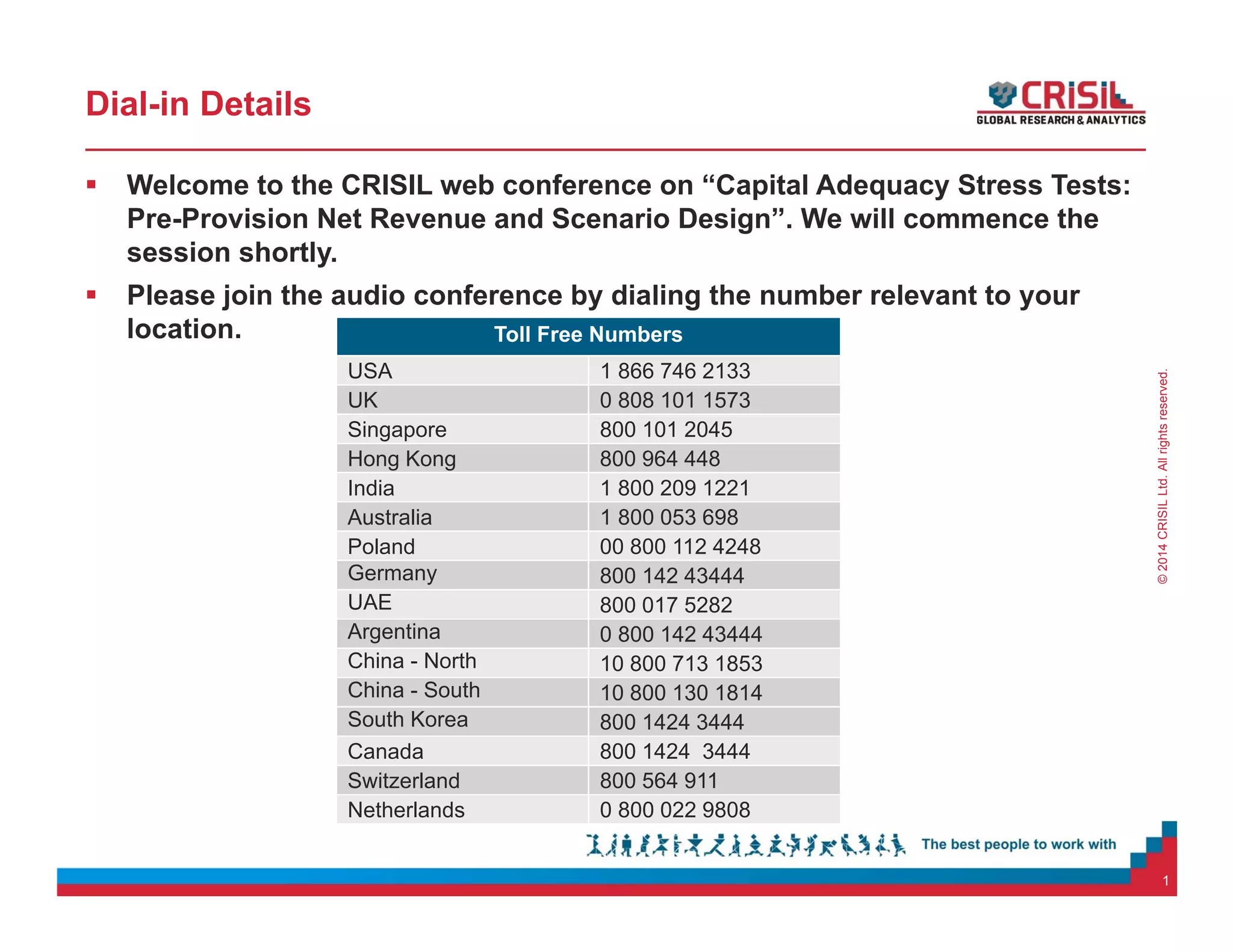

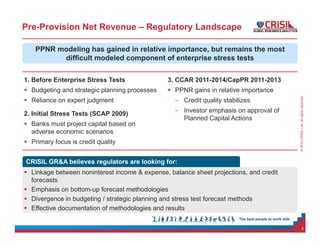

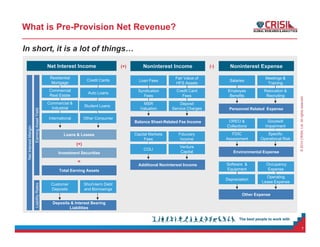

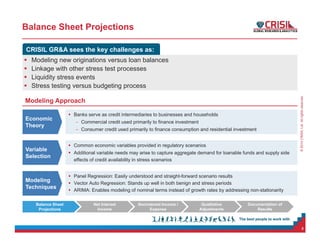

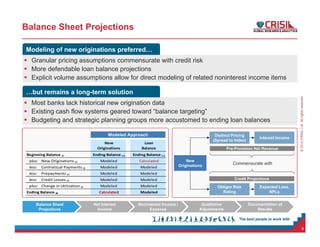

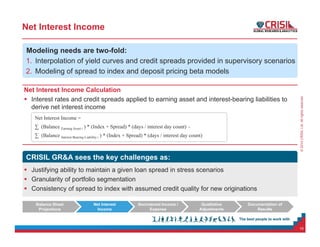

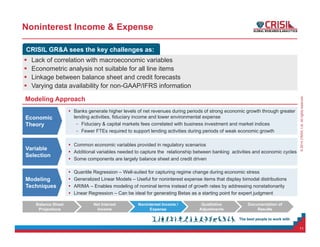

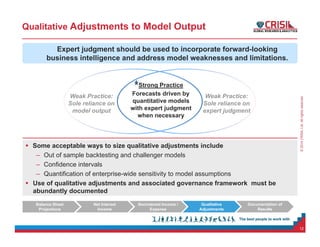

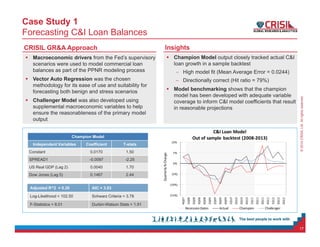

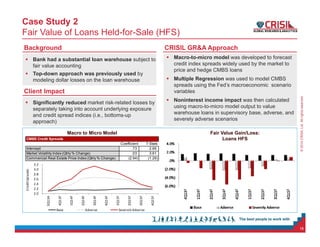

The document provides details about a web conference on capital adequacy stress tests with a focus on pre-provision net revenue (PPNR) modeling and scenario design. It includes dial-in details for participants to join the audio portion of the web conference, which will be presented by Joshua Hancher from CRISIL Global Research & Analytics. The agenda covers PPNR modeling components like balance sheet projections, net interest income, noninterest income and expenses. It also discusses scenario development and case studies from CRISIL GR&A on commercial loan forecasts and fair value of loans held-for-sale.