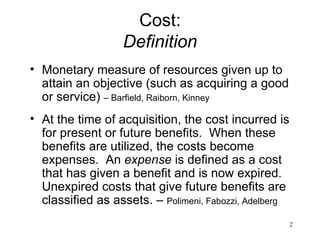

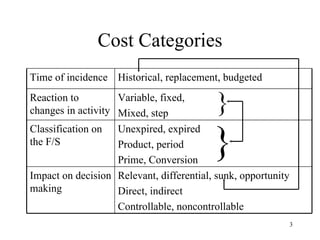

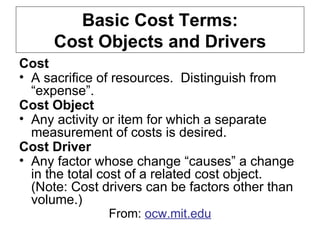

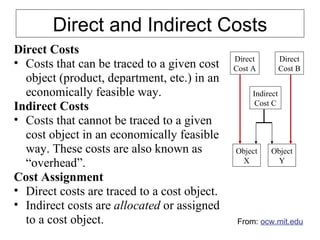

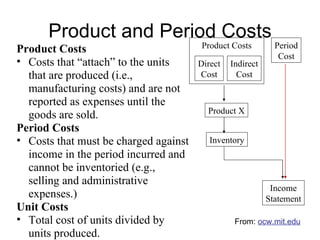

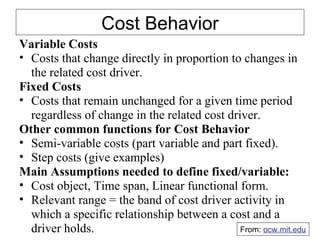

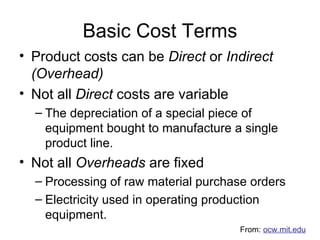

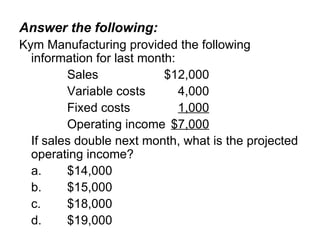

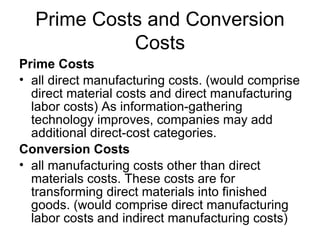

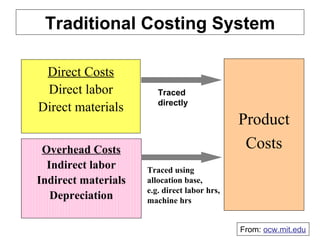

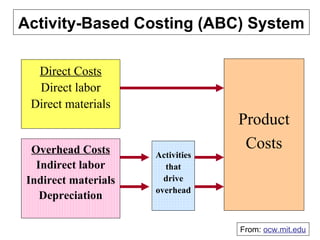

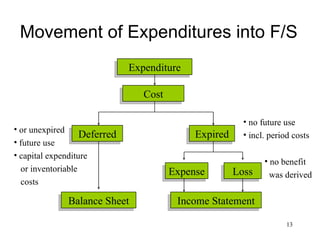

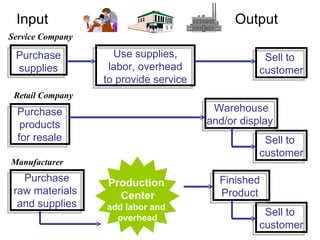

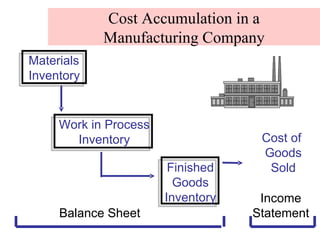

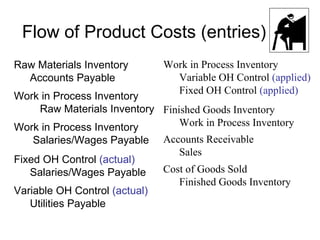

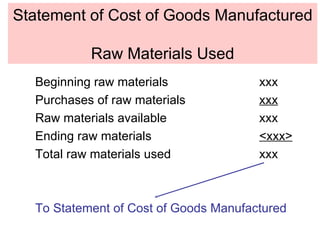

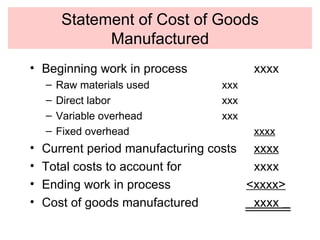

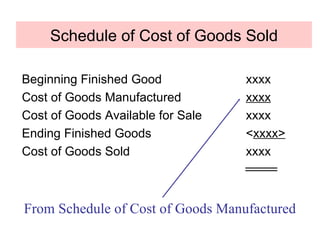

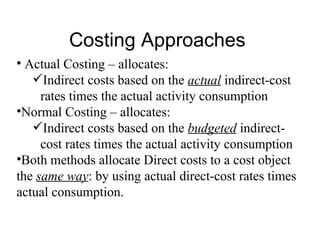

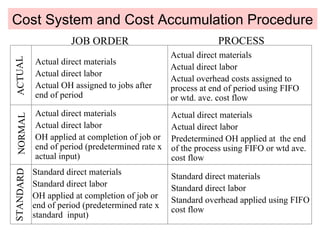

The document defines and discusses key cost accounting terms and concepts. It describes how costs flow through a manufacturing company, from raw materials to work in process to finished goods. It also covers cost accumulation procedures like job order costing and process costing, and how costs move from the balance sheet to the income statement. Cost classification categories like direct vs indirect, variable vs fixed, and product vs period costs are also summarized.