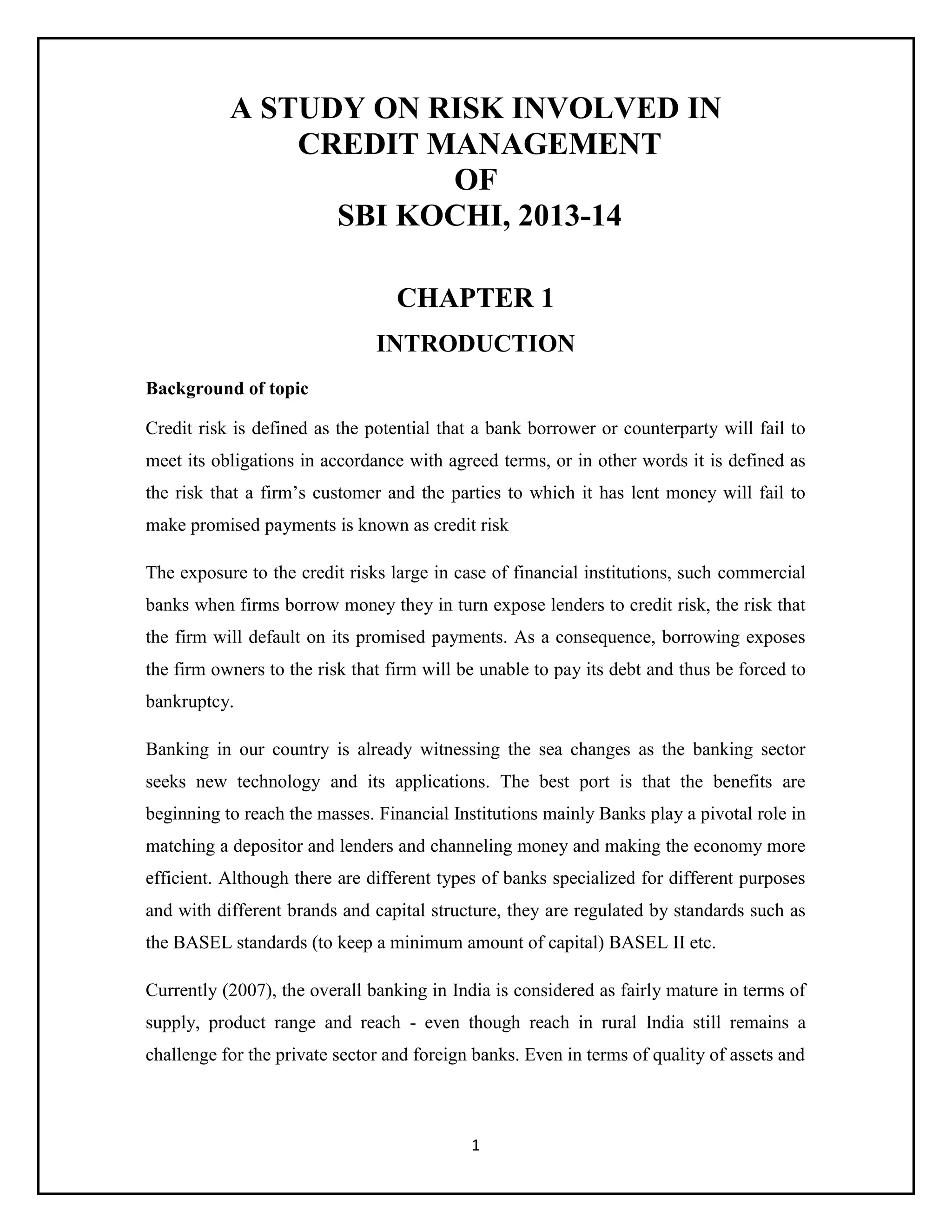

1. The document discusses credit risk management practices at SBI Kochi from 2013-2014. It provides background on credit risk and outlines key aspects of effective credit risk management like establishing appropriate risk environment, credit risk assessment, and portfolio management.

2. The theoretical background section defines terms like credit, risk, market risk, operational risk, and credit risk. It also discusses contributors to credit risk and key elements of credit risk management.

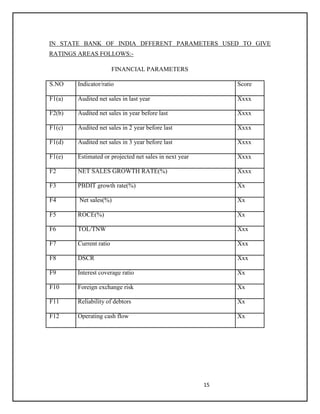

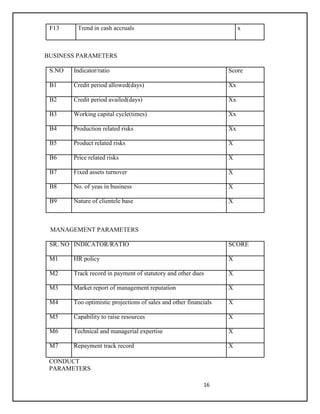

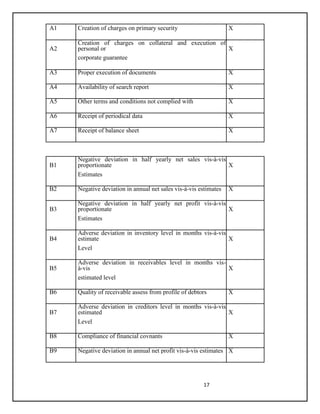

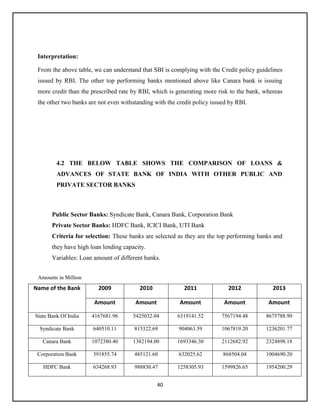

3. The document discusses credit rating and its use in credit decision making. It provides details on the rating tool used by SBI for assessing creditworthiness of borrowers, especially Small and Medium Enterprises.

![13

Based on the guidelines provided by Boston Consultancy Group (BCG), SBI adopted

credit rating tool.

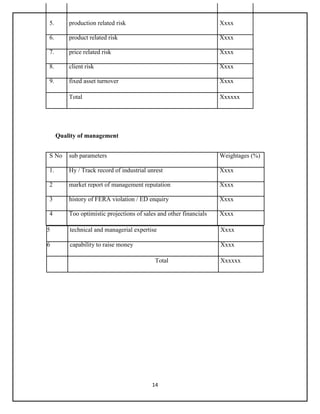

The rating tool for SME borrower assigns the following Weight ages to each one of the

four main categories i.e

(i) Scenario (I) : without monitoring tool

S No Parameters Weightages (%)

1 financial performance XXXX

2 operating performance XXXX

3 quality of management XXXX

4 industry outlook XXXX

(ii). Scenario (II): with monitoring tool [conduct of account]:- the weight age would be

conveyed separately on roll out of the tool. In the above parameters first three

parameters used to know the borrower characteristics. In fourth encapsulates the risk

emanating from the environment in which the borrower operates and depends on the

past performance of the industry its future outlook and macro economic factors.

Operating performance

S No Sub parameters Weightage

(%)

1. credit period allowed Xxxx

2. credit period availed Xxxx

3. working capital cycle Xxxx

4. Tax incentives Xxxx](https://image.slidesharecdn.com/brmfinal-140626035405-phpapp02/85/Study-on-credit-risk-management-of-SBI-Cochi-13-320.jpg)