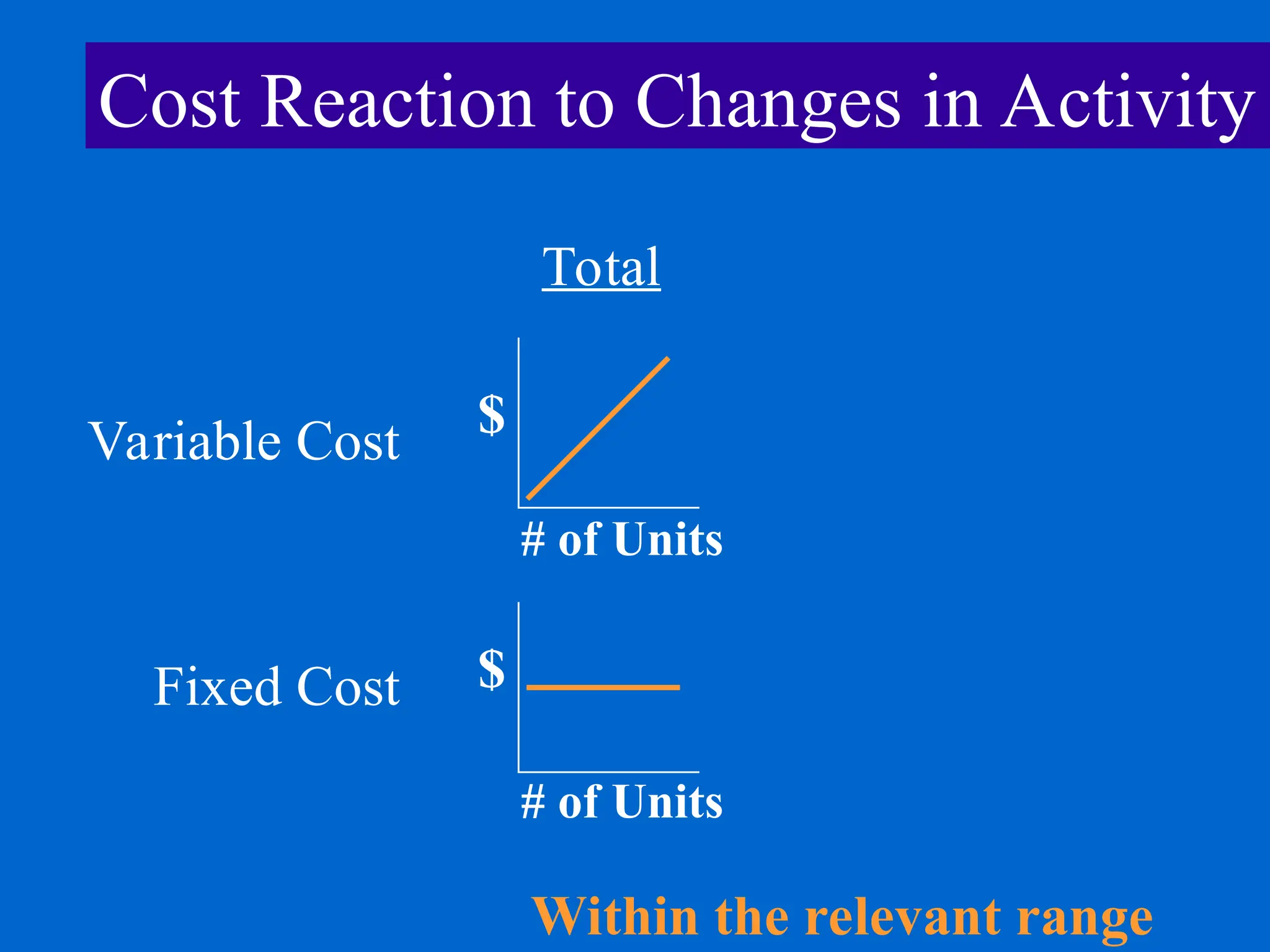

