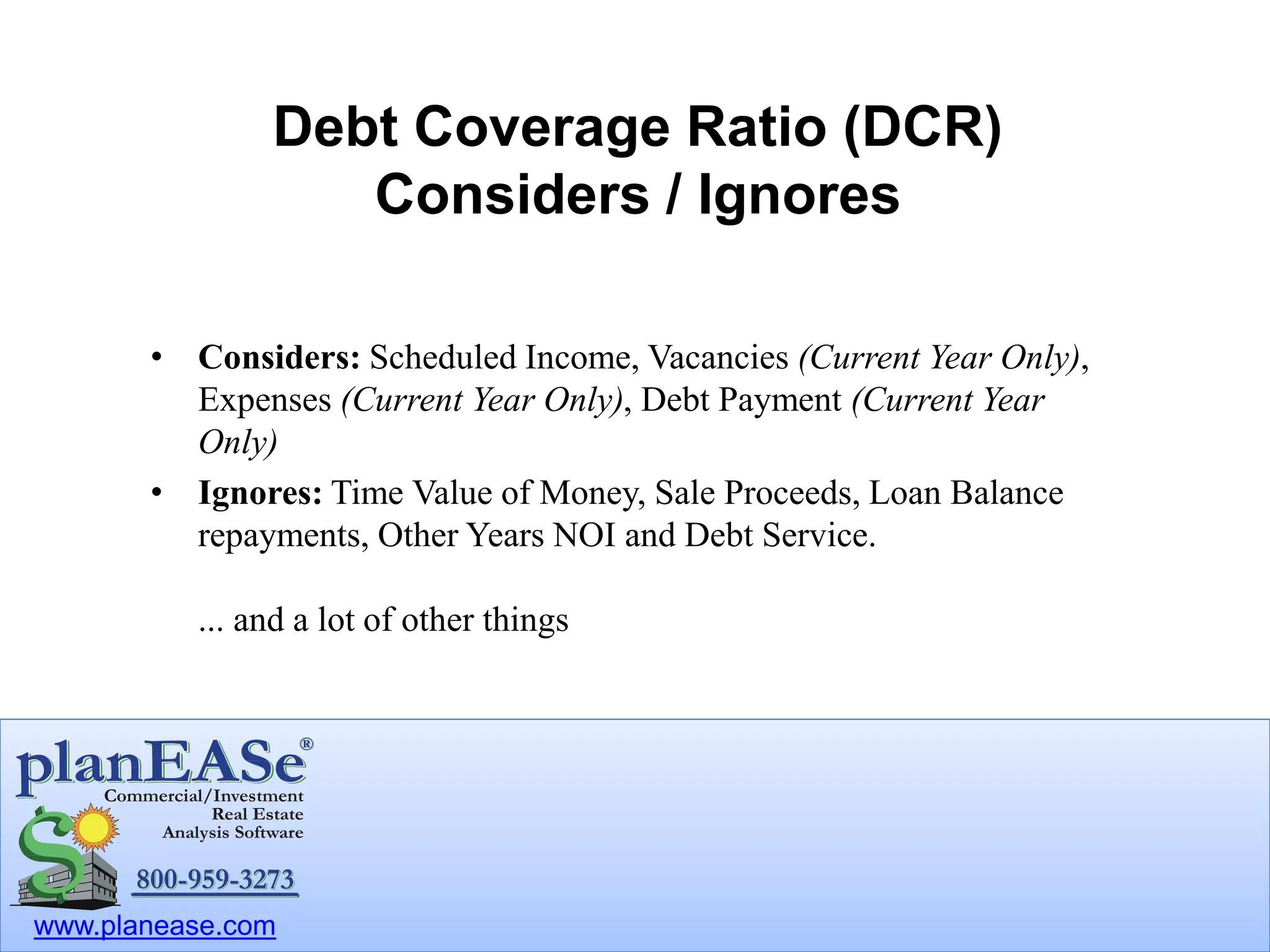

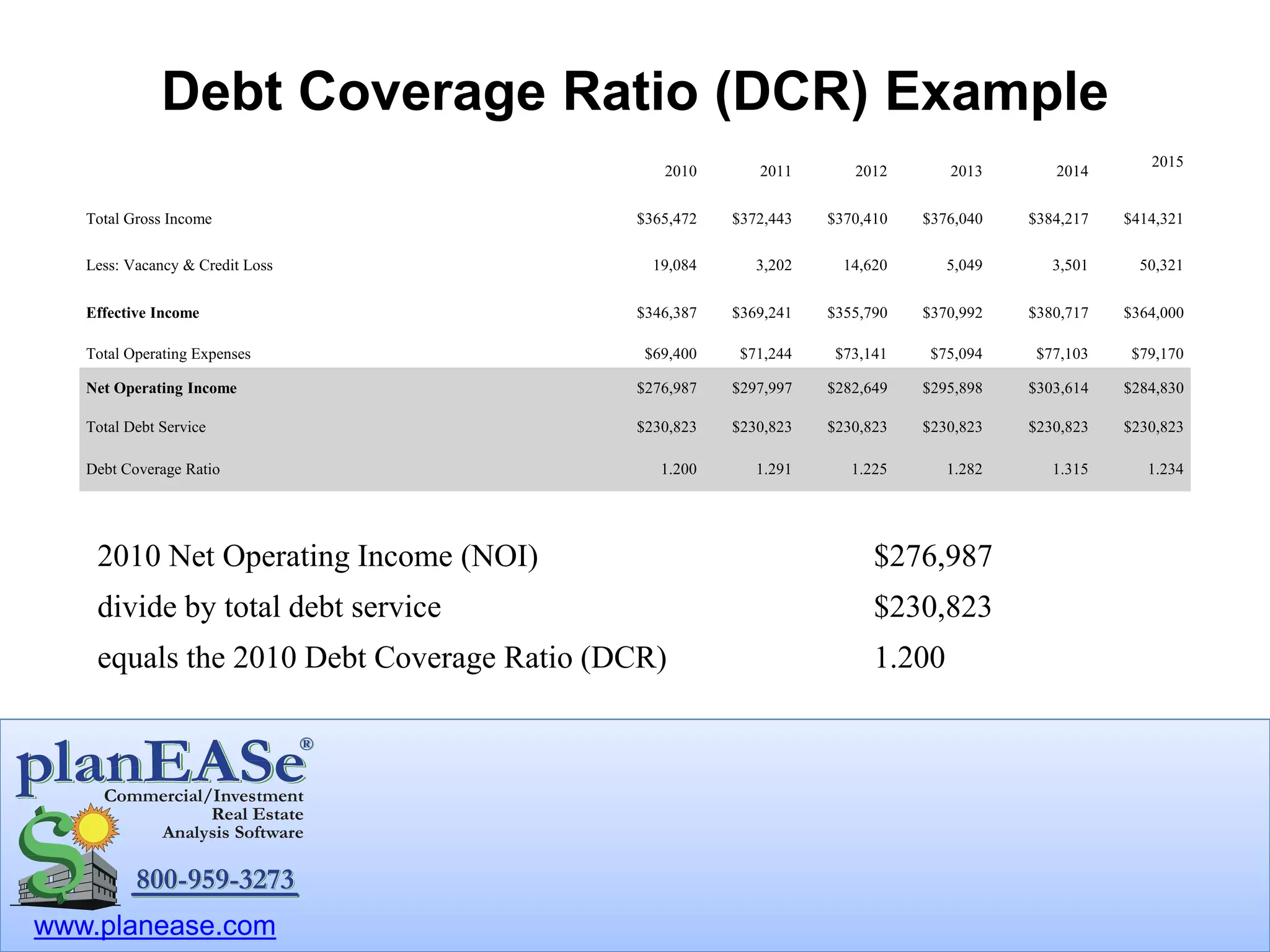

The document explains the Debt Coverage Ratio (DCR) in the context of commercial real estate investments, highlighting its importance in determining how much lenders are willing to loan based on net operating income versus debt service. It notes that the DCR considers factors such as scheduled income and current expenses while ignoring the time value of money and future projections. An example illustrating DCR calculations over several years is provided, along with an invitation to utilize Planease's free trial for further analysis.