The document provides guidance on calculating output tax in Pakistan. It defines key terms related to sales tax such as taxable period, registered person, taxable activity, taxable and exempt goods. It explains how to calculate output tax for local supplies based on the value of supply, which considers discounted prices, consideration in kind, minimum production amounts. It also covers calculating output tax on imports based on customs value. The document outlines which input tax is adjustable, such as purchases supporting by invoices, and which transactions are not eligible like credit over 180 days or purchases of personal goods. It also specifies how tax liability is determined by subtracting input tax from output tax.

![2

Sales Tax

Basic Structure

Output Tax

[S-2(20)]

- Input Tax

[S-2(14)]

(60)

100

40

Sales tax payable

Sales x Sales tax rate =

Purchase x Sales tax rate =

Tax Period

1 month

Tax Period

How to calculate

Output Tax?

Which Input is

adjustable?

How much of

input is

adjustable?

DR/CR Notes](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-2-320.jpg)

![3

Tax Period [S-2(43)]

means

- period of 1 month OR

- such other period as specified by FBR, in official gazzette, with approval of Federal Ministry-in-charge](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-3-320.jpg)

![4

Output Tax

How to calculate?

Time of Supply

[S-2(44)]

Rate of Sales Tax

[S-3]

Value of Supply

[S-2(46)]

Registered Person

[S-2(25)]

Taxable Activity

[S-2(35)]

Taxable Supplies

[S-2(41)]

Supply

[S-2(33)]

Taxable Goods

[S-2(39)]

Exempt Goods

[S-13]

Goods

[S-2(12)]

Exports

Local Supply

Imports

Un-registered

Person

To Registered

Person

Will charge Sales Tax](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-4-320.jpg)

![5

Output Tax

How to calculate?

Registered Person [S-2(25)]

means a person who:

- is registered OR

- is liable to be registered under Sales Tax Act

Provided that a person liable to be registered but not registered shall not be entitled to any

benefit available to a registered person under any provision of Sales Tax Act or the rules made

thereunder](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-5-320.jpg)

![6

Output Tax

How to calculate?

Taxable Activity [S-2(35)]

means any economic activity carried on by a person whether or not for profit

Includes

- business, trade or manufacture

- supply of goods, rendering of services

- one-off adventure in nature of trade

- anything done during commencement or termination of

economic activity

Does not include

- activity of employee to employer

- private recreation pursuit or hobby

- above activity done by person other

than individual](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-6-320.jpg)

![7

Output Tax

How to calculate?

Taxable Supplies [S-2(41)]

Supply of taxable goods by

other than goods exempt u/s 13

and including zero rated goods u/s 4

Importer

manufacturer

wholesales

distributor

retailer](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-7-320.jpg)

![8

Output Tax

How to calculate?

Taxable Goods [S-2(39)]

means all goods, other than those exempt u/s 13](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-8-320.jpg)

![9

Output Tax

How to calculate?

Exempt Goods [S-13]

Goods mentioned in 6th Schedule

Goods specified by Federal Govt, through notification in official gazzette, where immediate action is needed for any of following:

- national security,

- natural disaster,

- national food security in emergency situations &

- implementation of bilateral and multilateral agreements

Power to deliver goods without payment of Sales Tax [S-60]

Federal Govt can authorize delivery of goods without payment of sales tax, in following cases and subject to such conditions as it may deem fit:

i. Imports for re-exportation by registered importer

ii. Imports of raw material & subsequent export after manufacture by registered manufacturer cum exporter](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-9-320.jpg)

![10

Output Tax

How to calculate?

Goods [S-2(12)]

include moveable property,

other than

- actionable claims

- moneys

- stocks/shares/securities](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-10-320.jpg)

![11

Output Tax

How to calculate?

Supply [S-2(33)]

means to dispose off goods as owner

Sale

OR

transfer of right

includes:

- sale or transfer under hire purchase agreement

- auction of goods to satisfy debt

- possession of goods immediately before the person ceases to be registered person

- transfer of goods manufactured (i.e., goods belonging to another person), to the owner or to person nominated by him

- putting to private, business or non business use

of goods produced during taxable activity

for purposes other than taxable supplies

FBR with approval of Federal Minister-in-charge, can also specify transactions which may or may not constitute supply](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-11-320.jpg)

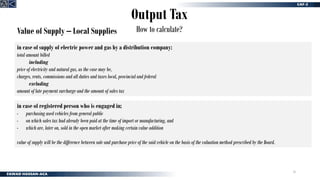

![12

Output Tax

How to calculate?