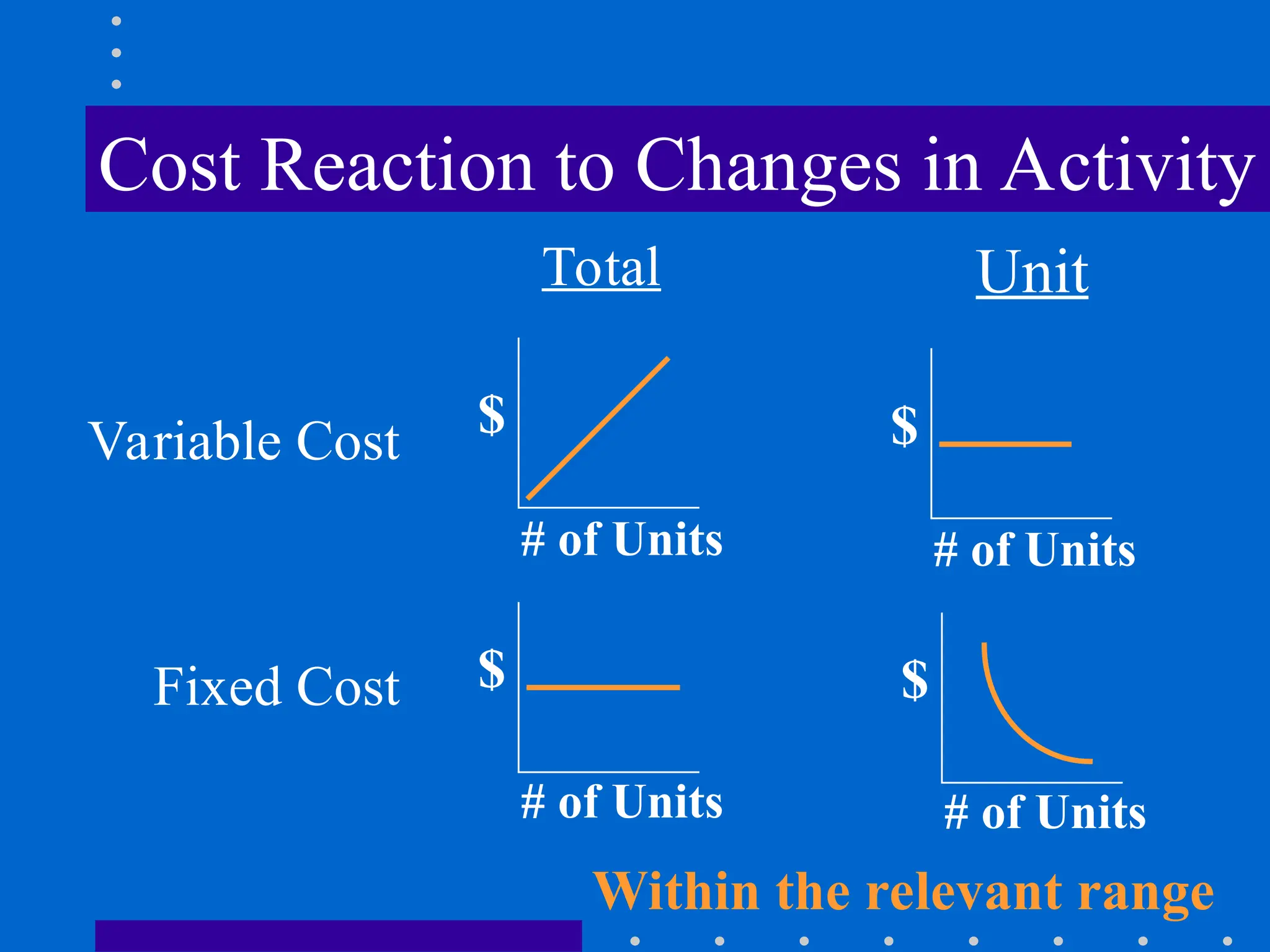

