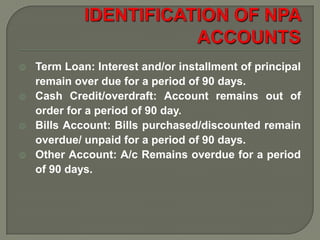

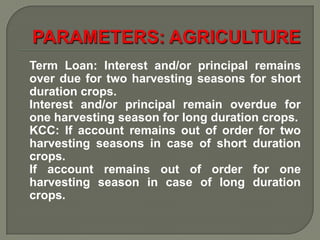

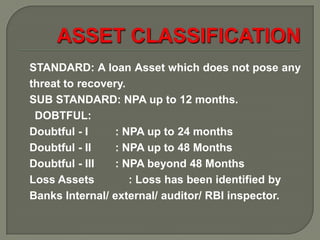

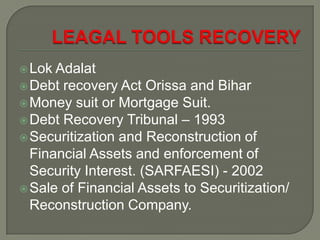

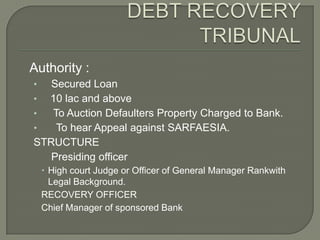

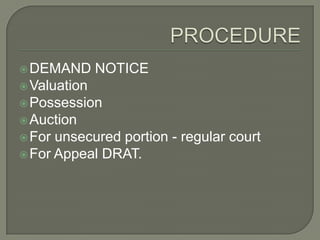

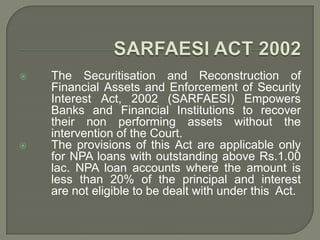

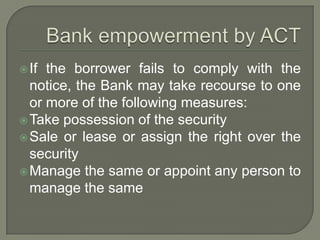

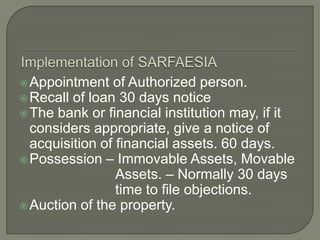

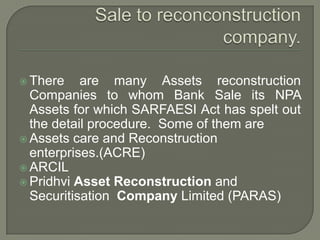

This document discusses non-performing assets (NPAs) in banks. It notes that NPAs are loan accounts that do not generate income for the bank. Common causes of NPAs include poor selection of borrowers, lack of timely support, and failure to monitor loans. The document outlines the classification standards for NPAs as standard, sub-standard, doubtful, and loss. It also discusses various legal recovery mechanisms available to banks for recovering NPAs, including Debt Recovery Tribunals, SARFAESI Act, and sale of NPAs to asset reconstruction companies.