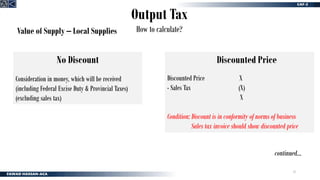

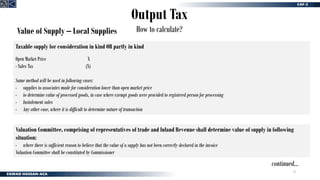

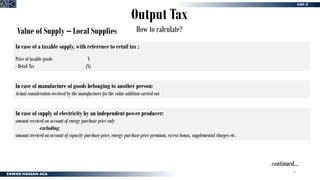

Value of Supply [S-2(46)]

• Local Supplies

• Imports](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-12-320.jpg)

![18

Output Tax

How to calculate?

Time of Supply [S-2(44)]

Goods Services

Under Hire

Purchase

Other than Hire

Purchase

When agreement is

entered into

When:

- Delivered

- Made available

In case part payment is received

In case of exempt

supplies

In all other cases

supply shall be accounted

for in tax period in which

exemption is withdrawn

supply shall be

accounted for in tax

period of supply

When rendered](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-18-320.jpg)

![19

Output Tax

How to calculate?

Rate of Sales Tax

• Other than zero rated supplies [S-3]

• Zero Rated Supplies [S-4]

• Change in rate of tax [S-5]](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-19-320.jpg)

![20

Output Tax

How to calculate?

Scope of Tax [S-3]

Goods supplied by Registered person

sales tax charged @ 17% on value of supplies/imports

1)

Supplies to un-registered person Further tax @ 3% Shall be charged

2)

Imports

Federal Govt can specify goods on which further tax not to be charged

FBR can also levy tax on:

- Production capacity

- Fixed basis

Sales tax @ mentioned in 10th Schedule

Retail Items (as per 3rd Schedule) sales tax charged @ 17% on retail price

this shall also be printed on each item

3)

continued…](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-20-320.jpg)

![21

Output Tax

How to calculate?

Scope of Tax [S-3]

8th Schedule items shall be charged to Sales tax @ mentioned in 8th Schedule

4)

6)

these items are local supplies

Liability to pay tax:

- Supplies

Sales tax withholding provisions have been mentioned in 11th Schedule

7)

9th Schedule items shall be charged to Sales tax @ mentioned in 9th Schedule

5)

these items are imports

- Imports

Supplier

Importer

However section 8A specifies joint and several liability in a supply chain

Gas transmission and dispatch company supplying gas to CNG stations shall charge sales tax @ 17% of value of supplies to consumers

8)

Federal Govt can charge Extra Tax upto maximum of 17% on specified goods in addition to the taxes mentioned above

9)

continued…](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-21-320.jpg)

![22

Output Tax

How to calculate?

Scope of Tax [S-3]

10) Retailer, other than Tier-1 Retailer, shall pay sales tax on basis of electricity bill as follows:

- bill upto Rs =20,000/- per month

- bill above Rs =20,000/- per month

5%

7.5%

This is in addition to sales tax charged on electricity consumption & input tax adjustment is not allowed against this sales tax

CIR shall issue order regarding exclusion of a person who is either a Tier-1 retailer, or not a retailer.

continued…](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-22-320.jpg)

![23

Output Tax

How to calculate?

Scope of Tax [S-3]

- Tier-1 retailers shall pay sales tax @ applicable to the goods sold

- Tier-1 retailers shall integrate their retail outlets with FBR's computerized system for real-time reporting of sales

11)

12) - In case of steel products/ship plates, minimum production shall be determined in accordance with 13th Schedule

- Higher of actual supplies or minimum production shall be treated as supplies for the month](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-23-320.jpg)

![24

Output Tax

How to calculate?

