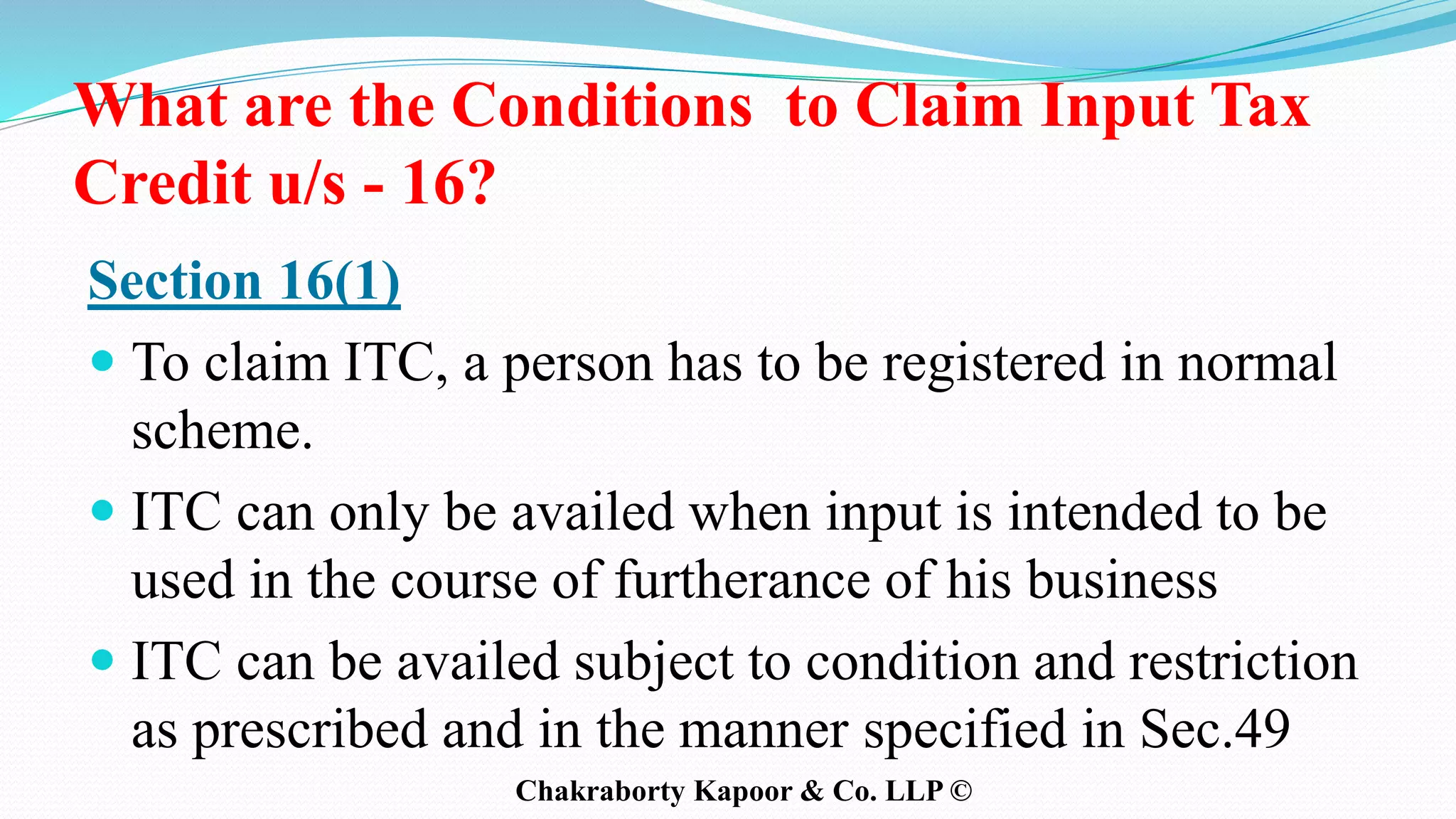

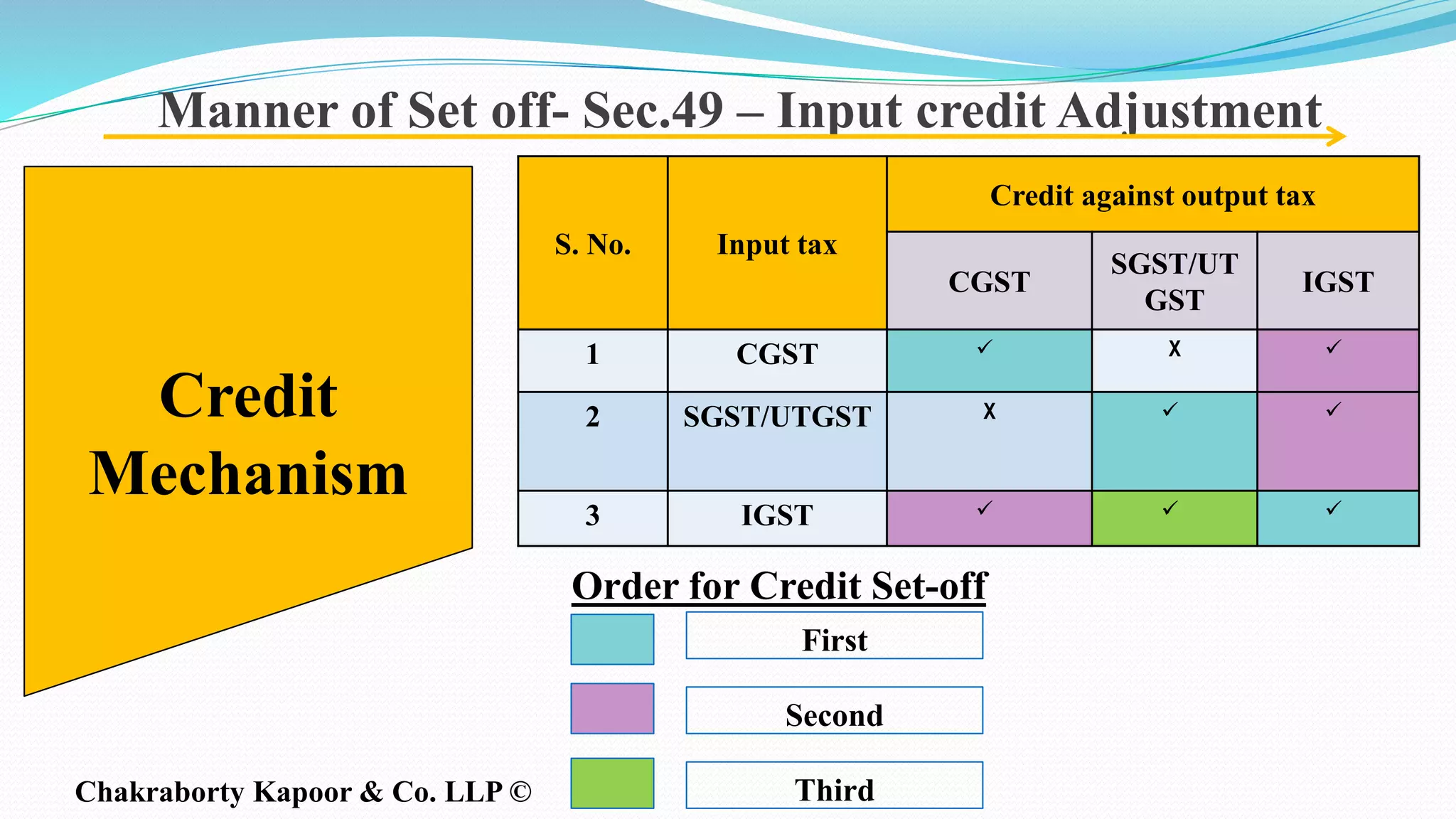

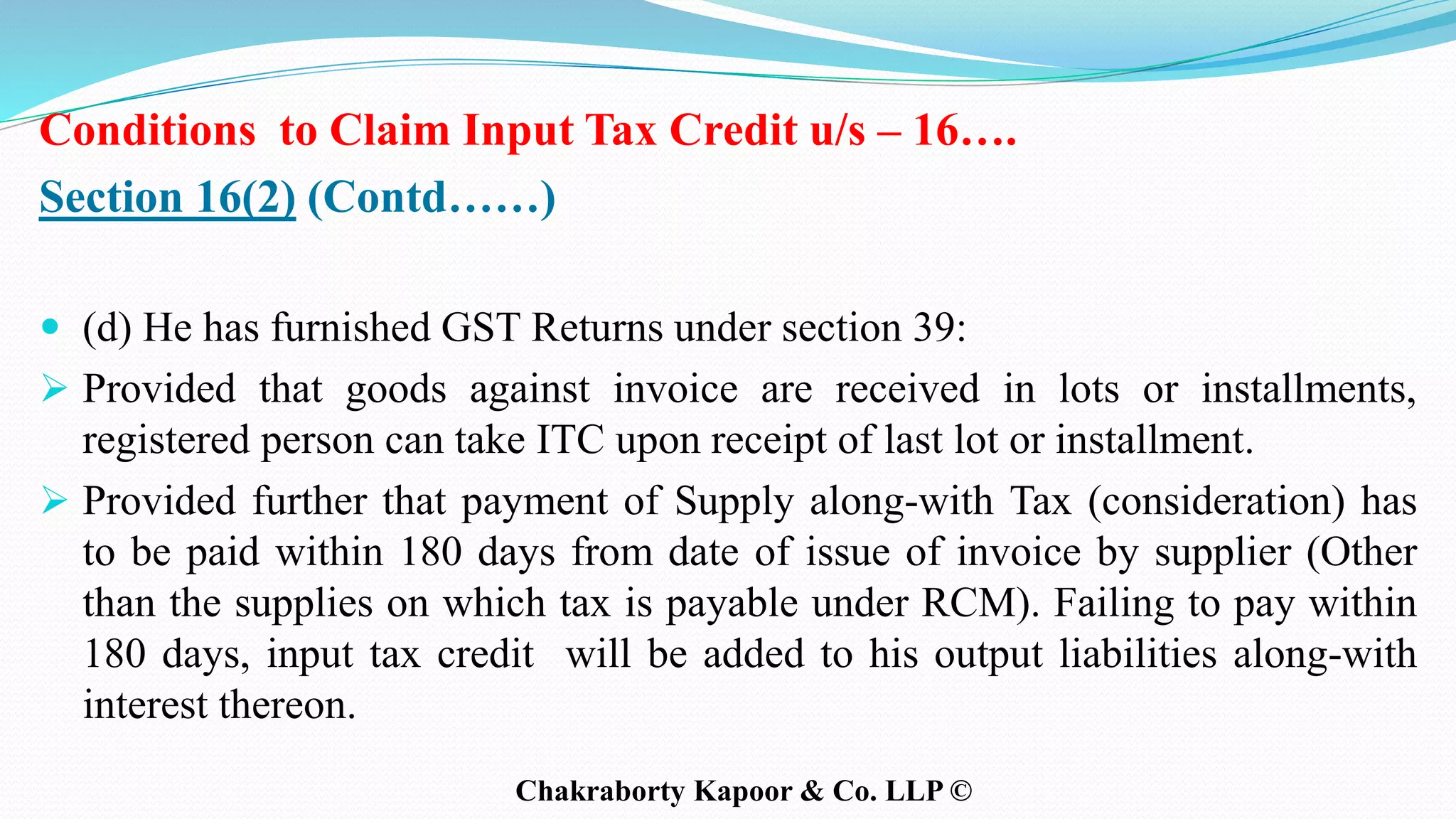

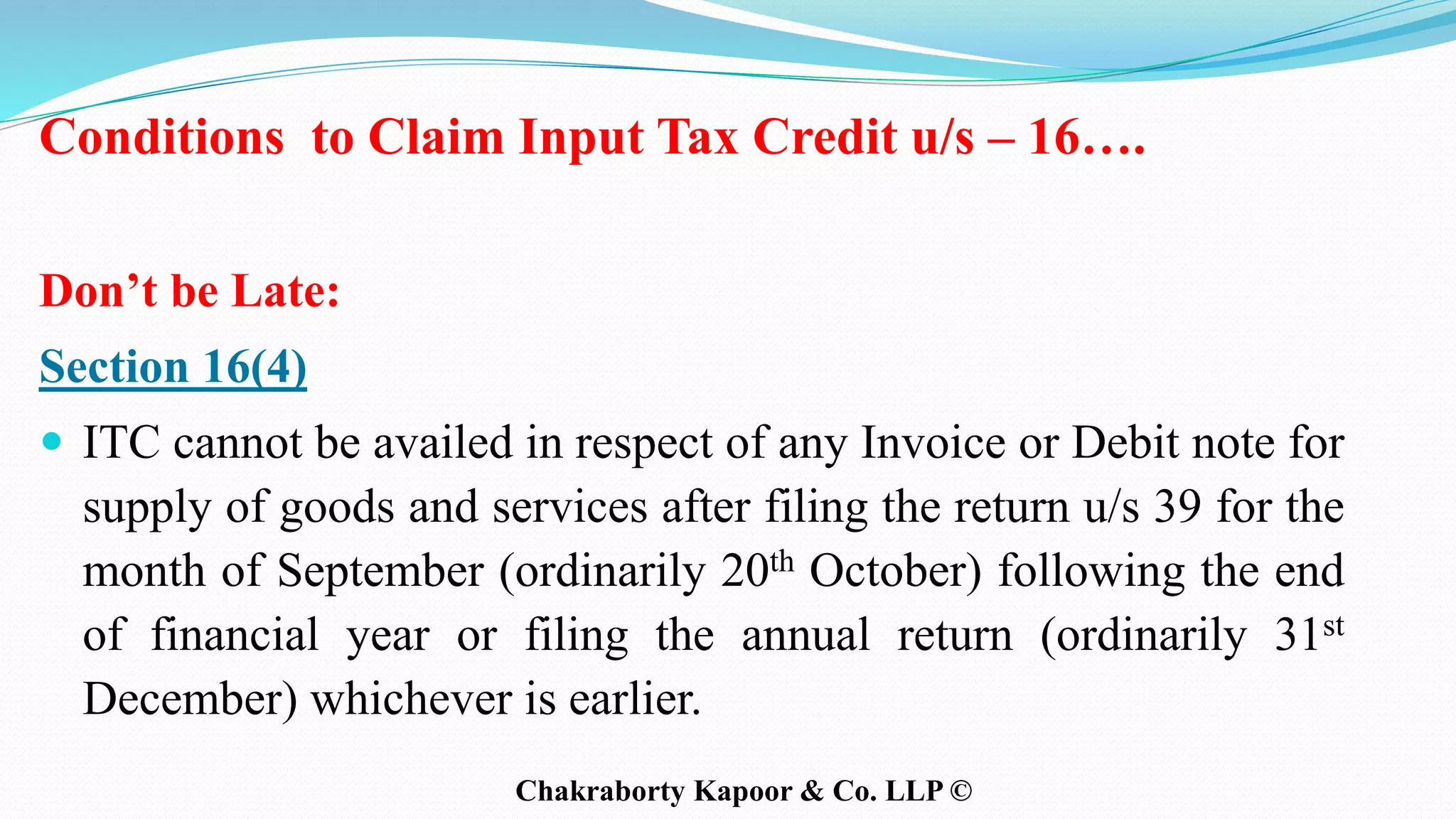

The document outlines the eligibility and conditions under Section 16 of the Goods and Services Tax (GST) for claiming input tax credit (ITC) by registered persons. Key conditions include possession of a valid tax invoice, receipt of goods/services, timely payment to the supplier, and compliance with GST return filing requirements. Additionally, ITC claims cannot be made after a certain deadline, and depreciation on capital goods affects eligibility.