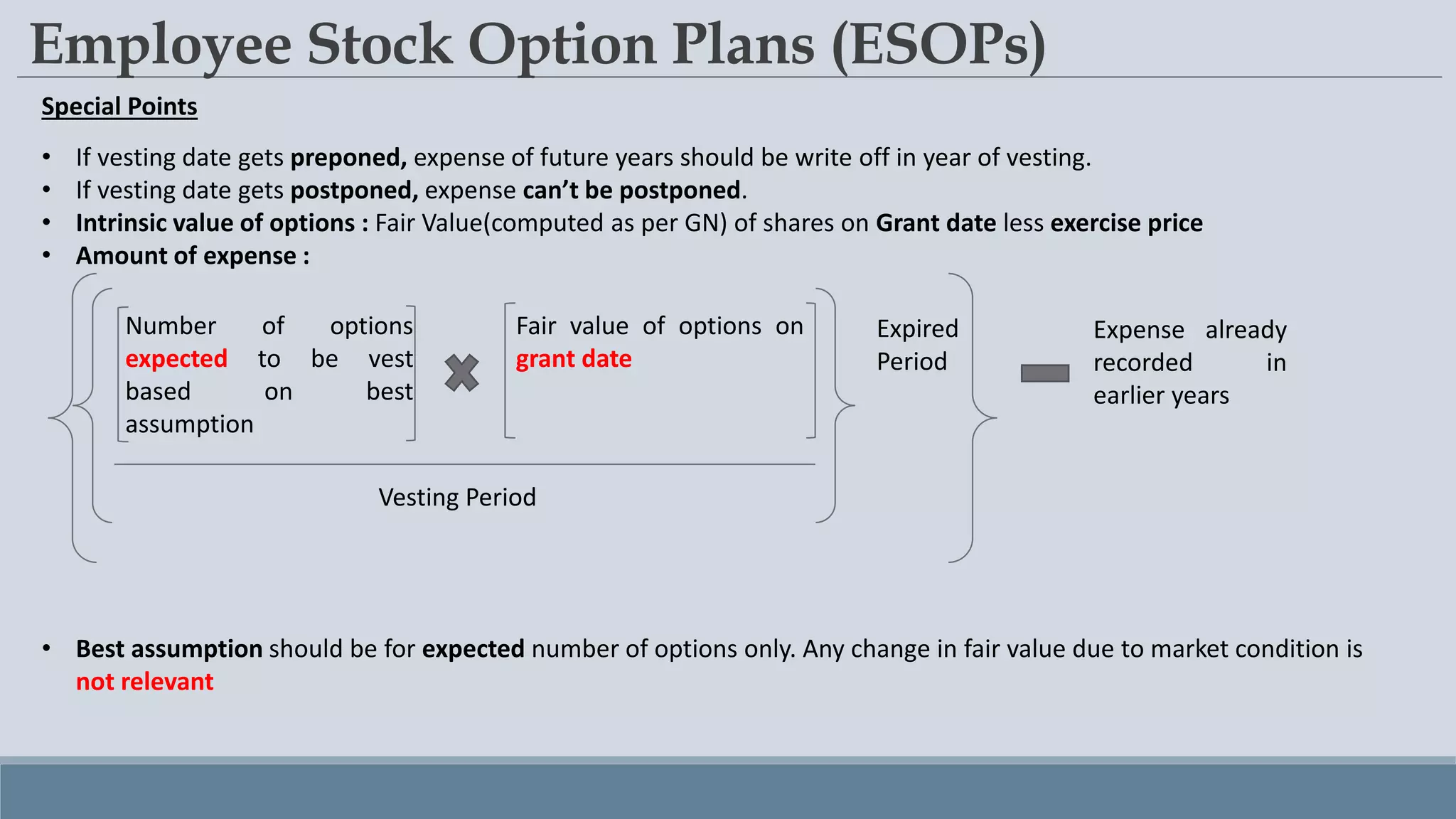

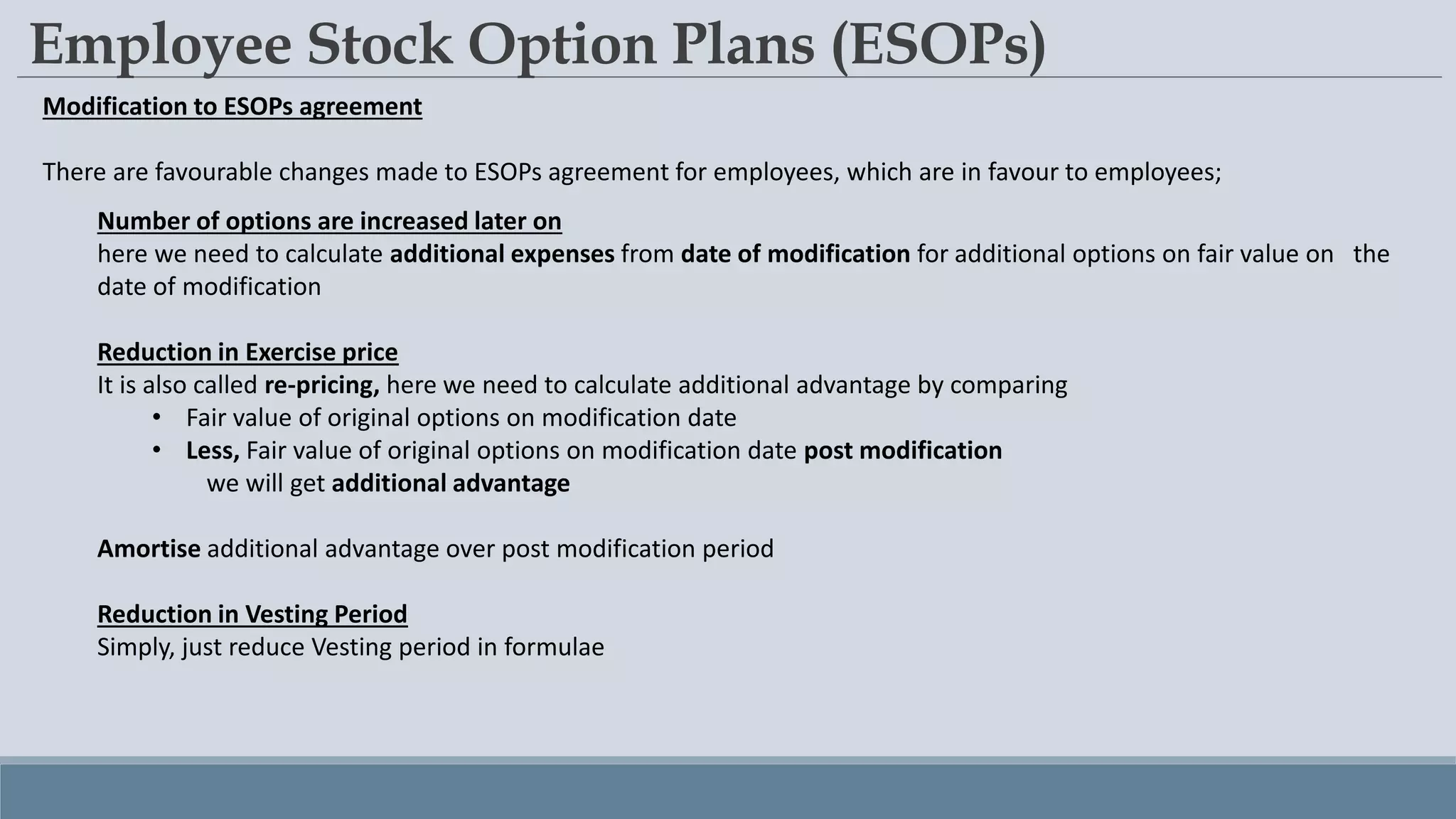

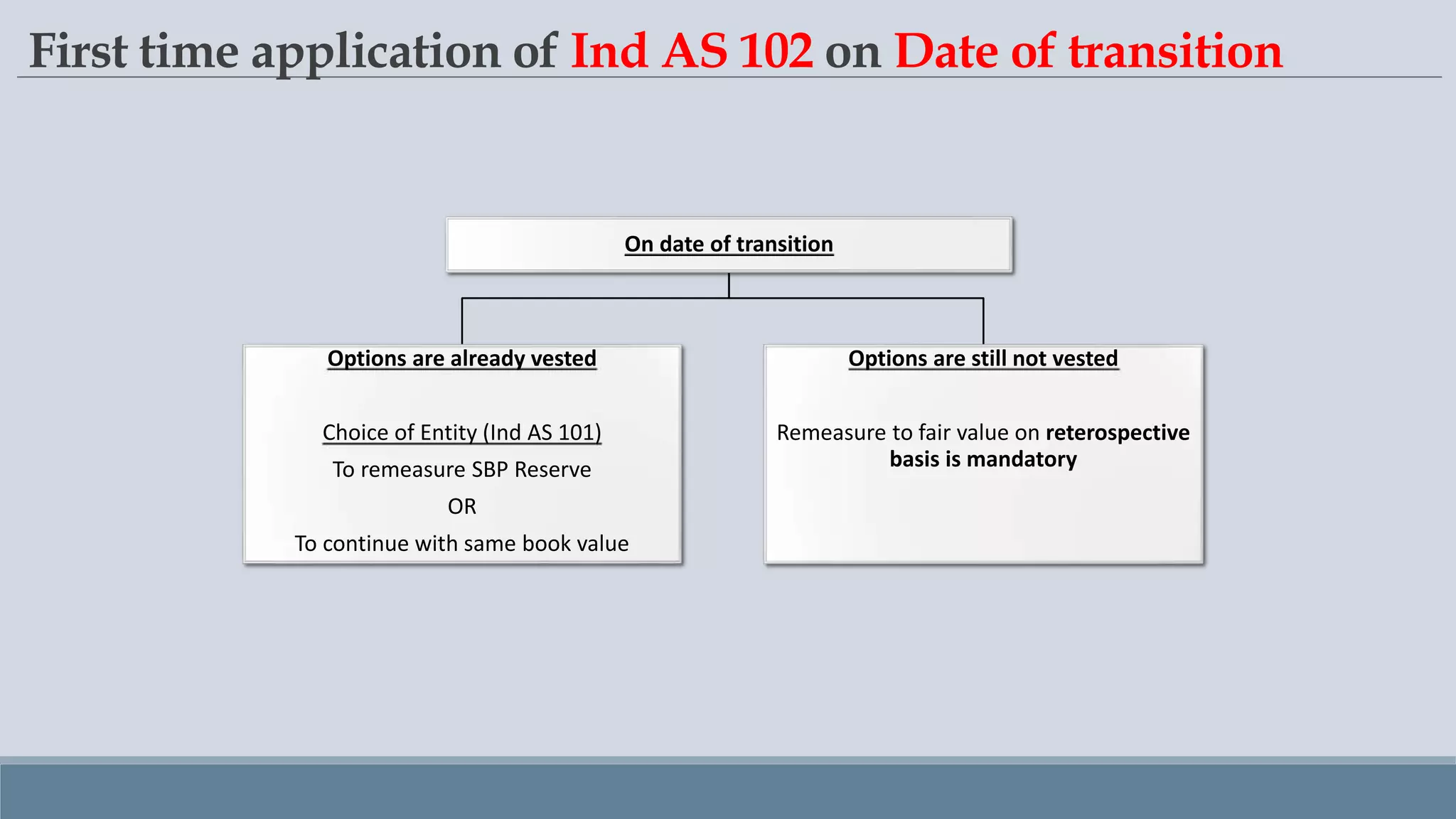

Share-based payments refer to contracts where goods or services are received in exchange for equity instruments or cash based on equity values. Equity instruments include shares or options of the reporting entity, its parent, or subsidiaries. Ind AS 102 applies to share-based payment transactions, except those with shareholders or involving the acquisition of a business. Share-based payments can be settled via equity instruments or cash. Recognition involves recording an expense over the vesting period based on the fair value of instruments on the grant date. Disclosures are required to understand the nature and extent of share-based payment arrangements.