Zero Rating [S-4]

Sales tax @ 0% shall be charged on following:

1) Exports

2) 5th Schedule items

3) Provisions and stores on conveyance proceeding to destination outside Pakistan, as mentioned u/s 24 of Customs Act 1969

4) Goods specified by Federal Govt through notification whenever circumstances exist to take immediate action for;

- national security,

- natural disaster,

- national food security in emergency situations &

- implementation of bilateral and multilateral agreements

Exceptions:

1. Goods exported, but have been or are intended to be re-imported

2. Goods entered for export under the Customs Act, 1969, but not

exported

3. Goods exported to a country specified by the FG

FG can restrict amount of input tax on such zero rated supplies which otherwise

chargeable to sales tax](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-24-320.jpg)

![25

Output Tax

How to calculate?

Change in rate of tax [S-5]

Bill of entry /

GD

Bill of

lading

Goods Declaration (GD)

Manifest of Conveyance

Bill of

lading](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-25-320.jpg)

![26

Output Tax

How to calculate?

Change in rate of tax [S-5]

Local Supplies Imports

Rate in force at time of supply

Goods are entered for

home consumption

Goods are cleared

from warehouse

GD is presented in

advance of the arrival

of the conveyance

If the tax is not paid

within seven days of the of

the goods declaration u/s

104 of the Customs Act,

the tax shall be charged at

the rate as is in force on

the date on which tax is

actually paid

Rate in force on date

when GD is presented

u/s 79 of Customs Act

1969

Rate in force on date

when GD for clearance

of goods is presented

u/s 104 of Customs

Act 1969

Rate in force on

the date on which

the manifest of the

conveyance is

delivered](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-26-320.jpg)

![27

Which input is adjustable?

• Tax credits not allowed [S-8]

• Determination of tax liability [S-7]

• Certain transactions not admissible [S-73]

• Destruction of goods [R-23]](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-27-320.jpg)

![28

Which input is adjustable?

Tax credits not allowed [S-8]

continued…

A registered person shall not be entitled to deduct input tax paid on:

1. the goods or services which are not used or not to be used for the manufacture or production of taxable goods or for taxable supplies made or to be

made by him;

2. the goods on which extra amount of tax is payable under sub-section (5)of section 3;

3. any other goods or services which the Board with the approval of the Minister Incharge of the Federal Government may by a notification in the official

Gazette specify;

4. the goods or services in respect of which sales tax has not been deposited in the Government treasury by the respective supplier;

5. fake invoices;

6. purchases made by a registered person in case he fails to provide information relating to his imports, purchases, sales etc. as required by the Board

through a notification u/s 26(5);

7. purchases in respect of which a discrepancy is indicated by CREST or input tax of which is not verifiable in the supply chain;](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-28-320.jpg)

![29

Tax credits not allowed [S-8]

continued…

8. goods and services not related to the taxable supplies made by the registered person;

9. goods and services acquired for personal or non-business consumption;

10. goods used in, or permanently attached to, immoveable property, such as building and construction materials, paints, electrical and sanitary fittings,

pipes, wires and cables, but excluding pre-fabricated buildings and such goods acquired for sale or re-sale or for direct use in theproduction or

manufacture of taxable goods;

11. vehicles falling in Chapter 87 of the First Schedule to the Customs Act,1969, parts of such vehicles, electrical and gas appliances, furniture furnishings,

office equipment (excluding electronic cash registers), but excluding such goods acquired for sale or re-sale;

12. services in respect of which input tax adjustment is barred under the respective provincial sales tax law;

13. import or purchase of agricultural machinery or equipment subject to sales tax at the rate of 7% under Eighth Schedule to this Act; and

Which input is adjustable?](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-29-320.jpg)

![30

Tax credits not allowed [S-8]

14. from the date to be notified by the Board, such goods and services which, at the time of filing of return by the buyer, have not been declaredby the

supplier in his return or he has not paid amount of tax due as indicated in his return.

15. goods purchased which are attributable to supplies made to un-registered person, on pro-rata basis, for which sale invoices do not bear NIC or NTN of

the recipient

Which input is adjustable?](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-30-320.jpg)

![31

Determination of tax liability [S-7]

Conditions:

1. should be supported by Sales Tax Invoice bearing name and registration number of tax payer who is claiming input tax

2. supplier must have declared such supply in his return and he has paid amount of tax due as indicated in his return

3. in case of supply of electricity or gas, a bill bearing his registration # and the address where the connection is installed

4. in case of imports, it should be supported by :

a. Bill of entry OR Goods Declaration

b. Sales Tax Registration number

c. Customs clearance u/s 79, 81 or 104

5. in case of purchase through auction, it should be supported by Treasury Challan (showing amount of sales tax paid) bearing name and registration

number of tax payer who is claiming input tax

Which input is adjustable?

