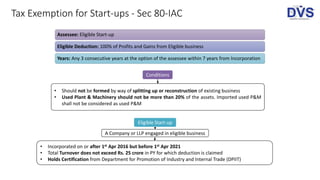

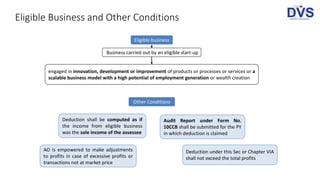

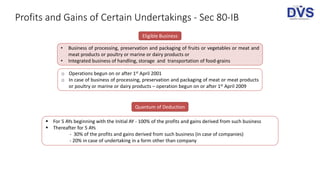

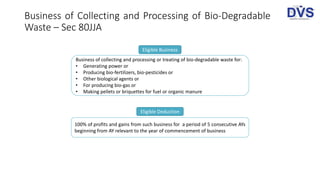

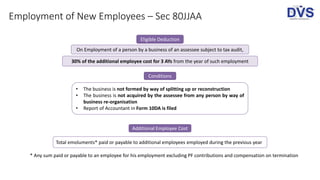

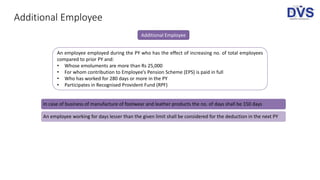

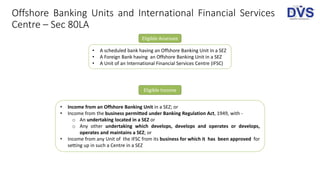

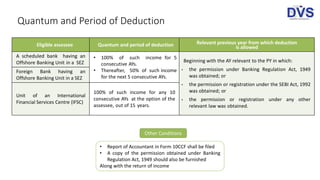

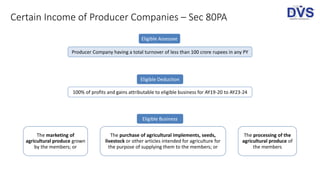

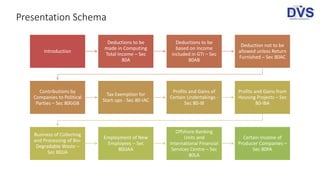

Chapter VI-A details various deductions applicable for corporate assessees in computing total income to reduce tax liability, including provisions under sections 80A to 80PA. Key deductions include those for contributions to political parties, tax exemptions for start-ups, and profits from housing projects, each with specific eligibility criteria. The chapter emphasizes the importance of filing returns to claim these deductions and outlines the limitations on the total deductions allowable.

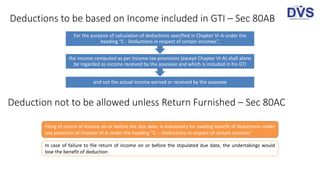

![Deductions to be made in Computing Total Income – Sec 80A

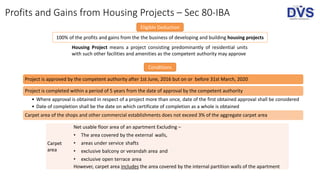

In computing the Gross Total Income* [GTI] of an assessee, deductions specified in Sec 80C to Sec 80U shall be allowed

In any case Total Deductions under Chapter VIA shall not exceed the GTI of the Assessee i.e there can be no loss due to deductions

If any deductions are allowed to an AOP/BOI, no deduction under the same Sec shall be allowed to a member in relation to their

share in the AOP/BOI

The profits and gains allowed as deduction under Sec 10AA or under any provision of Chapter VI-A under the heading "C.-

Deductions in respect of certain incomes" in any AY, shall not be allowed as deduction under any other provisions

Such deduction shall not exceed the profits and gains of the undertaking or unit or enterprise or eligible business

No deduction shall be allowed if the deduction has not been claimed in the return of income

The transfer price of goods and services between eligible business and other business of the assessee shall be determined at the

market value of such goods or services as on the date of transfer

Where a deduction has been allowed under this Chapter for a eligible business, no deduction under Sec 35AD is permissible in

relation to such business for the same or any other AY

*Gross total income - means the total income computed in accordance with the

provisions of Income-tax Act, before making any deduction under this Chapter VI-A](https://image.slidesharecdn.com/chaptervi-adeductionspartii-07-200121051359/85/Chapter-VI-A-Deductions-while-Computing-Total-Income-Part-II-7-320.jpg)

![Contd.

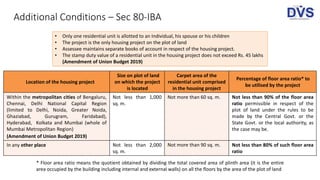

Part C - Deductions in respect of certain incomes under Chapter VI-A

Section Deduction

80-IA Deductions in respect of profits and gains from undertakings or enterprises engaged in

infrastructure development/ operation/ maintenance, generation/ transmission/ distribution of

power etc.

80-IAB Deduction in respect of profits and gains derived by an undertaking or enterprise engaged in

development of SEZ

80-IAC Deduction in respect of profits and gains derived by an eligible start-up from an eligible business

80-IB Deduction in respect of profits and gains from certain industrial undertakings other than

infrastructure development undertakings

80-IBA Deduction in respect of profits and gains from housing projects

80-IC Deduction in respect of profits and gains from certain undertakings or enterprises in certain special

category States [Himachal Pradesh and Uttaranchal]

80-IE Deduction in respect of profits and gains from manufacture or production of eligible article or

thing, substantial expansion to manufacture or produce any eligible article or thing or carrying on of

eligible business in North-Eastern States](https://image.slidesharecdn.com/chaptervi-adeductionspartii-07-200121051359/85/Chapter-VI-A-Deductions-while-Computing-Total-Income-Part-II-8-320.jpg)