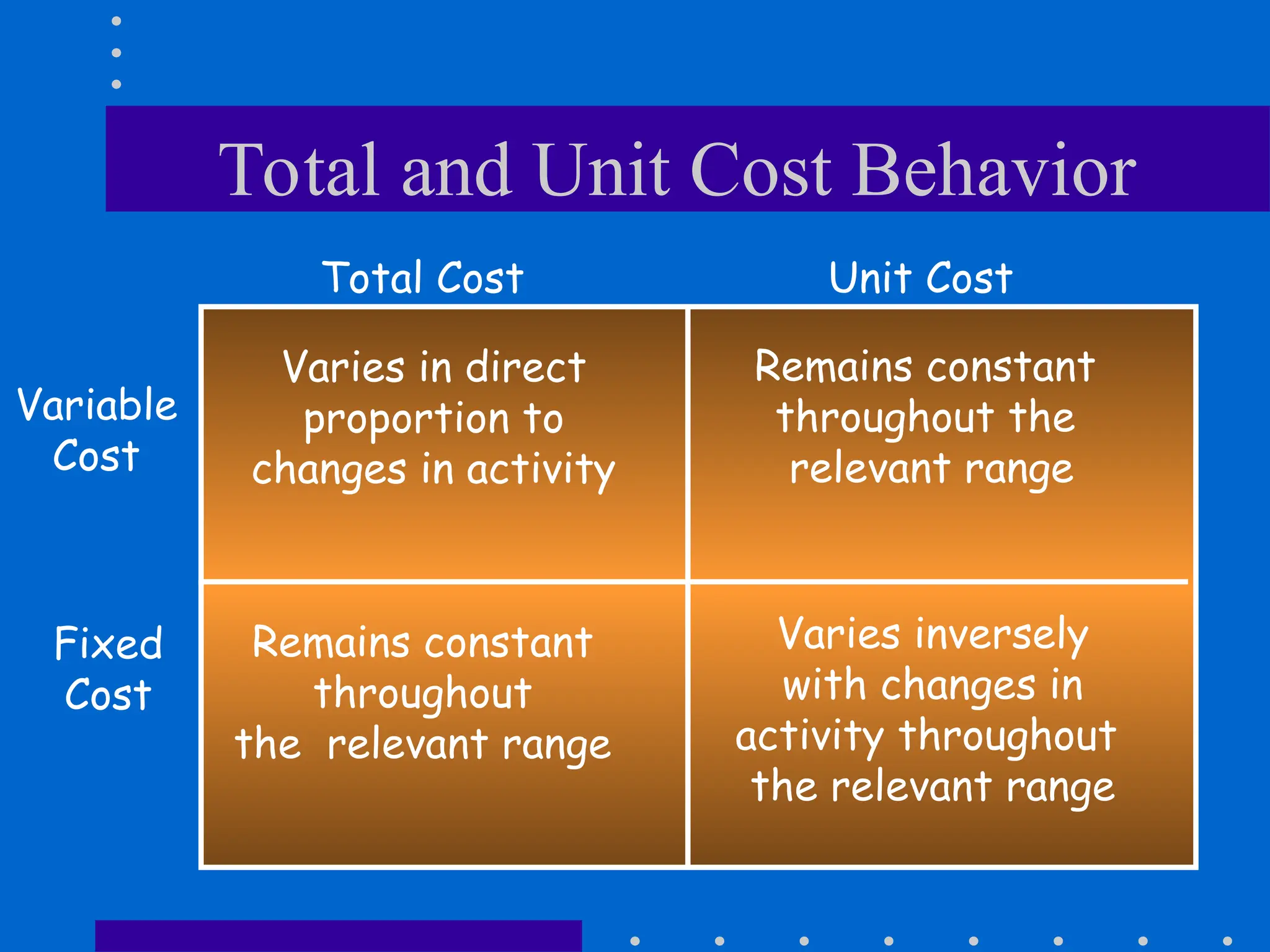

