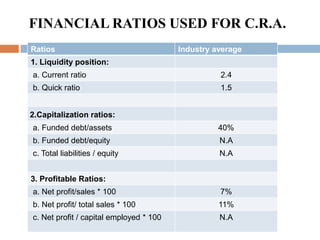

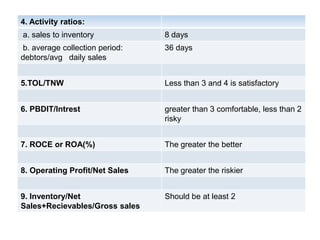

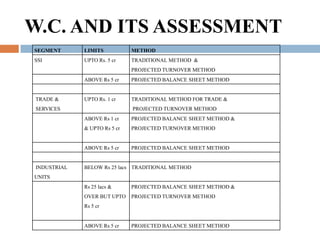

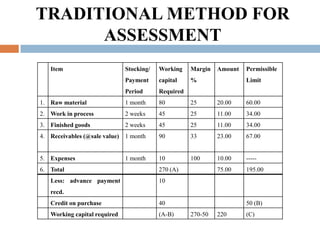

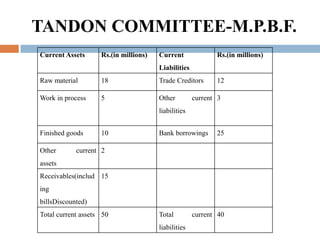

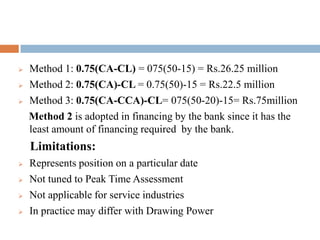

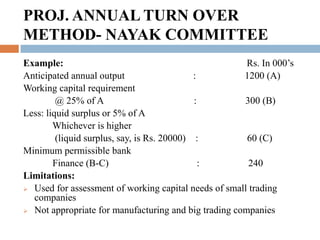

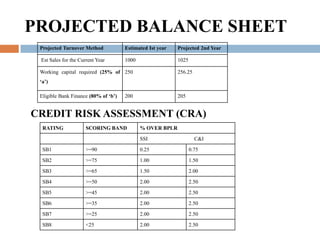

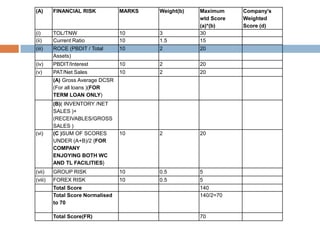

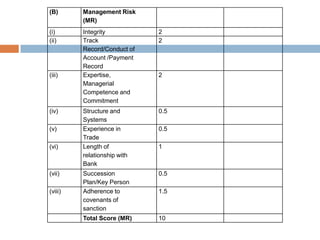

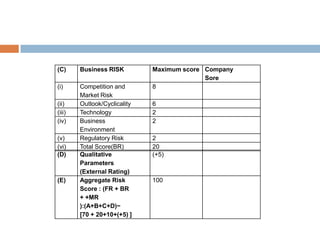

This document discusses credit appraisal for working capital finance provided to small and medium enterprises (SMEs) by State Bank of India (SBI). It outlines various methods used by SBI to assess working capital needs and provide financing, including the Tandon Committee method, projected annual turnover method, and projected balance sheet method. The document analyzes SBI's loan policies, credit appraisal standards, and the use of financial ratios to evaluate credit risk. It also provides recommendations to improve SBI's support for SME working capital needs through measures like a rating system, relationship lending, and an IT-enabled application and monitoring system.