Form 12BB Manual-23-24_Guidelines.pdf

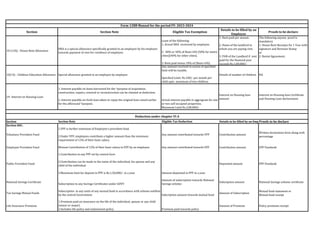

- 1. Section Section Note Eligible Tax Exemption Details to be filled by an Employee Proofs to be declare 10 (13A) - House Rent Allowance HRA is a special allowance specifically granted to an employee by his employer towards payment of rent for residence of employee. Least of the following: 1. Actual HRA receiveed by employee. 2. 40% or 50% of Basic+DA (50% for metro cities)(40% for other cities). 3. Rent paid minus 10% of (Basic+DA). 1. Rent paid per annum. 2. Name of the landlord to whom you are paying rent. 3. PAN of the Landlord if rent paid for the financial year exceeds Rs.1,00,000/- The following anyone proof is mandatory 1. House Rent Receipts for 1 Year with signature and Revenue Stamp or 2. Rental Agreement. 10(14) - Children Education Allowance Special allowance granted to an employee by employer. Any amount received in excess of specified limit will be taxable. Specified Limit: Rs.100/- per month per child upto maximum of two children. Details of number of children NA 24- Interest on Housing Loan 1. Interest payable on loans borrowed for the *purpose of acquisition, construction, repairs, renewal or reconstruction can be claimed as deduction. 2. Interest payable on fresh loan taken to repay the original loan raised earlier for the afforesaid *purpose. Actual interest payable in aggregrate for one or two self occupied properties. Maximum Limit Rs.2,00,000/- Interest on Housing loan amount Interest on Housing loan Certificate and Housing Loan declareation Section Section Note Eligible Tax Deduction Details to be filled by an Emp Proofs to be declare Section 80C: Voluntary Provident Fund 1.VPF is further extension of Employee's provident fund. 2.Under VPF, employees contribute a higher amount than the minimum requirement of 12% of their basic salary. Any amount contributed towards VPF Contribution amount Written declaration form along with percentage Employee Provident Fund Minium Contribution of 12% of their basic salary to EPF by an employee. Any amount contributed towards EPF Contribution amount EPF Passbook Public Provident Fund 1.Contribution to any PPF set by central Govt. 2.Contribution can be made in the name of the individual, his spouse and any child of the individual. 3.Maximum limit for deposit in PPF is Rs.1,50,000/- in a year Amount deposited in PPF in a year Deposited amount PPF Passbook National Savings Certificate Subscription to any Savings Certificates under GOVT Amount of subscription towards National Savings scheme Subsription amount National Savings scheme certificate Tax Savings Mutual Funds Subscription to any units of any mutual fund in accordance with scheme notified by the central Government Subcription amount towards mutual fund Amount of Subscription Mutual fund statement or Mutual fund receipt Life Insurance Premium 1.Premium paid on insurance on the life of the individual, spouse or any child (minor or major). 2.Includes life policy and endowment policy. Premium paid towards policy Amount of Premium Policy premium receipt Form 12BB Manual for the period FY: 2023‐2024 Deduction under chapter VI A

- 2. Unit linked insurance Plan Contribution in the name of the individual, his or her spouse or any child of the individual in the Unit Linked Insurance Plan 1971. Amount of Contribution Amount of Premium Policy Details Contribution paid receipt Unit linked insurance Plan of LIC mutual Fund Contribution in the name of the individual, his or her spouse or any child of the individual in the Unit Linked Insurance Plan of LIC Mutual Fund. Amount of Contribution Amount of Premium Mutual fund statement or Mutual fund receipt Contribution to Pension Fund Contribution by an individual to a pension fund Amount of Contribution Contribution amount Children Tuition Fee 1.Payment of tuition fees by an individual assessee at the time of admission or thereafter to any university, college, school or other educational institutions within India. 2.For the purpose of full time education of any two children of the individual. Amount of tution fees for full-time education Tution fees paid amount University/college/school tution fee receipt Housing Loan Principal Repayment/Stamp Duty/ Registeration Fee 1.Any payment made towards the cost of purchase or construction of a new residential house property. 2.Stamp duty, registeration fee and other expenses for the purposes of transfer of such house property to the assessee. Amount paid towards repayment of housing loan/stampduty/ registeration fee. Paid amount Repayment loan Schedule/ certificate. Subscription to Equity/ Debentures in Public Company Subscription to equity shares or debentures in public company or in any public financial institution Amount of subscription Amount paid for shares/debentures Share Purchase Certificate 5Years Fixed Deposit in Scheduled Bank/Post office 1.Investment in five year time deposit in an account under Post Office. 2.Investment in term deposit not less than five years with a scheduled bank. 3.Maximum limit for term deposit in scheduled bank is Rs.1,50,000/- Deposited Amount Deposited amount Deposit Receipts NABARD Board Subscription to such bonds issued by NABARD Subcription amount towards NABARD Bond Subsription amount Bond Receipt Senior Citizens Savings Scheme Any depoist in an account under Senior Citizens Savings scheme. Deposited Amount Deposited amount Deposit Receipt Sukanya Samriddhi Yojana Any sum paid or deposited during the previous year in Sukanya Samriddhi Scheme by individual in the name of 1. Any girl child of the individual or 2. Any girl child for whom such individual is the legal guardian. Deposited or paid Amount Deposited or paid Amount Deposit Receipt Section 80CCC Contribution to certain pension funds Any amount paid or deposited by the assessee in any annuity plan of LIC of India or under any other insurer . Maximum permissable deduction is Rs.1,50,000/- Depoist amount Deposit Receipt Note:Aggregrate deduction under sections 80C,80CCC & 80CCD(1) is Rs.1,50,000/‐