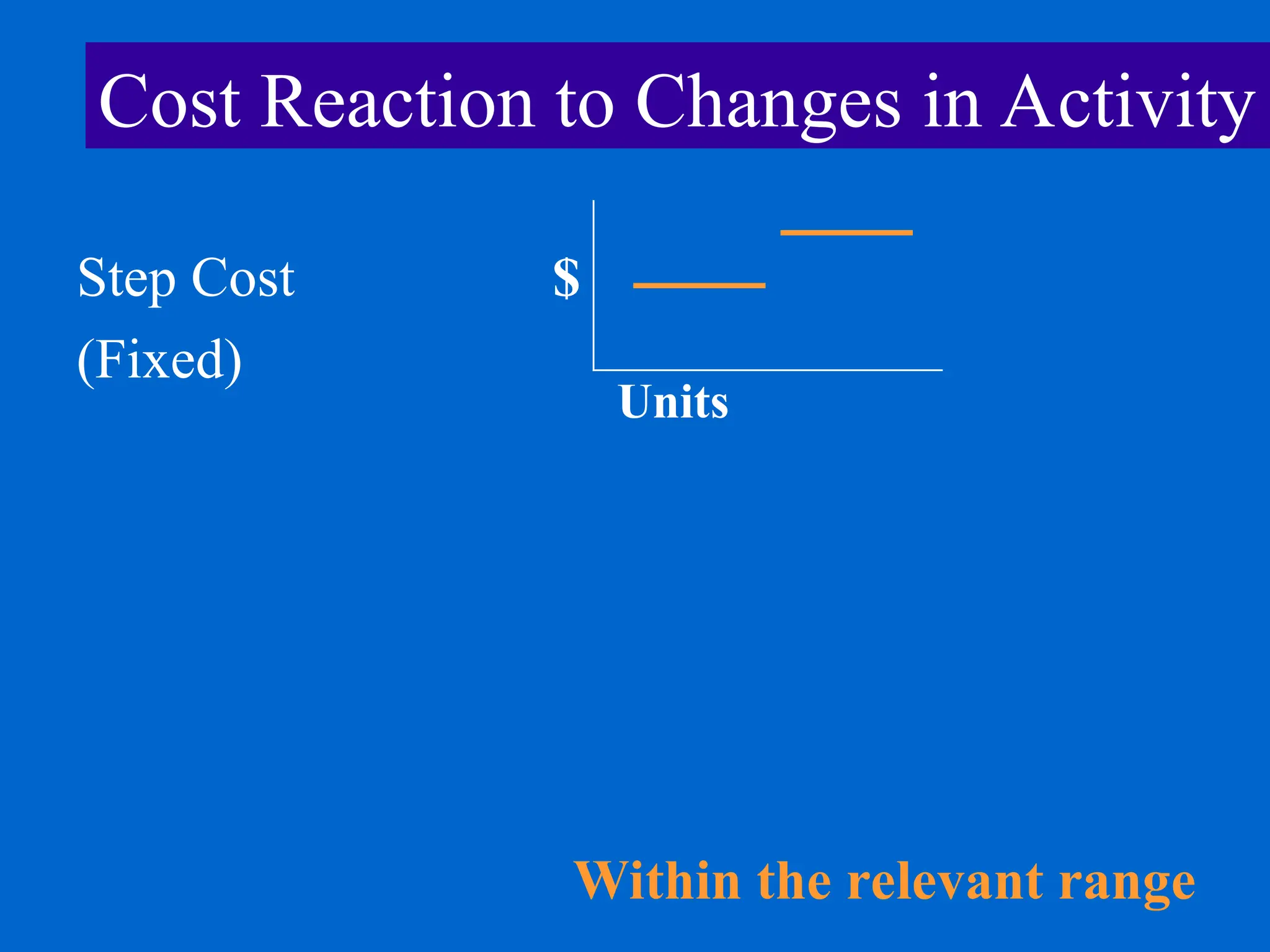

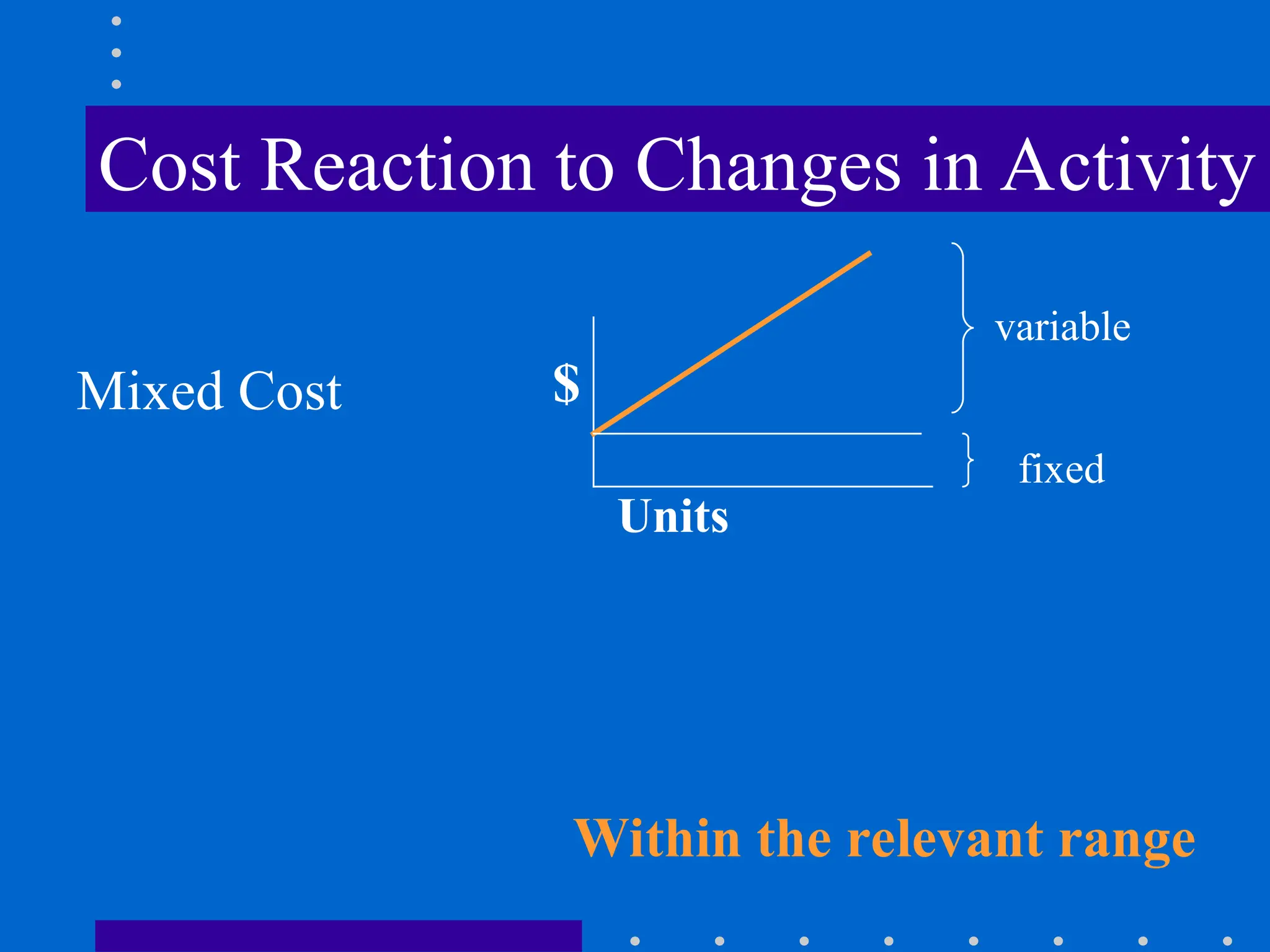

