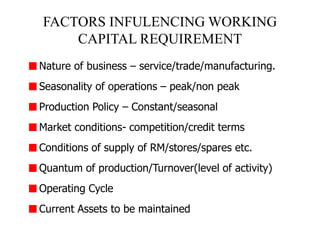

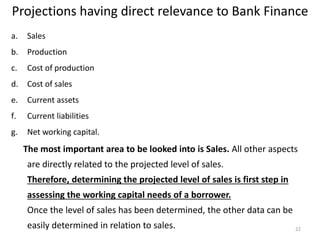

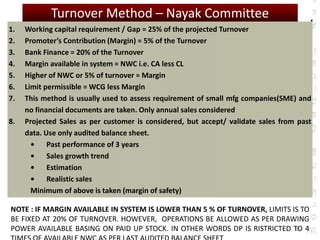

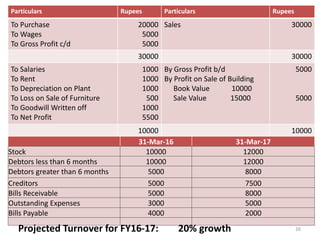

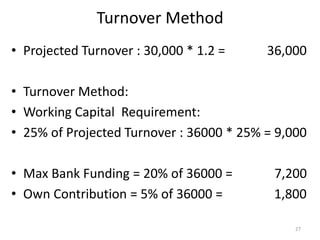

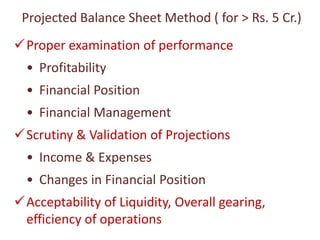

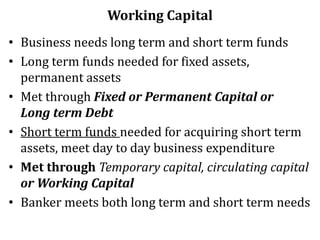

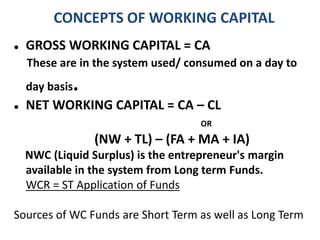

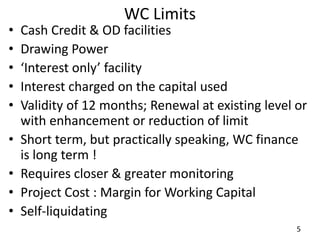

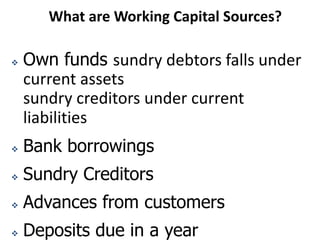

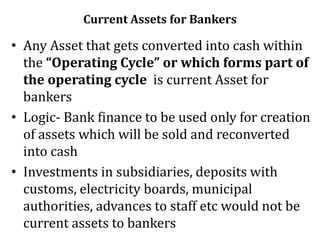

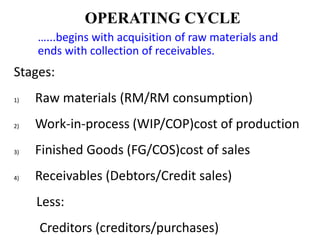

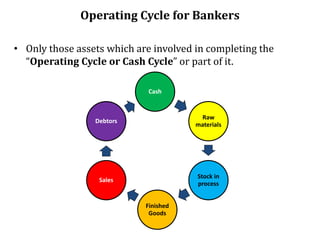

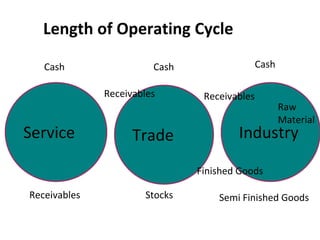

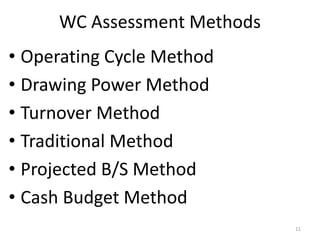

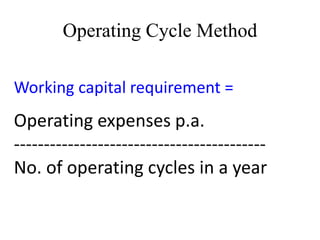

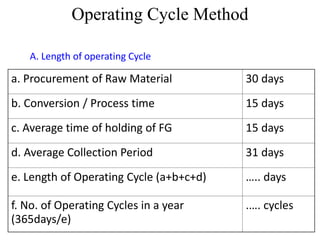

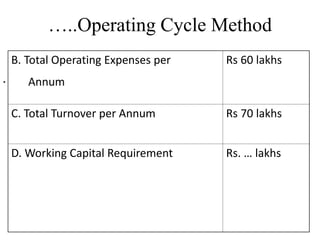

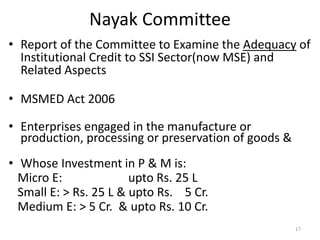

Working capital refers to the funds required to operate a business on a day-to-day basis. It is used to acquire current assets such as inventory and accounts receivable. There are various methods to assess working capital requirements, including the operating cycle method, turnover method, and projected balance sheet method. The operating cycle method calculates needs based on the time required to complete the operating cycle from acquiring raw materials to collecting payment from customers. The turnover method, recommended by the Nayak Committee, sets the requirement at 25% of projected annual turnover. Proper validation of projections is important when using the projected balance sheet method for larger businesses.

![Recommendations

• (i) give pref. to village industries, tiny industries

and other small scale units in that order, while

meeting the credit requirements of the SSI;

• (ii) grant working capital credit limits to SSI (now

MSE) units computed on the basis of minimum

20% of their est. annual turnover whose credit

limit in individual cases is upto Rs.2 Cr.[since

raised, Rs.5 Cr.]

18](https://image.slidesharecdn.com/15-161120183557/85/15-working-capital-18-320.jpg)