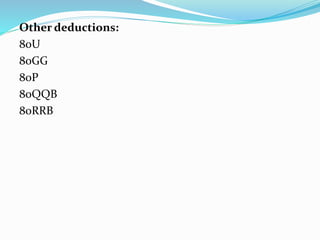

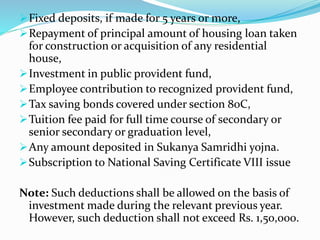

This document discusses various tax deductions available under Sections 80C to 80U of the Indian Income Tax Act. Key deductions include:

- Investments in retirement funds, life insurance, tuition fees, home loans (Section 80C, up to Rs. 150,000)

- Contributions to pension funds (Section 80CCC, up to Rs. 150,000)

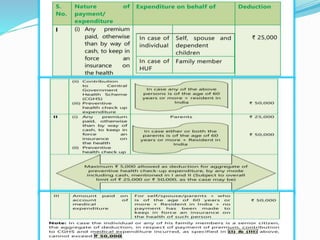

- Medical insurance premiums for self, spouse, dependents and parents (Section 80D, up to Rs. 50-75,000)

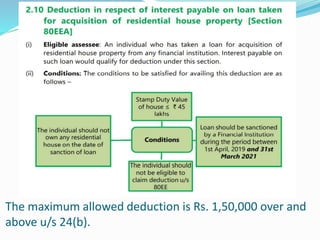

- Interest on education loans and home loans (Section 80E and 80EE, up to Rs. 50,000 each)

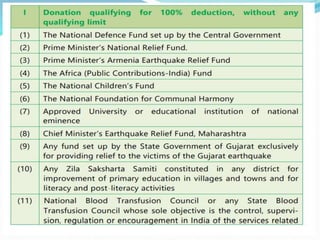

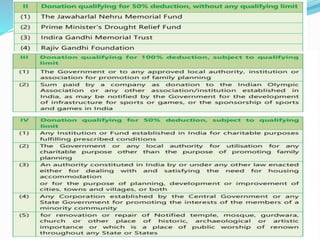

- Donations to charitable organizations (Section 80G, tax deductible

![Section 80C to 80U

[Tax Saving Instruments,

Investment and Opportunities]](https://image.slidesharecdn.com/sessioniv-deductionsec80cto80u-230317041209-9bb2879d/75/Session-IV-Deduction-Sec-80C-to-80U-pptx-1-2048.jpg)

![Deduction in respect of certain pension funds:

[Section 80CCC]

Maximum permissible deduction is Rs. 1,50,000.

Deduction in respect of contribution to pension scheme

notified by the Central Government: [Section 80CCD]

“Atal Pension Yojna”

A person working under Central Government has to

contribute 10% of salary towards their pension account.

The deduction in case of self- employed individual would

be limited to 20% of gross total income in the previous

year.

Additional deduction of Rs. 50,000 in respect of amount

deposited towards NPS. [Section 80CCD(1B)]](https://image.slidesharecdn.com/sessioniv-deductionsec80cto80u-230317041209-9bb2879d/85/Session-IV-Deduction-Sec-80C-to-80U-pptx-6-320.jpg)

![Limit on deduction under section 80C, 80CCC &

80CCD: [Section 80CCE]

This section restricts the aggregate amount of deduction

under section 80C + 80CCC + 80CCD to Rs. 1,50,000.

It is to be noted that deduction of Rs. 50,000 u/s 80CCD

(1B) and employer’s contribution to pension scheme

(allowable as deduction u/s 80CCD(2) in the hands of

employee) shall be outside the overall limit of Rs.

1,50,000.](https://image.slidesharecdn.com/sessioniv-deductionsec80cto80u-230317041209-9bb2879d/85/Session-IV-Deduction-Sec-80C-to-80U-pptx-7-320.jpg)

![Deduction for Health/ Medical insurance premium:

[Section 80D]

Deduction in respect of medical insurance or health

insurance including preventive health check up on the

health of individual self, spouse, dependent children and

parents, and medical expenditure in respect of very senior

citizen

In case of HUF- any member thereof.

Such deduction shall be limited to-

On the health of self, spouse and dependent children Rs.

25,000

On the life of parent or parents Rs. 25,000 , if one is senior

citizen Rs. 50,000

Amount paid on medical expenditure of very senior citizen,

who is a resident in India,

Contribution to CGHS/ Preventive health check up

maximum Rs. 5,000](https://image.slidesharecdn.com/sessioniv-deductionsec80cto80u-230317041209-9bb2879d/85/Session-IV-Deduction-Sec-80C-to-80U-pptx-8-320.jpg)

![Deduction in respect of medical treatment of

dependent disabled relatives: [Section 80DD]

The quantum of deduction shall be limited to Rs. 75,000

and in case of severe disability Rs. 1,25,000.

Relatives means in case of individual the spouse,

children, parents, brother and sister of the

individual who is wholly or mainly dependant on such

individual.

Incase of HUF, any member there of.](https://image.slidesharecdn.com/sessioniv-deductionsec80cto80u-230317041209-9bb2879d/85/Session-IV-Deduction-Sec-80C-to-80U-pptx-10-320.jpg)

![Deduction in respect of medical treatment of

certain prescribed disease:[Section 80DDB]

Maximum amount of deduction allowed shall be Rs.

40,000 or actual amount paid whichever is less.

Incase of senior citizen =Rs. 1,00,000](https://image.slidesharecdn.com/sessioniv-deductionsec80cto80u-230317041209-9bb2879d/85/Session-IV-Deduction-Sec-80C-to-80U-pptx-11-320.jpg)

![Deduction in respect of interest on loan taken

for higher education: [Section 80E]

Maximum allowed deduction shall be “actual amount

paid” in relation with interest on loan taken for

higher education.

Deduction in respect of interest on loan for construction

or acquisition of house: [Section 80EE]

Maximum deduction of Rs. 50,000](https://image.slidesharecdn.com/sessioniv-deductionsec80cto80u-230317041209-9bb2879d/85/Session-IV-Deduction-Sec-80C-to-80U-pptx-12-320.jpg)

![Deduction in relation with donation [Section 80G]

A. 100% deduction without qualifying limit

B. 50% deduction without qualifying limit

C. 100% deduction with qualifying limit

D. 50% deduction with qualifying limit

Qualifying limit = 10% of adjusted total income

Adjusted total income = Gross total income – Deduction

other than section 80G](https://image.slidesharecdn.com/sessioniv-deductionsec80cto80u-230317041209-9bb2879d/85/Session-IV-Deduction-Sec-80C-to-80U-pptx-14-320.jpg)

![Deduction in respect of interest on savings account

[Section 80TTA]

Firstly income from interest shall be disclosed under the

head income from other source.

Afterwards, allowed as deduction from gross total

income.

Maximum allowed deduction is Rs. 10,000.](https://image.slidesharecdn.com/sessioniv-deductionsec80cto80u-230317041209-9bb2879d/85/Session-IV-Deduction-Sec-80C-to-80U-pptx-17-320.jpg)