Output tax

- Input tax

X

(X)

X

excluding "Further Tax" charged @ 3% from un-reg person

if not claimed in relevant tax period, then can be claimed in

6 subsequent tax periods](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-31-320.jpg)

![32

Certain transactions not admissible [S-73]

Input tax in respect of following transactions is not allowed:

1. Amount above Rs =50,000/- paid other than through crossed cheque or other banking channel

• Online transfer of funds and transaction through credit cards shall be considered transaction through banking channel, if verifiable from bank

statement of buyer and supplier

• Exception; utility bills

2. Credit purchases not paid within 180 days

However, FBR may extend time through condonation u/s 74

3. Amount paid should be credited in business bank account of supplier

“business bank account” means a bank account utilized by the registered person for business transactions AND

declared to the Commissioner through Form STR-1 or change of particulars in registration database

4. Input in respect of >>>>sales made by registered person to un-registered persons

Exception; input in respect of sales made to an un-registered person,

• upto Rs 10 million a month &

• upto Rs 100 million a year

Which input is adjustable?

Payable and receivable adjustment shall be treated as payments, provided that:

(i) applicable sales tax has been charged and paid by both and

(ii) prior approval of CIT for adjustments

Not applicable on following:

(i) FG/PG/LG deptts, authorities, etc. not

engaged in making of taxable supplies’

(ii) Foreign Missions, diplomats and

privileged persons.

(iii) Registered persons engaged in

manufacturing and supply of fertilizer upon

submission of required documents.

(iv) All other persons not engaged in supply

of taxable goods](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-32-320.jpg)

![33

Destruction of goods [R-23]

If buyer returns goods because these are unfit for consumption and

are required to be destroyed by the supplier,

then goods shall be destroyed

after obtaining permission from Collector of Sales Tax, and

under supervision of officer of Sales Tax not below the rank of Assistant Collector.

The input tax in respect of such destroyed goods shall not be admissible

Which input is adjustable?](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-33-320.jpg)

![34

How much of input is adjustable?

Adjustable input tax [S-8B]

1. Adjustment of input tax limited upto

2. Input tax in excess of above OR refund can be claimed subject to following conditions:

a. in case of Registered person whoes accounts are audited in accordance with Companies Act 2017, a statement of value addition less than the limit

is certified by Auditors

b. in case of any other person, conditions as may be specified by FBR

c. adjustment shall be made on yearly basis in 2nd month following end of financial year

3. FBR may also prescribe any other limit for any person or class of transactions

4. Penalty on Auditor:

Any auditor found guilty of misconduct in furnishing the certificate shall be referred to the Council for disciplinary action under section 20D of

Chartered Accountants, Ordinance, 1961

5. In case of locally manufactured electric vehicles subject to reduced rate of tax under the 8th Schedule

input tax allowed shall be limited to amount of output tax and no refund or carry forward of excess input tax shall be allowed

6. In case a Tier-1 retailer does not integrate his retail outlet, the adjustable input tax for whole of that tax period shall be reduced by 60%

90% of output tax

limit not applicable on

• Listed Companies

• Fixed Assets and Capital Goods](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-34-320.jpg)

![35

DR / CR Notes

DR / CR Notes [S-9] [R-20 & 21]

If sales tax invoice has been issued by supplier, then in following situations a debit or credit note shall be issued by

supplier;

- cancellation of supply OR

- return of goods OR

- change in the nature of supply OR

- change in the value of the supply OR

- in case of any other event in which the amount shown in the tax invoice or the return needs to be modified

After issuance of debit or credit note a corresponding adjustment could be made in sales tax return

✓ Adjustments, which lead to reduction in output tax or increase in input tax

can only be made if the corresponding Debit Note or Credit Note is issued

within 180 days of the relevant supply.

✓ The Collector of Sales Tax may, at the request of the supplier, in specific

cases, by giving reasons in writing, extend this period by a further 180

days.](https://image.slidesharecdn.com/salestax-220330111739/85/Sales-Tax-pdf-35-320.jpg)