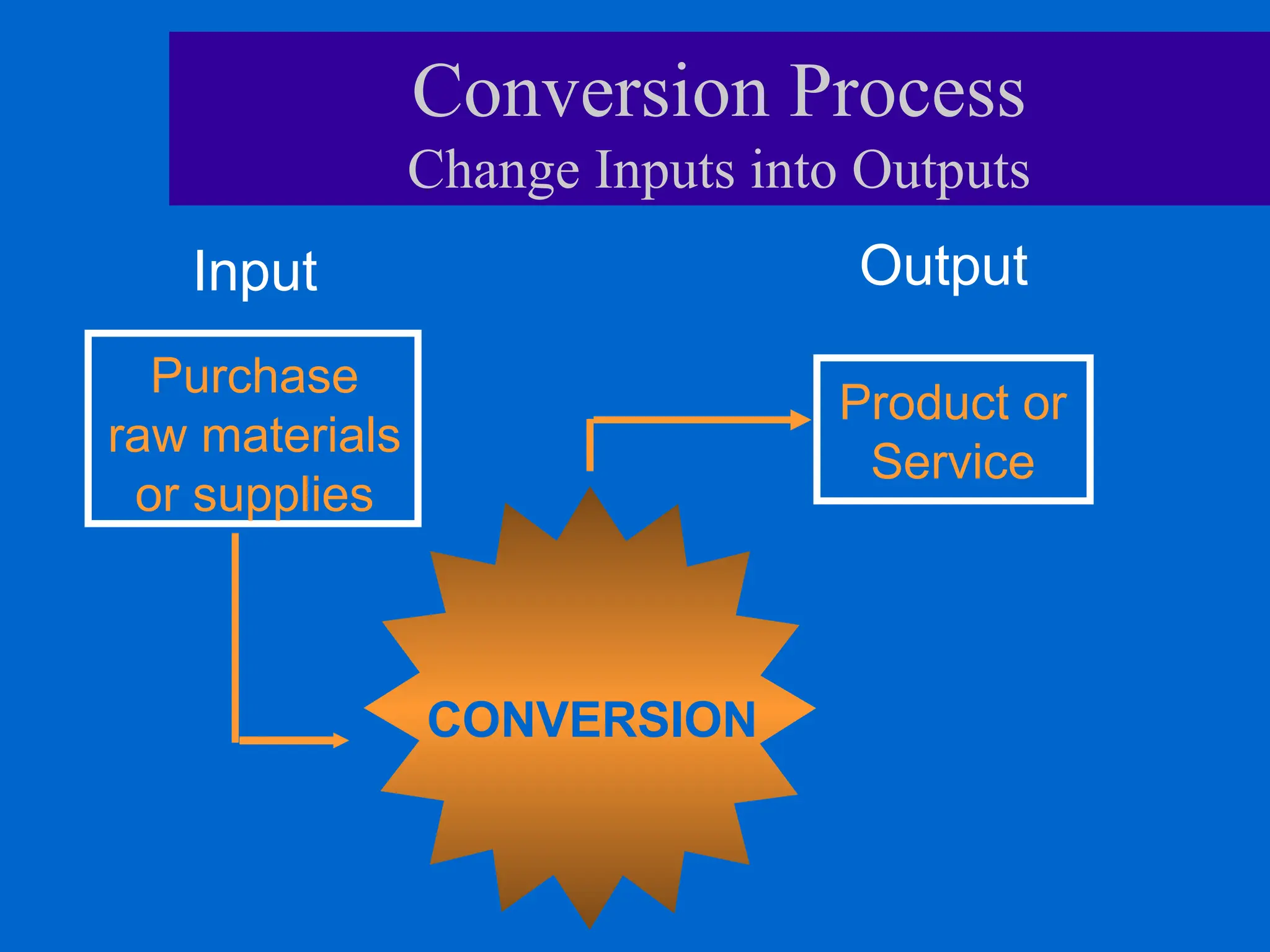

