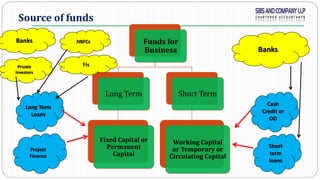

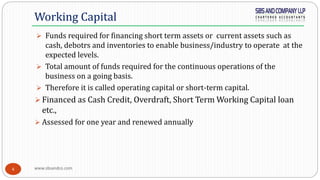

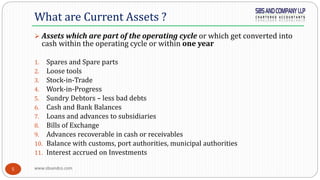

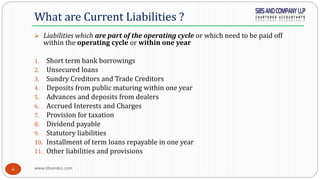

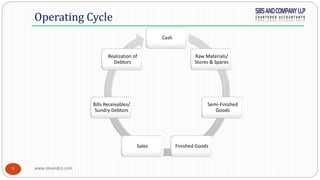

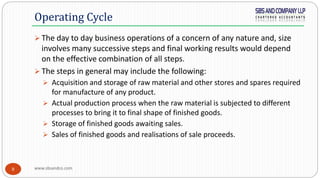

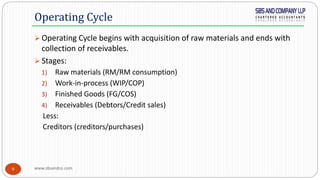

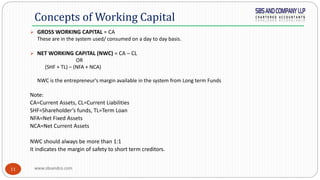

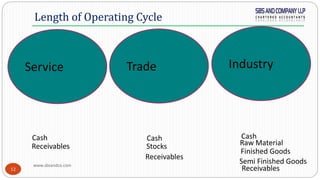

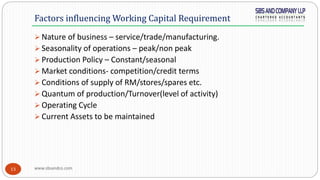

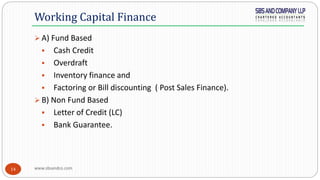

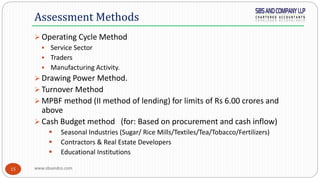

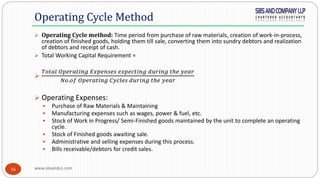

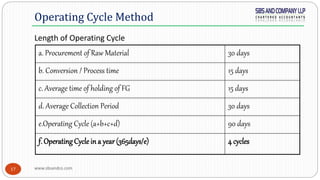

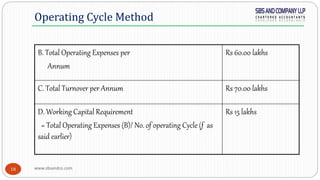

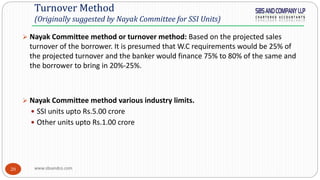

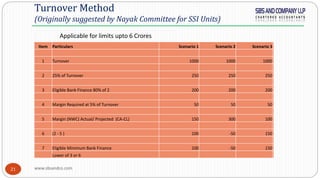

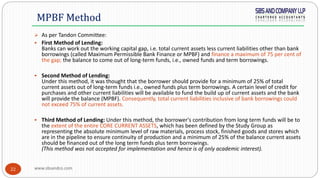

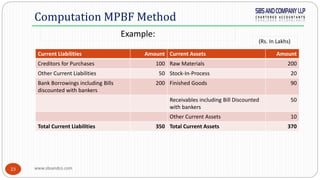

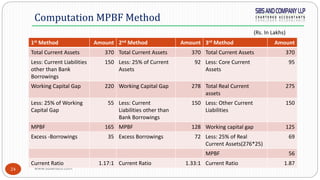

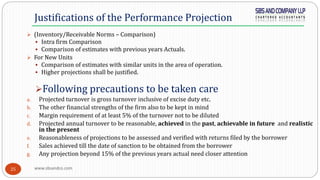

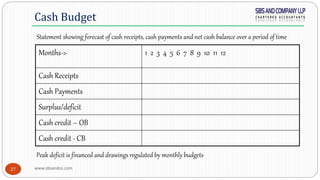

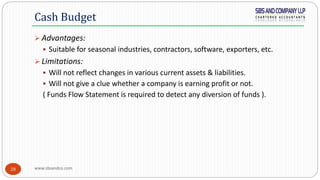

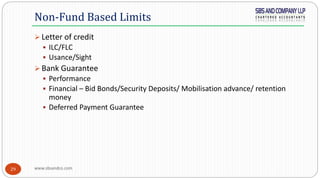

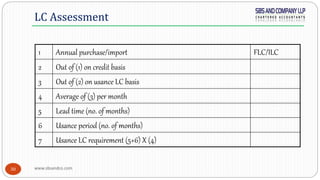

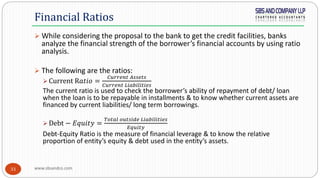

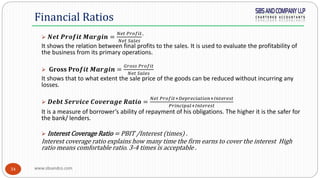

This document discusses working capital assessment. It defines working capital and its components like current assets and current liabilities. It explains the operating cycle and factors influencing working capital requirements. Various methods of assessing working capital are described, including turnover method, MPBF method, cash budget method and operating cycle method. Guidelines for justifying projections and assessing non-fund based limits like letters of credit and bank guarantees are also provided. Ratios used in analyzing a borrower's financial strength are listed.