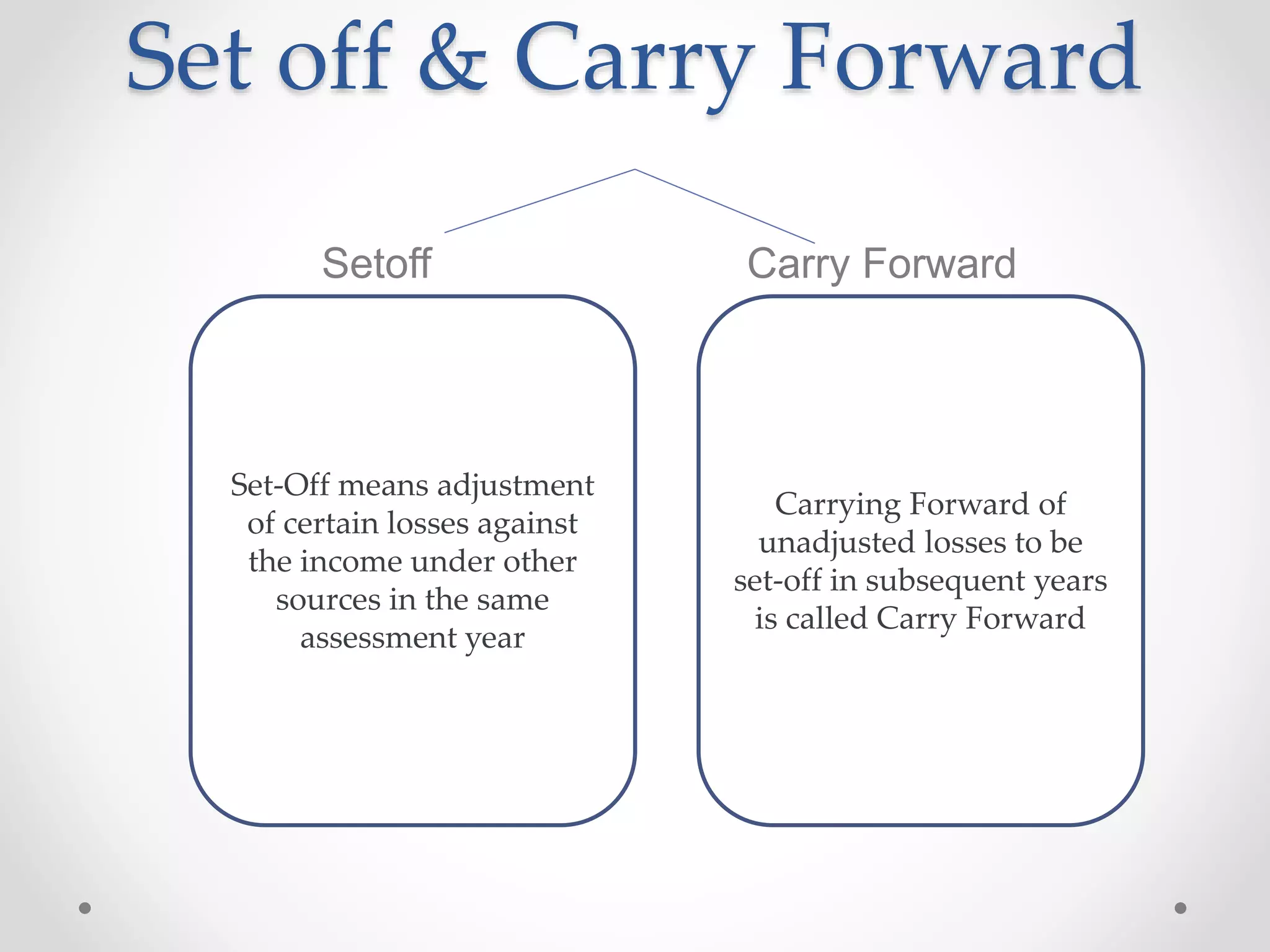

This document discusses set off and carry forward of losses under the Indian Income Tax Act. It provides details on:

1. Set off of losses from one source of income against income from another source under the same head (intra-head set off) and against income from other heads (inter-head set off), subject to certain exceptions.

2. Carrying forward unadjusted losses to future years for set off against income of those years, with time limits varying from 4 to 8 years depending on the head.

3. Key points around set off and carry forward of losses from different income sources like house property, business, capital gains, and owning race horses.