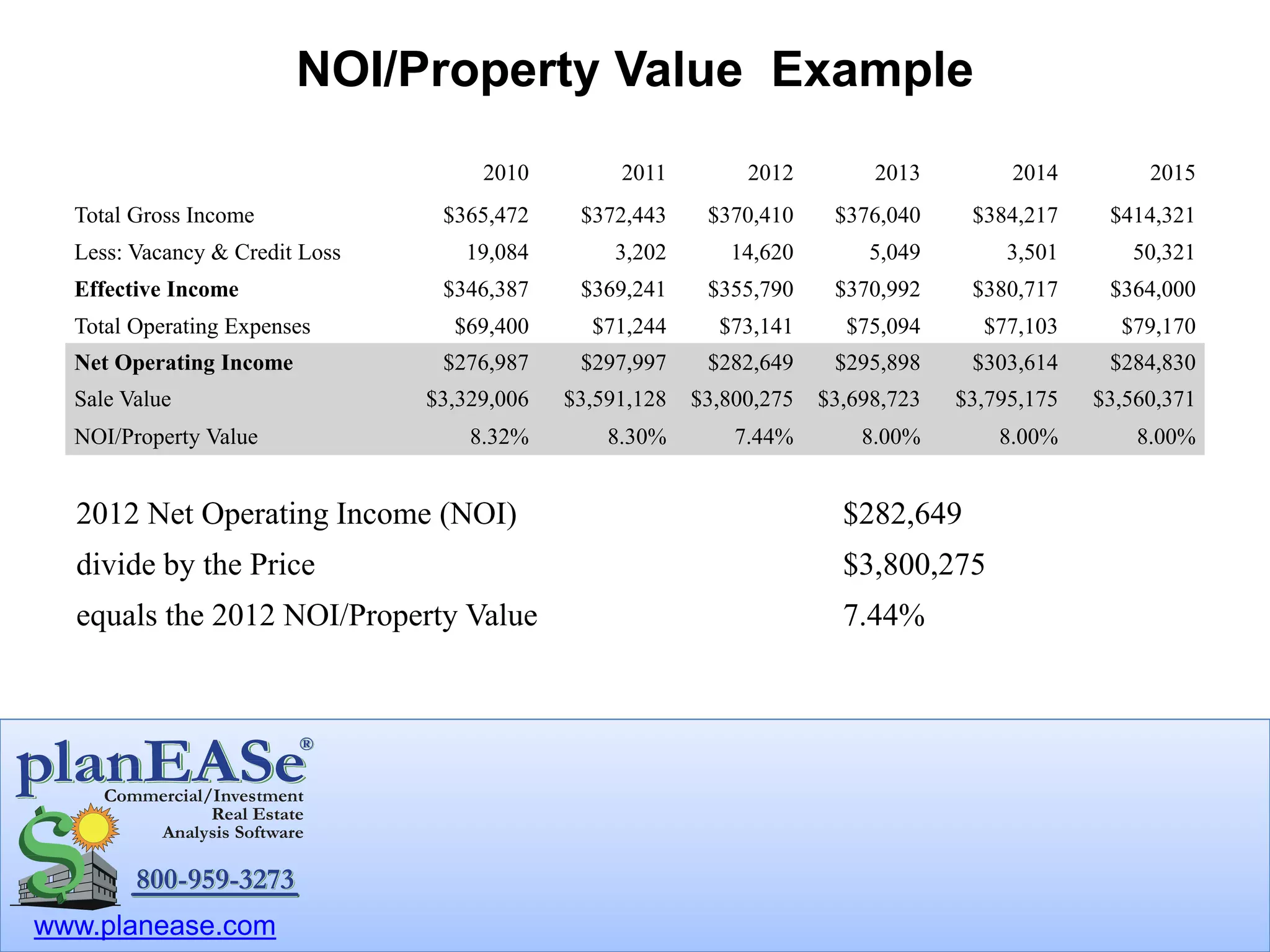

The document explains the net operating income (NOI) to property value ratio, also known as the overall capitalization rate, which assesses property appreciation by comparing NOI to sale value. It details what factors are considered and ignored in this calculation, highlighting its sensitivity to current income, vacancies, and expenses. An example of the NOI/property value ratio over several years is provided, along with an invitation to utilize Planease's services through a free trial.