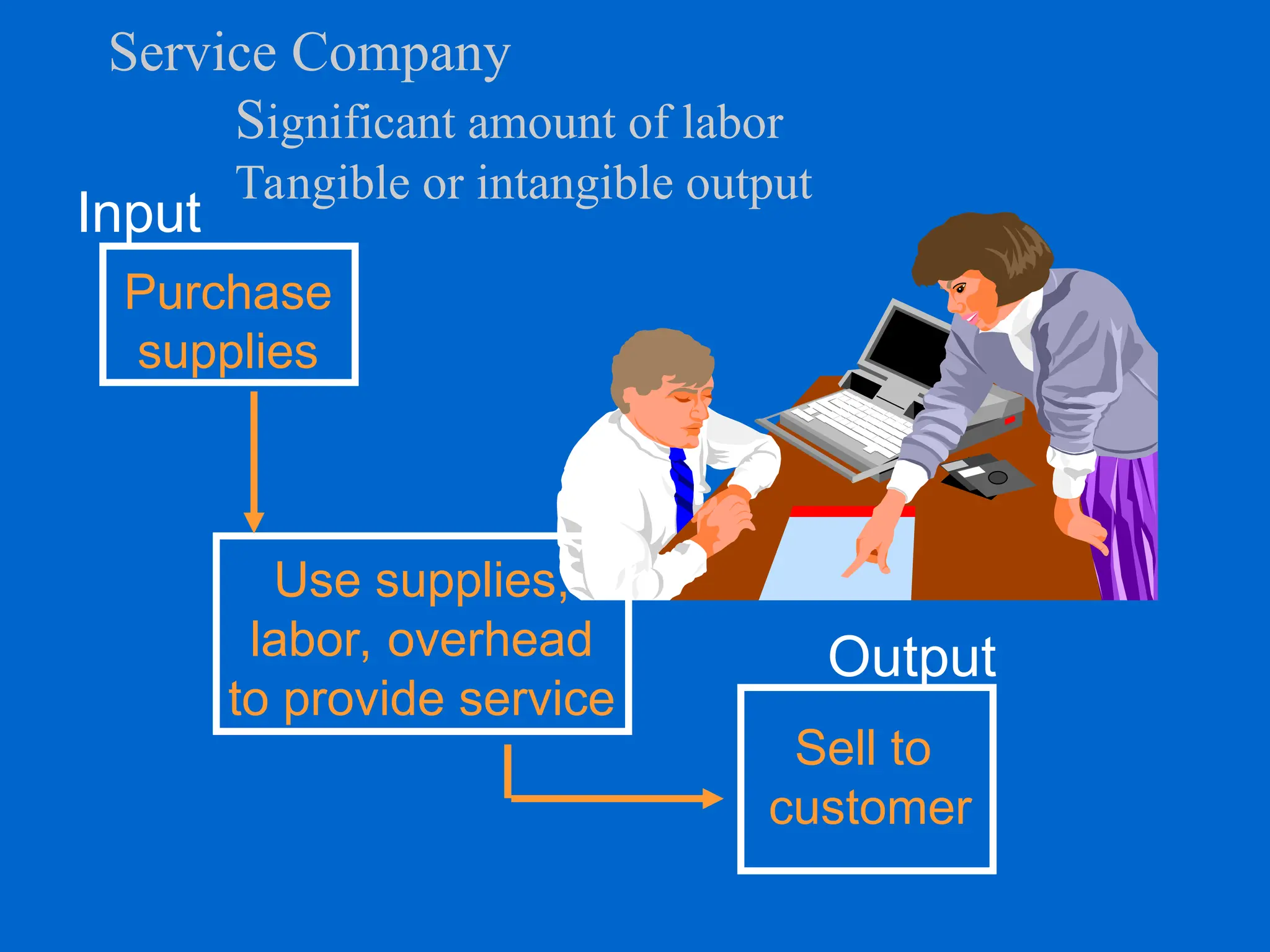

