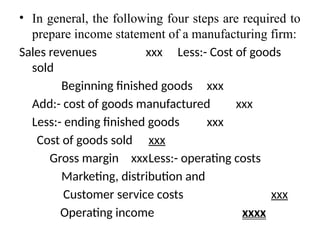

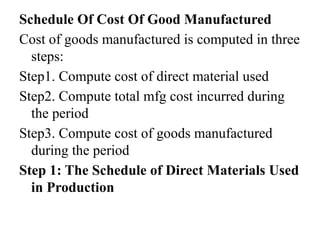

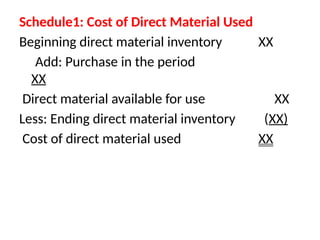

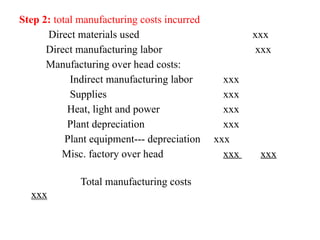

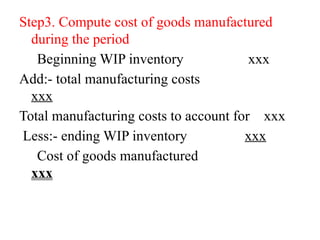

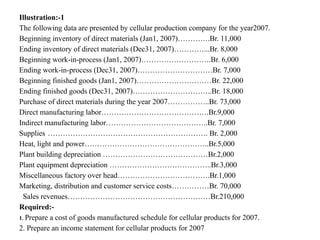

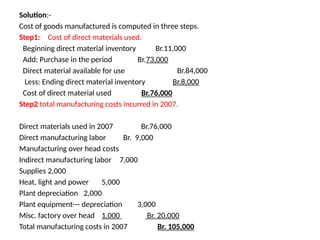

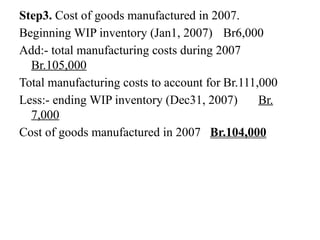

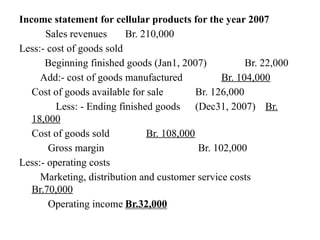

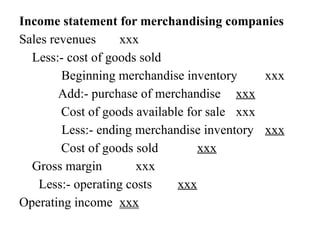

Chapter two focuses on cost terminology and classification, providing definitions and types of costs, including direct, indirect, fixed, and variable costs. It explains cost flow in manufacturing firms and how to prepare financial statements, detailing the income statement for manufacturing companies compared to merchandising companies. Key formulas for calculating cost of goods manufactured and understanding manufacturing costs are also included.