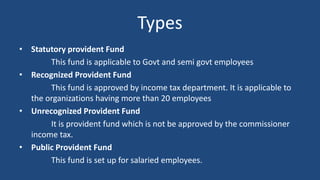

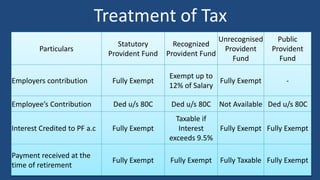

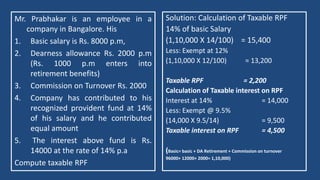

The document discusses provident funds in India, including statutory provident funds for government employees, recognized provident funds for large private organizations, unrecognized funds, and public provident funds. It notes that employer contributions are fully exempt for statutory and public funds. Employee contributions are deductible under section 80C for all funds. Interest is fully exempt for statutory, recognized up to 9.5%, and public funds, but taxable for unrecognized funds. At retirement, payouts are fully exempt for all except unrecognized funds, which are fully taxable. It also provides an example calculation for taxable recognized provident fund of an employee.