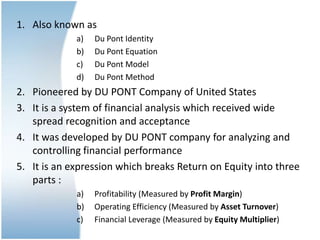

The document discusses the Du Pont analysis method of financial analysis. It was pioneered by the Du Pont company in the United States. The Du Pont analysis breaks down return on equity into three components: profit margin, asset turnover, and financial leverage. It is used to understand how net return on investment is influenced by net profit margin and asset turnover ratio.