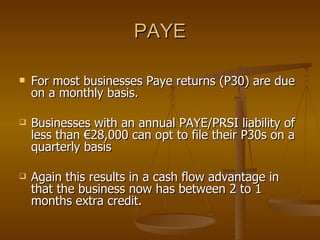

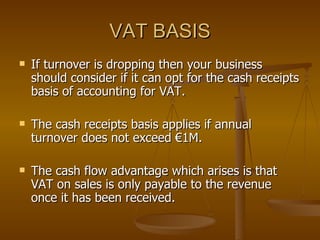

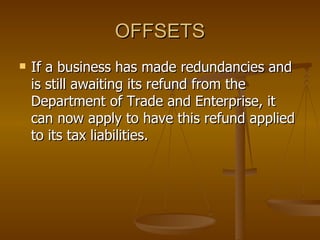

The document outlines ways for businesses to reduce their tax compliance burden and improve cash flow during times of reduced economic activity. It recommends that businesses consider filing VAT and PAYE returns less frequently, canceling VAT registration if turnover decreases below thresholds, switching to the cash receipts basis for VAT accounting if turnover drops, and applying redundancy refunds from the Department of Trade and Enterprise against tax liabilities. Contact details are provided for any additional information needs.

![CONTACT US If you would like any further information on any of the issues raised in this slide show please contact us. [email_address]](https://image.slidesharecdn.com/managingyourcashflow-12645348716619-phpapp01/85/Managing-Your-Cash-Flow-9-320.jpg)