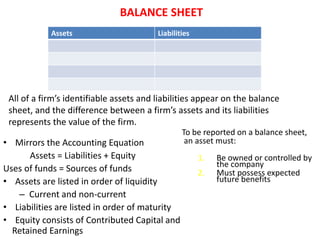

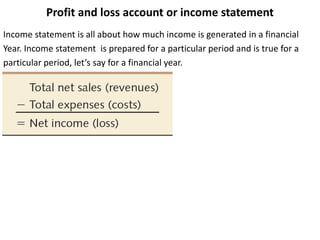

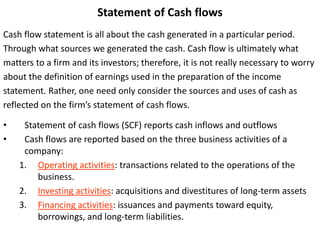

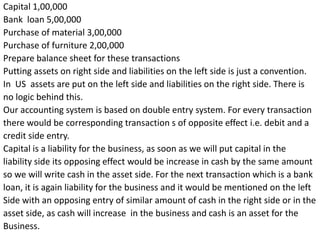

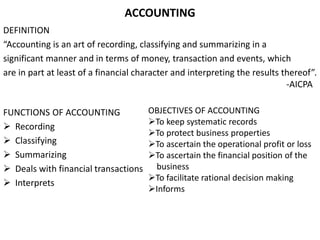

Accounting involves recording, classifying, and summarizing financial transactions and events. It has the objectives of keeping systematic records, protecting business assets, and facilitating decision making. The key concepts in accounting include separate entity, going concern, money measurement, cost, dual aspect, accounting period, and matching. Financial statements like the balance sheet, income statement, and statement of cash flows are prepared using accounts from the general ledger in accordance with accounting principles.

![Accounting Principles

Separate entity concept

In accounting business is considered to be a separate entity from the proprietor[s].

Thus when one person invest Rs. 10,000 into business. It will be deemed that the proprietor

has given that such of money to the business which will shown as a ‘liability’ in the books of

the business.

Going concern concept

According to this concept it is assumed that the business will continue for a fairly long time to

come. There is neither the intention nor the necessity to liquidate the particular business

venture in the foreseeable future.

Money measurement concept

Accounting records only monetary transactions. Events or transactions which cannot be

expressed in money do not find place in the books of accounts though they may be very useful

for the business.

Cost concept

The cost concept does not mean that the asset will always be shown at cost but it become the

basis for all future accounting for the assets. It means that asset is recorded at cost at the time

of its purchase but it may systematically be reduced in its value by charging depreciation.](https://image.slidesharecdn.com/b-150220073433-conversion-gate02/85/accounting-basics-3-320.jpg)