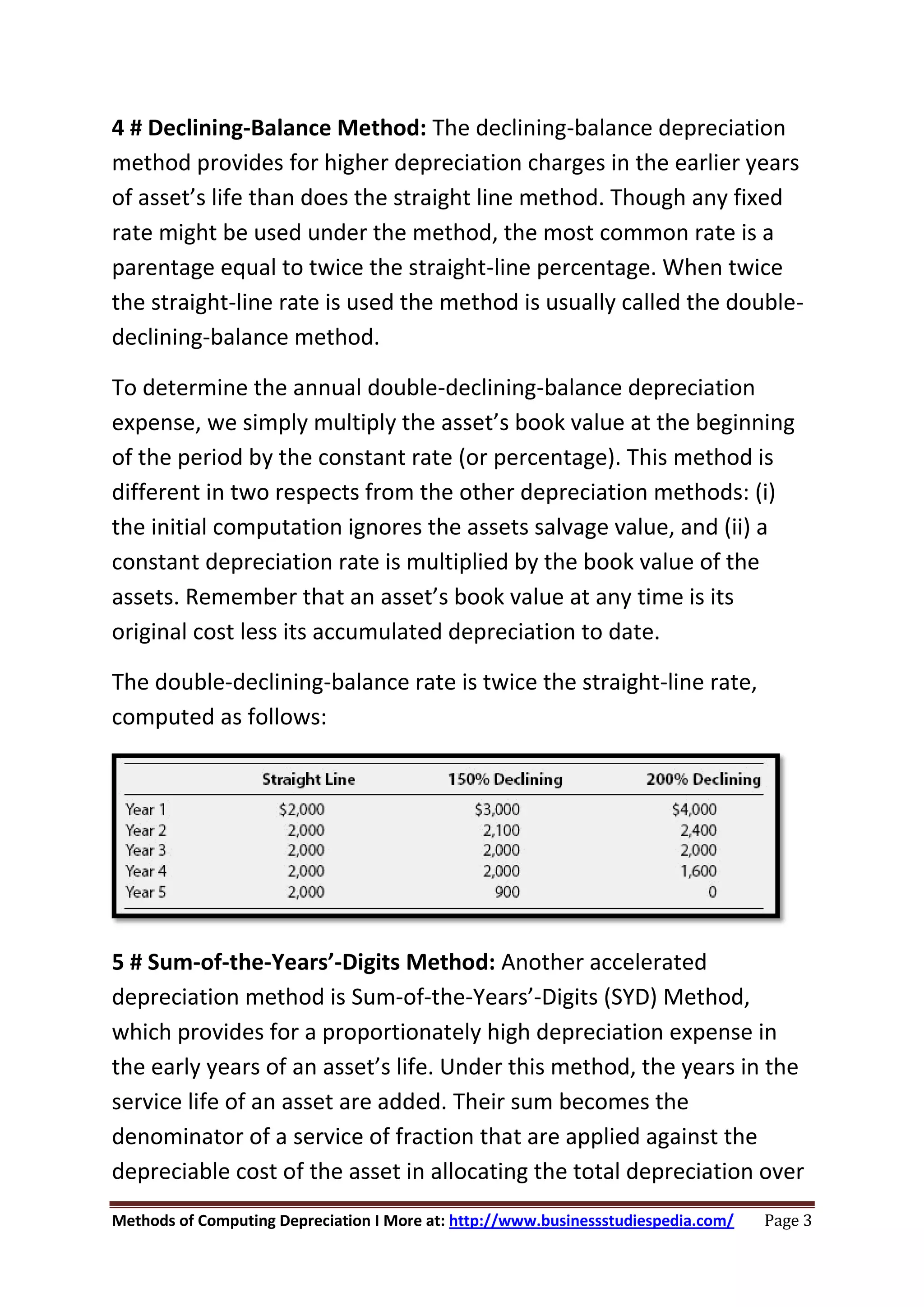

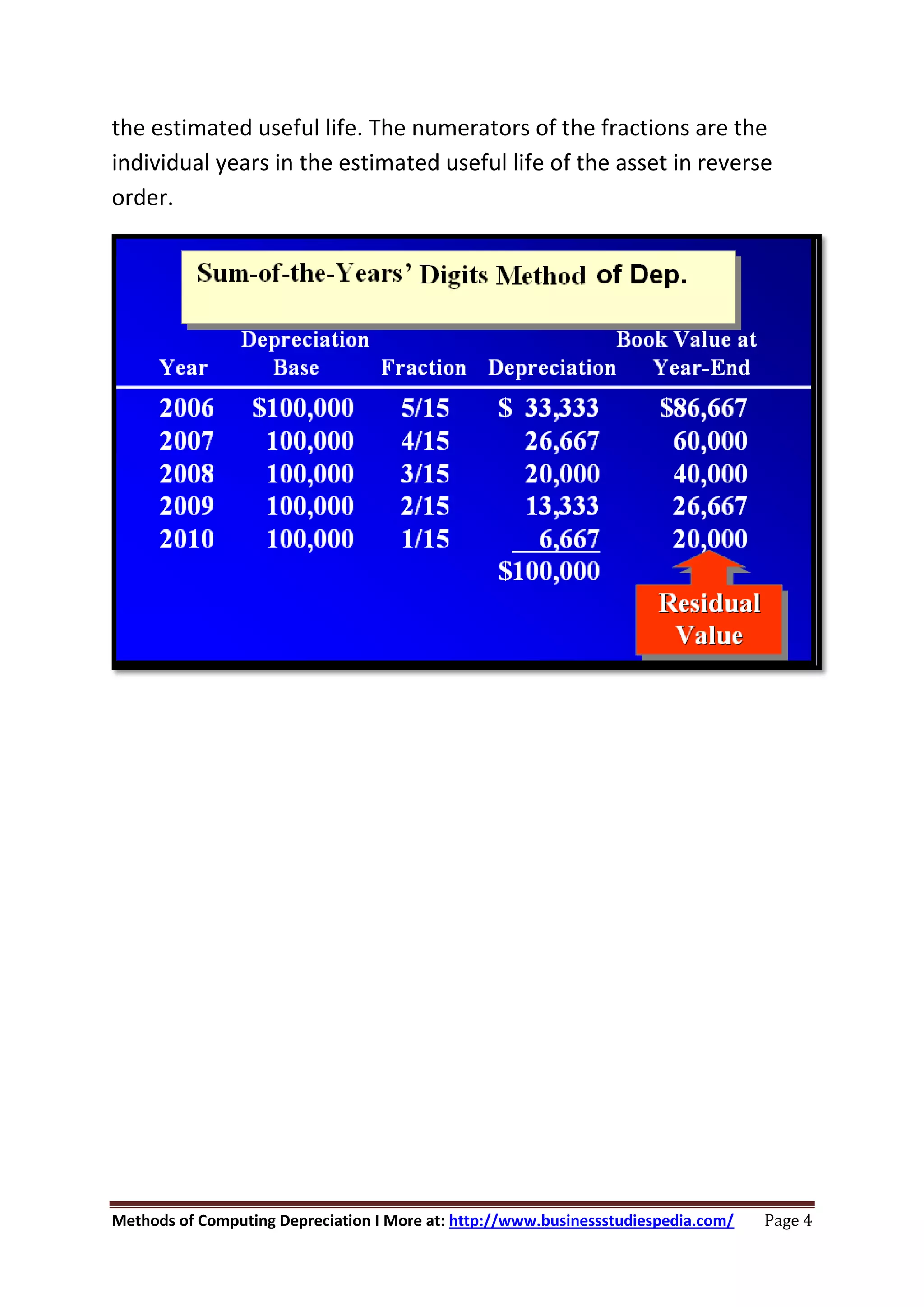

The document discusses various methods of computing depreciation for financial reporting, highlighting that different methods can be suitable for different assets. The main methods include the straight-line method, units-of-output method, and accelerated methods such as the declining-balance and sum-of-the-years'-digits methods. Each method serves unique circumstances regarding asset usage and financial consideration, allowing businesses flexibility in their approach to depreciation.