- 3. Sec 80CCD (1B) Contribution made by individual taxpayer towards National Pension Scheme. Maximum permissable deduction is Rs.50,000/- Contribution amount scheme/ deposit receipt. Sec 80U Applicable to resident individual ,at any time during the previous year, is certified Eligible deduction: 1. Rs.75,000/- in respect of person with disability. 2. Rs.1,25,000/- in respect of person with severe disability i.e Having disability over 80% Medical claim amount and % of disability Disability Certificate issued by authorized medical practioner. Sec 80G Donation qualifying for 100% deduction without any qualifying limit. Donation to the following fund: 1. Prime Minister's National Relief Fund. 2. The National Children's Fund 3. Approved university or educational institution of national eminence. 4. Any state government fund set up to provide medical relief to the poor. 5. The National Sports Fund set up by the Central Government. 100% donation amount eligible . Note: Donation exceedings Rs.2,000/- in cash not allowed for deduction Donation Amount Donation Receipt (Ensure the 12A Regn No and PAN Photo Copy) Donation qualifying for 100% deduction with qualifying limit. Donation to government or approved local authority, institution or association to 100% donation amount eligible ,subject to limit* Note: Donation exceedings Rs.2,000/- in cash not allowed for deduction Donation Amount Donation Receipt (Ensure the 12A Regn No and PAN Photo Copy) Donation qualifying for 50% deduction with qualifying limit. 1.Any sum paid as donation to institution establised in India for charitable purpose. 2.Any sum paid for renovation or repair of Notified temple, Mosque, gurdwara, church or other place of historic , in which renown throught by any state or 50% donation amount eligible ,subject to limit* Note: Donation exceedings Rs.2,000/- in cash not allowed for deduction Donation Amount Donation Receipt (Ensure the 12A Regn No and PAN Photo Copy) Sec 80EE Deduction for interest on loan borrowed from any financial institution for acquisition of residential house property. Deduction upto Rs.50,000/- would be allowed in respect of inerest on loan subject to condition. Condition: 1. Loan should be sanctioned during P.Y 2016-17. 2. Assessee should be first time buyer. 3. The amount of loan sanctioned for residential house property does not exceed Rs.35 lakh 4. The value of residential house property does not exceed Rs.50 lakh. Amoun paid towards interest Interest on Loan certificate Sec 80E 1.Interest on loan taken from any financial institution or approved charitable institution. 2. Loan should taken pursuing higher education of individual or spouse or children of the individual or for student to whom individual is legal guardian. Earliest of following is allowed for deduction 1.Interest payment in initial 8 assessment year or Until the interest is paid in full Amount of interest paid during the year Interest certificate and Loan statement

- 4. Sec 80DDB- Dedcution for medical treatment of specified diseases or ailments Amount paid for specified diseases or ailment for an Individual or his dependant. Dependant being the following persons, 1. Spouse 2.Children 3. Parents 4. Brothers or Sisters * Wholly or Mainly dependant on individual Step : 1 Lower of following *Actual sum paid or *Rs.40,000/- (Rs.1,00,000/- for medical treatment of senior citizen). Note: Eligible deduction = Step 1 Amount minus if any amount received from insurance company or reimbursed by employer. 1.Amount paid for medical treatment. 2.Checkbox needs to filed if amount spent for senior citizens Medical Bill Sec 80DD‐Medical treatment of dependant with disability *Any amount incurred for the medical treatment (Including nursing) , training and rehabilitation of a dependant disabled. *Any amount paid or deposited under the LIC or any other insurer. Note:Dependant being the following persons, 1. Spouse 2.Children 3. Parents 4. Brothers or Sisters * Wholly or Mainly dependant on individual Eligible deduction: 1. Disability 40% - Flat deduction Rs.75,000/- 2. Disability 80% - Flat deduction Rs.1,25,000/- in case of severe disability Amount paid for medical expense. Copy of medical certificate authenticating the disability of dependant. Sec 80D Medical Insurance Premium Any premium paid other than by way of cash for self, spouse and dependent children Maximum of Rs.25,000/- Note : Rs.50,000/- in case individual or spouse is senior citizen Amount of premium Medical premium receipts Medical Insurance Premium Any premium paid other than by way of cash for parents whether or not dependent on the individual. Maximum of Rs.25,000/- Note : Rs.50,000/- in case either or both of parents are senior citizens. Amount of premium Medical premium receipts Preventive Health Checkup Any amount paid including cash for self, spouse, dependent children or parents of individual. *Maximum limit Rs.5,000/- Amount spent for checkup Medical Bills Note:Amount paid under preventive health checkup subject to overall aggregate limits(i.e Rs.25,000/‐ or Rs.50,000 as the case may be)