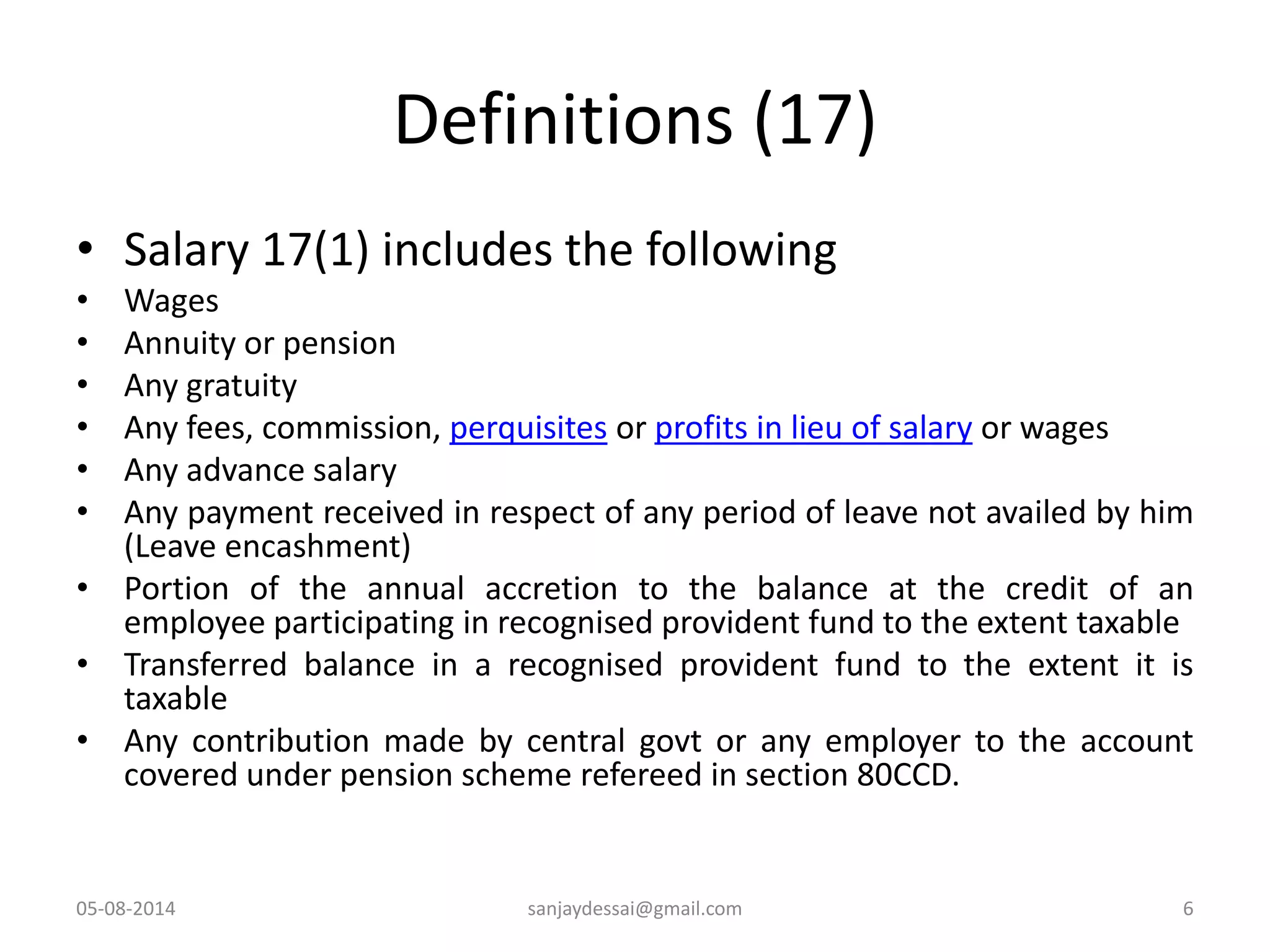

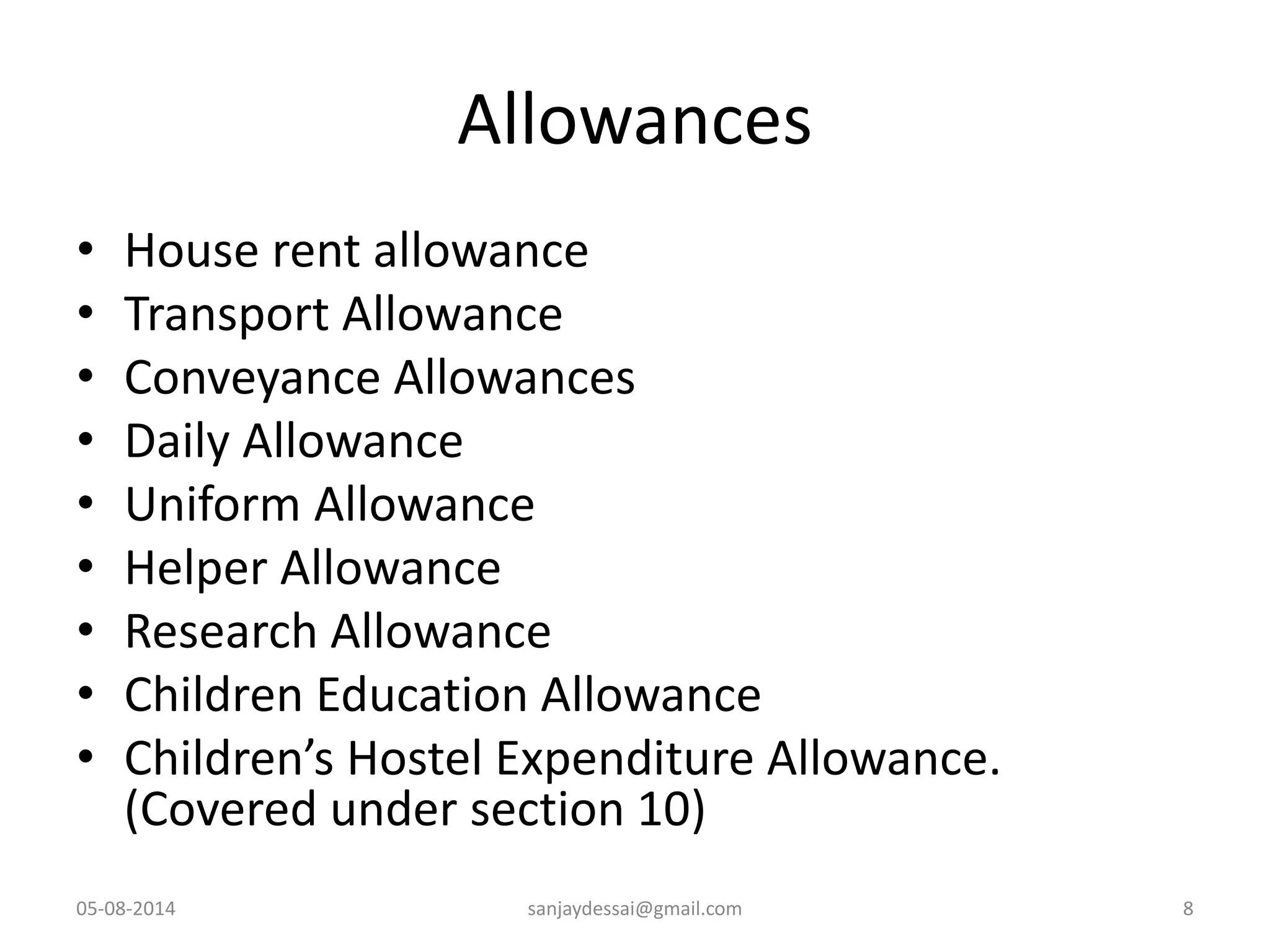

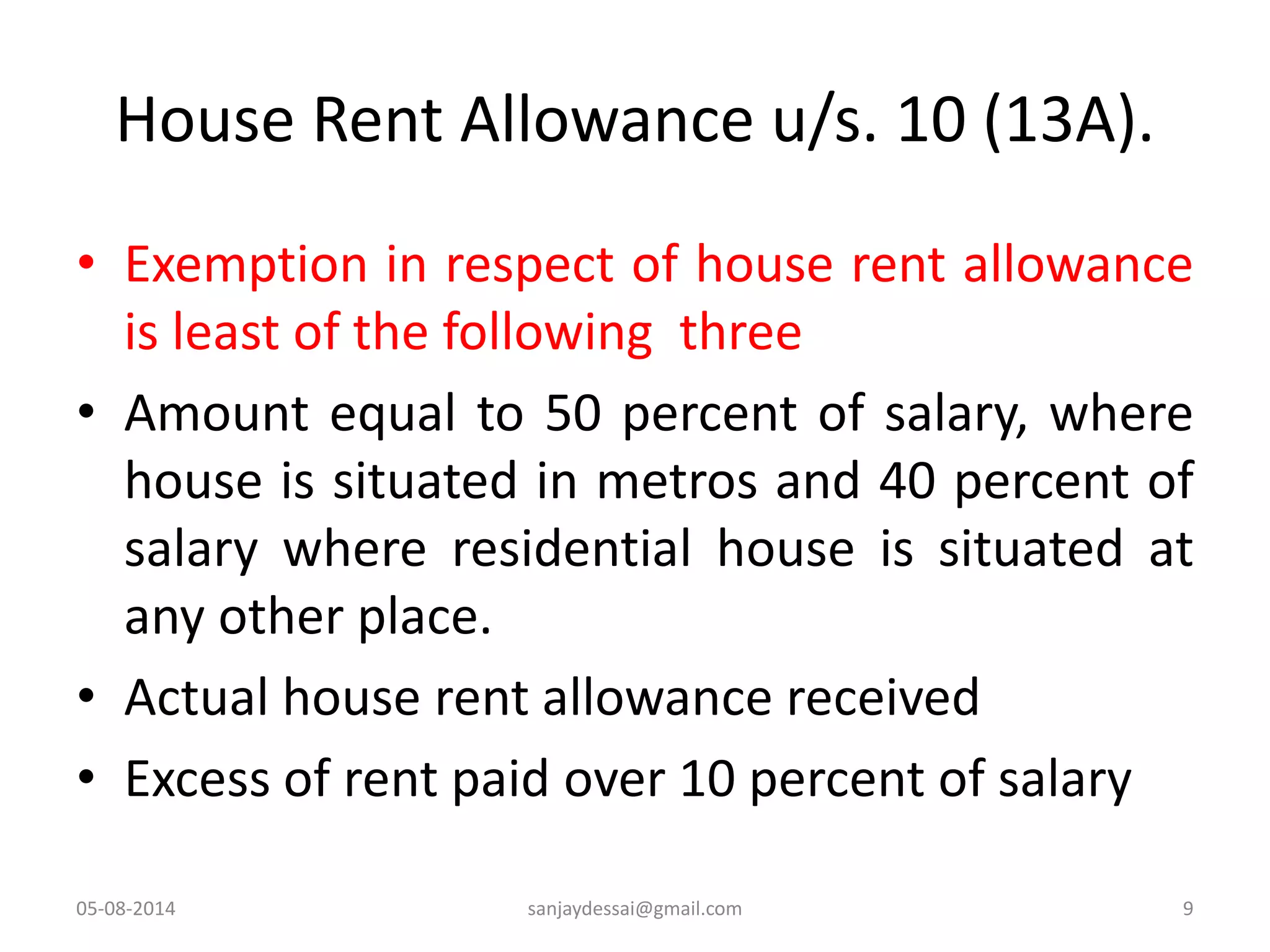

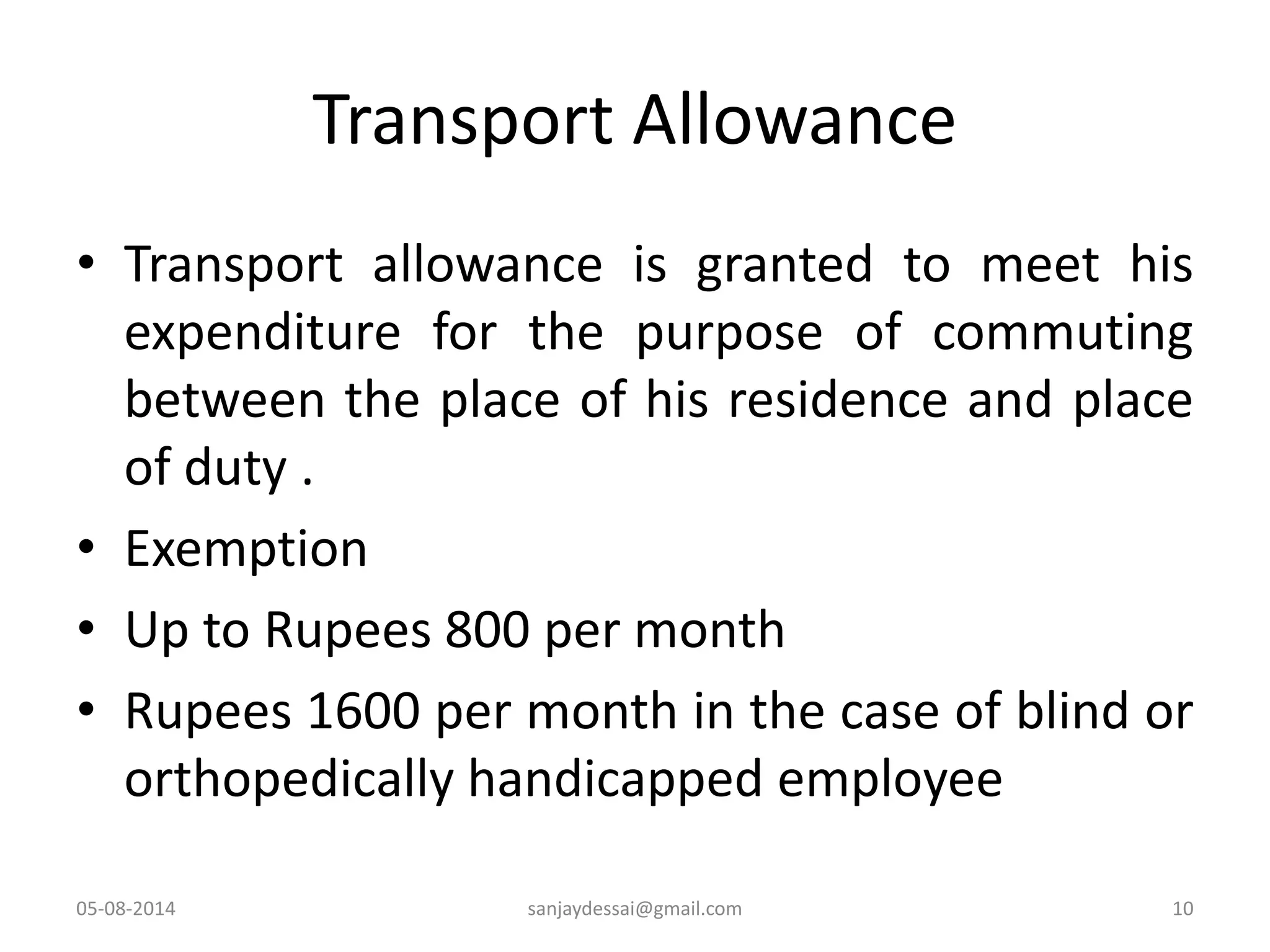

