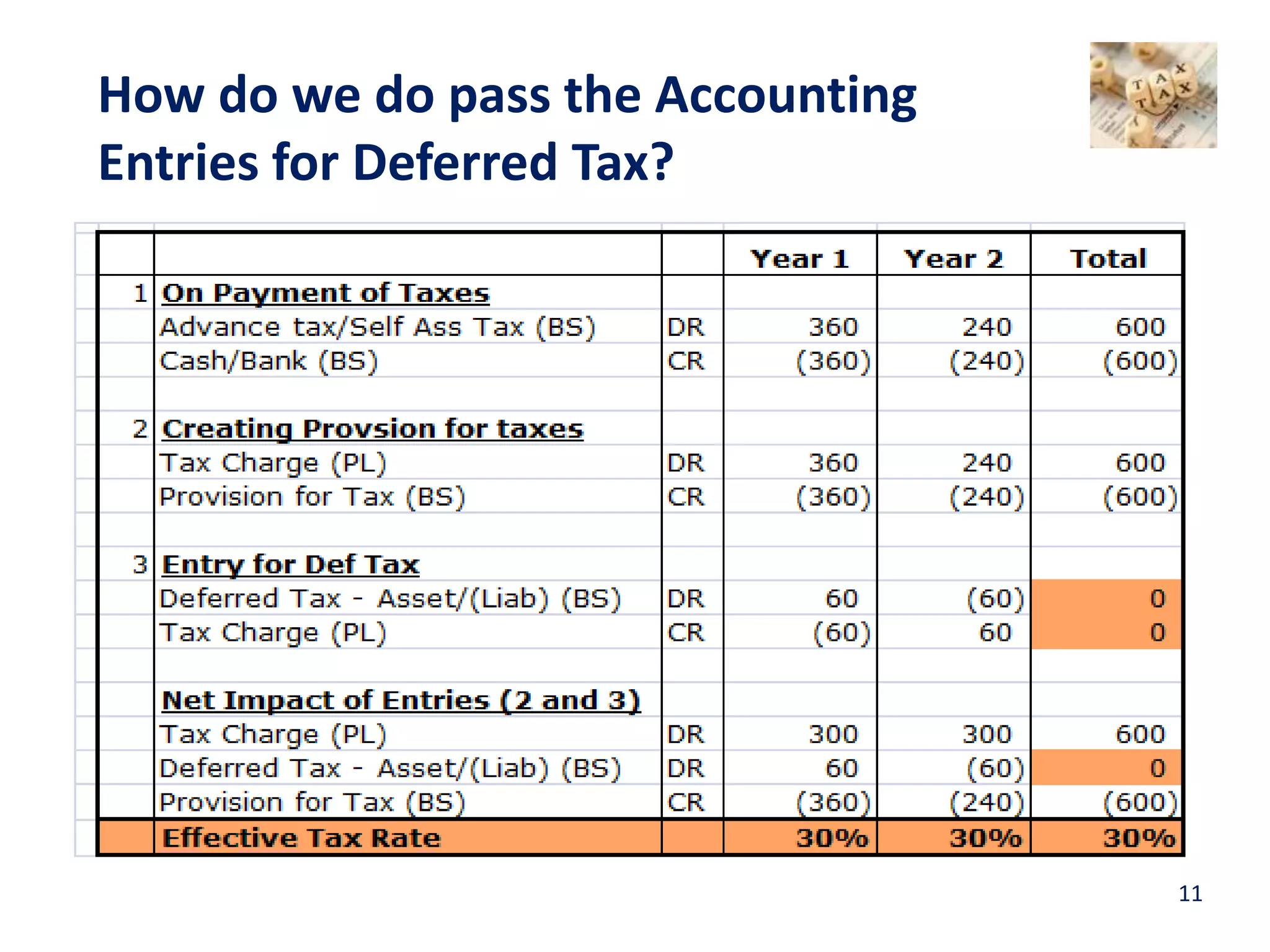

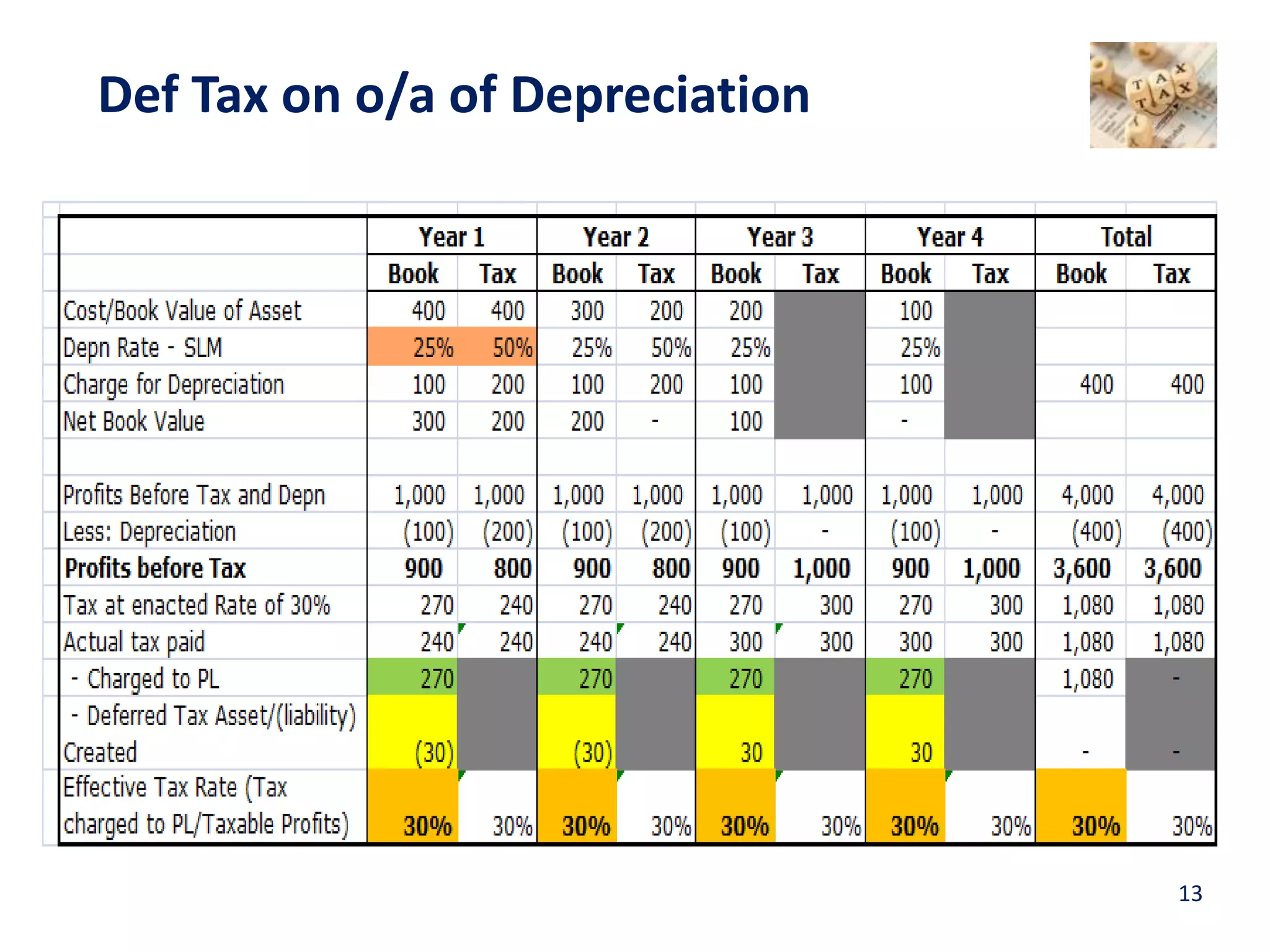

Deferred taxes arise due to temporary differences between accounting profits and taxable profits. Main reasons for differences are depreciation rates and methods, and timing of expense deductions. This causes effective tax rates to differ from statutory rates, creating volatility in reported profits. To eliminate volatility, deferred tax accounts track cumulative temporary differences and corresponding tax effects. Deferred tax assets arise when past taxes paid exceed book taxes, and liabilities arise when book taxes exceed past taxes paid. Accounting for deferred taxes successfully eliminates profit volatility due to temporary differences between book and tax rules.