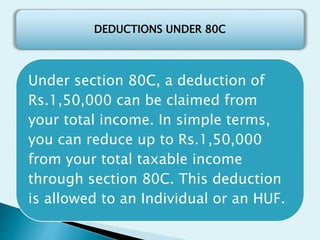

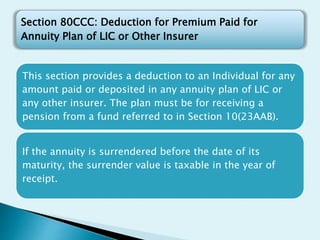

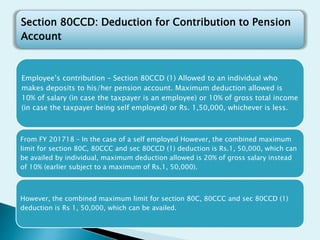

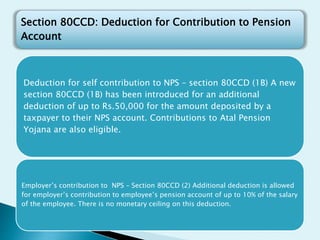

Under Section 80C, individuals can claim a tax deduction of up to Rs. 1,50,000 for amounts paid towards life insurance premiums, provident funds, eligible investments and more. Section 80CCC provides an additional deduction of up to Rs. 1,50,000 for contributions to certain pension plans. Section 80CCD allows deductions of up to Rs. 1,50,000 for contributions to Central Government pension schemes.