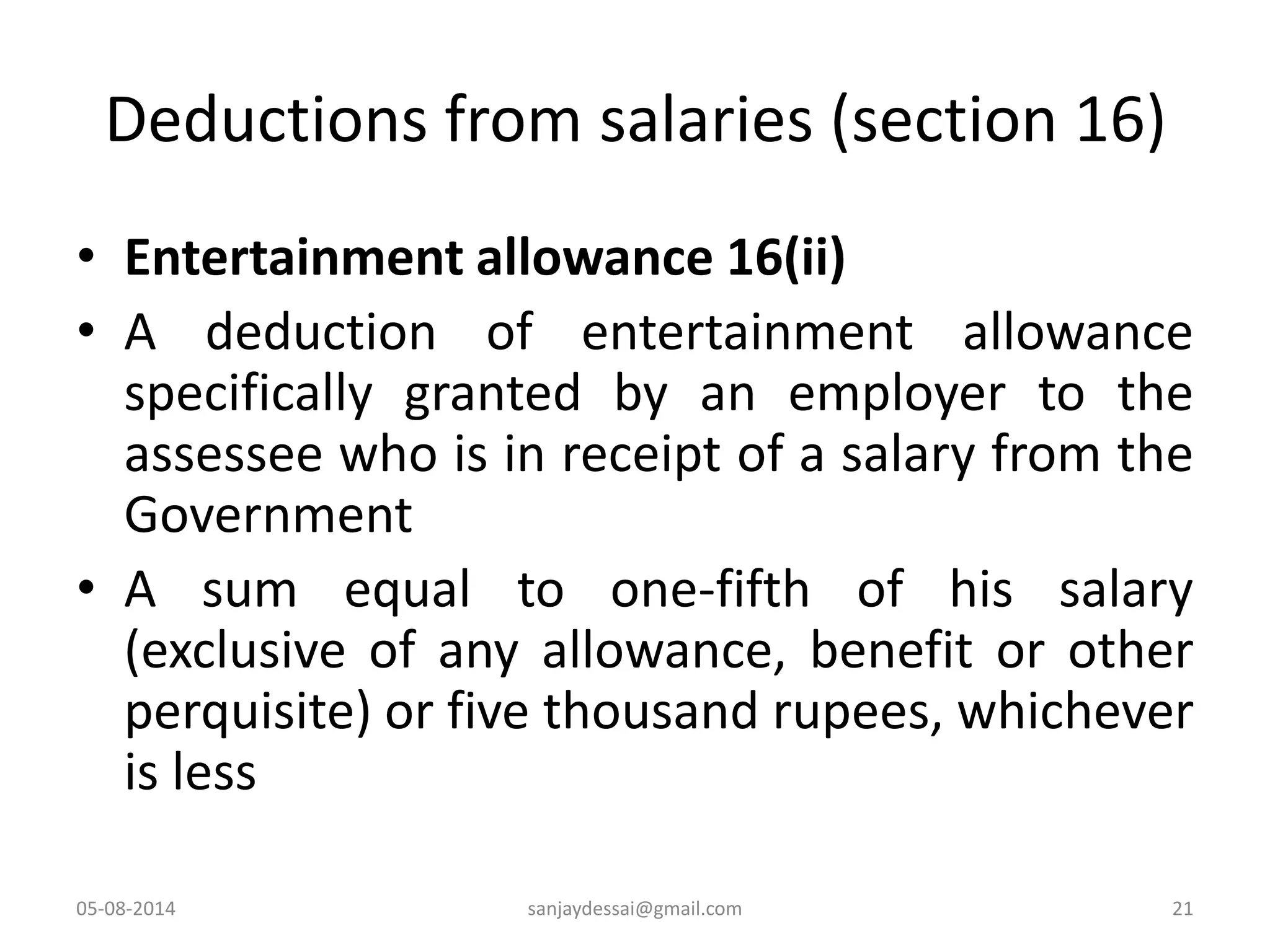

The document outlines the computation of income from salaries for B.Com students based on the Goa University syllabus, detailing relevant sections of income tax law, including definitions of salary, allowances, and perquisites. It explains the taxability of various forms of salary, the allowances available and their exemptions, and provides guidance on deductions applicable under the Income Tax Act. Key topics include the treatment of house rent, transport, children education, and medical allowances, along with specific sections addressing deductions and taxable elements associated with employment.