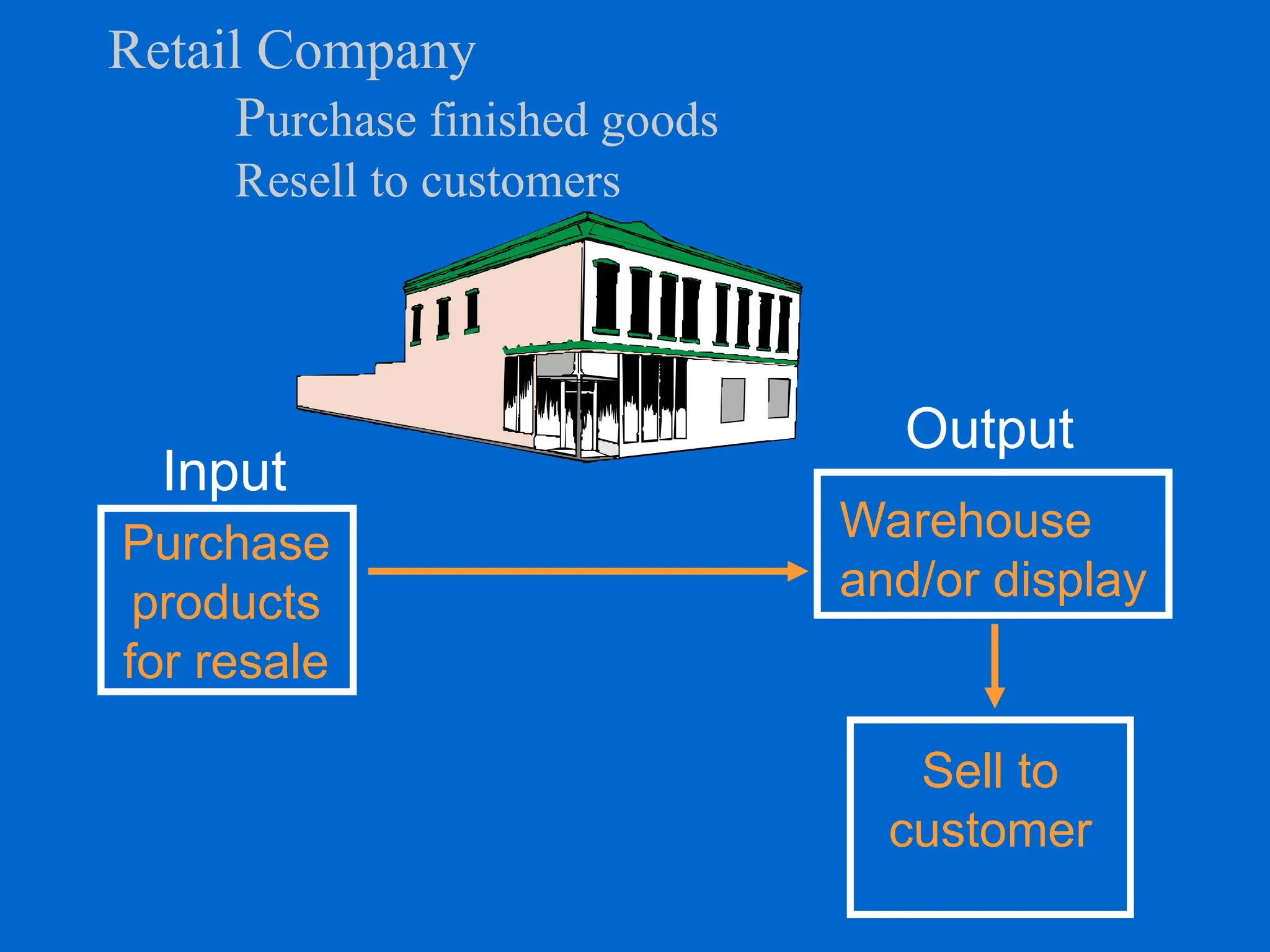

