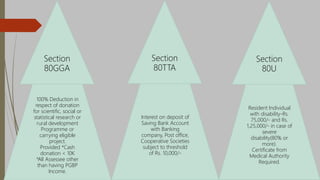

This document outlines various tax deductions that can be claimed by individuals under Section 80C-80U of the Income Tax Act of 1961 in India. Some key deductions include:

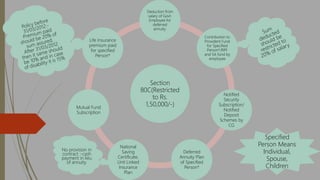

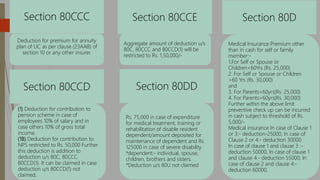

- Contributions to provident funds, life insurance premiums, tuition fees for up to two children, home loan principal repayment, and certain investments can be deducted from gross total income under Section 80C, up to Rs. 1.5 lakh.

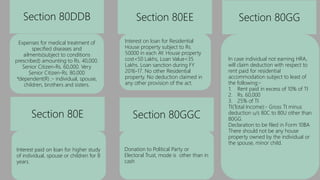

- Medical insurance premiums paid for self, spouse, children and parents are deductible under Section 80D, up to certain limits based on age.

- Expenses incurred for medical treatment of specified diseases can be deducted under Section 80DDB, up to Rs.