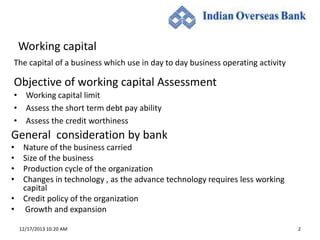

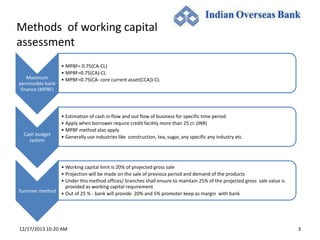

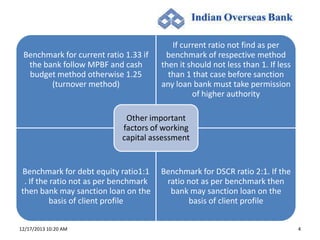

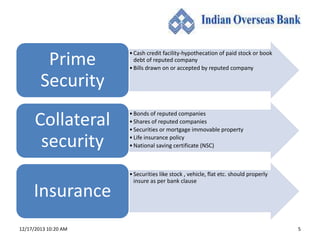

This document discusses methods for assessing working capital requirements. It outlines three common methods - maximum permissible bank finance, cash budget system, and turnover method. It also discusses general considerations like business nature, size, production cycle, and credit policy. Benchmark ratios for current, debt-equity, and debt service coverage are provided. The document emphasizes the importance of prime security, collateral security, and insurance when obtaining working capital financing.