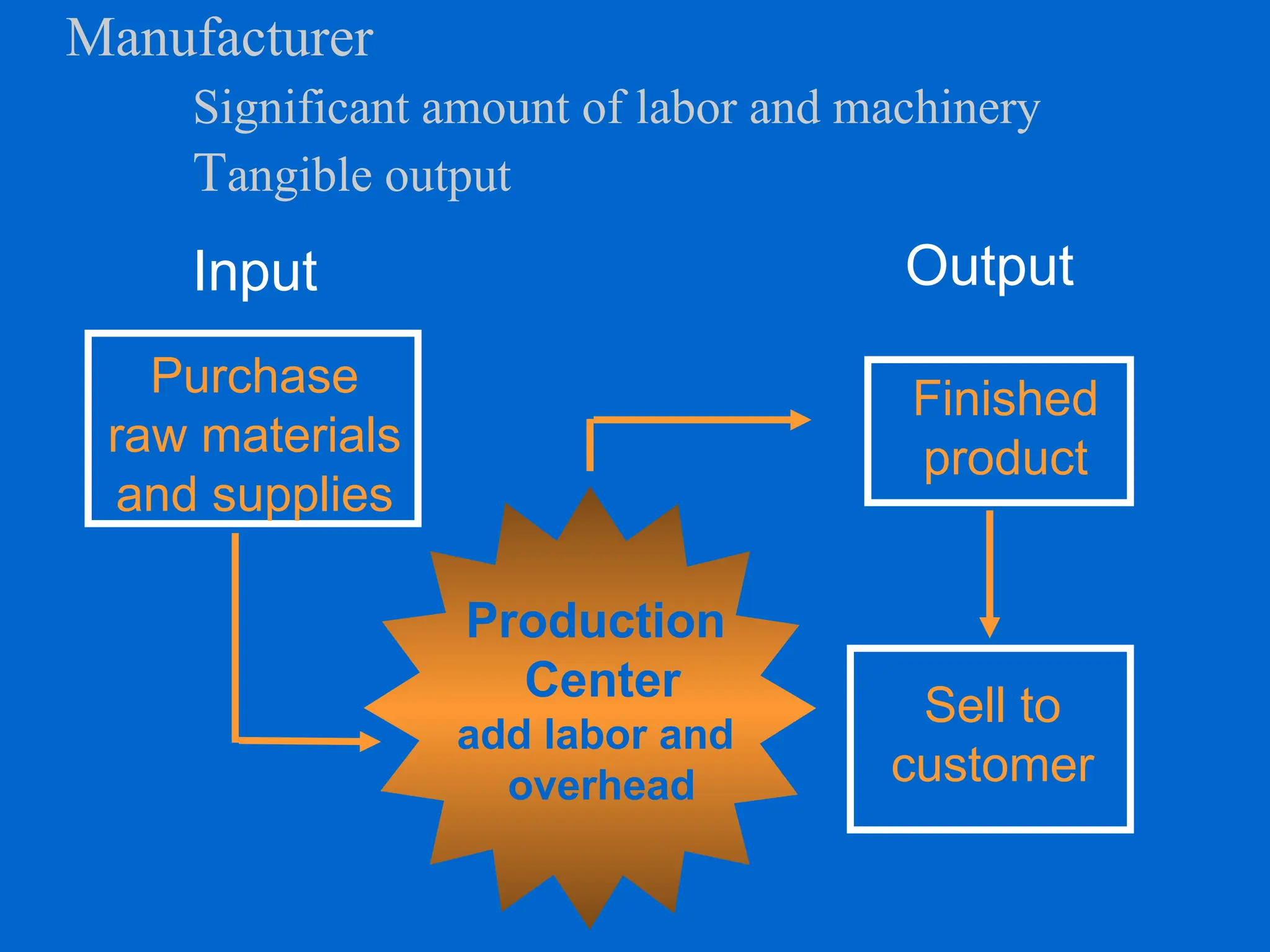

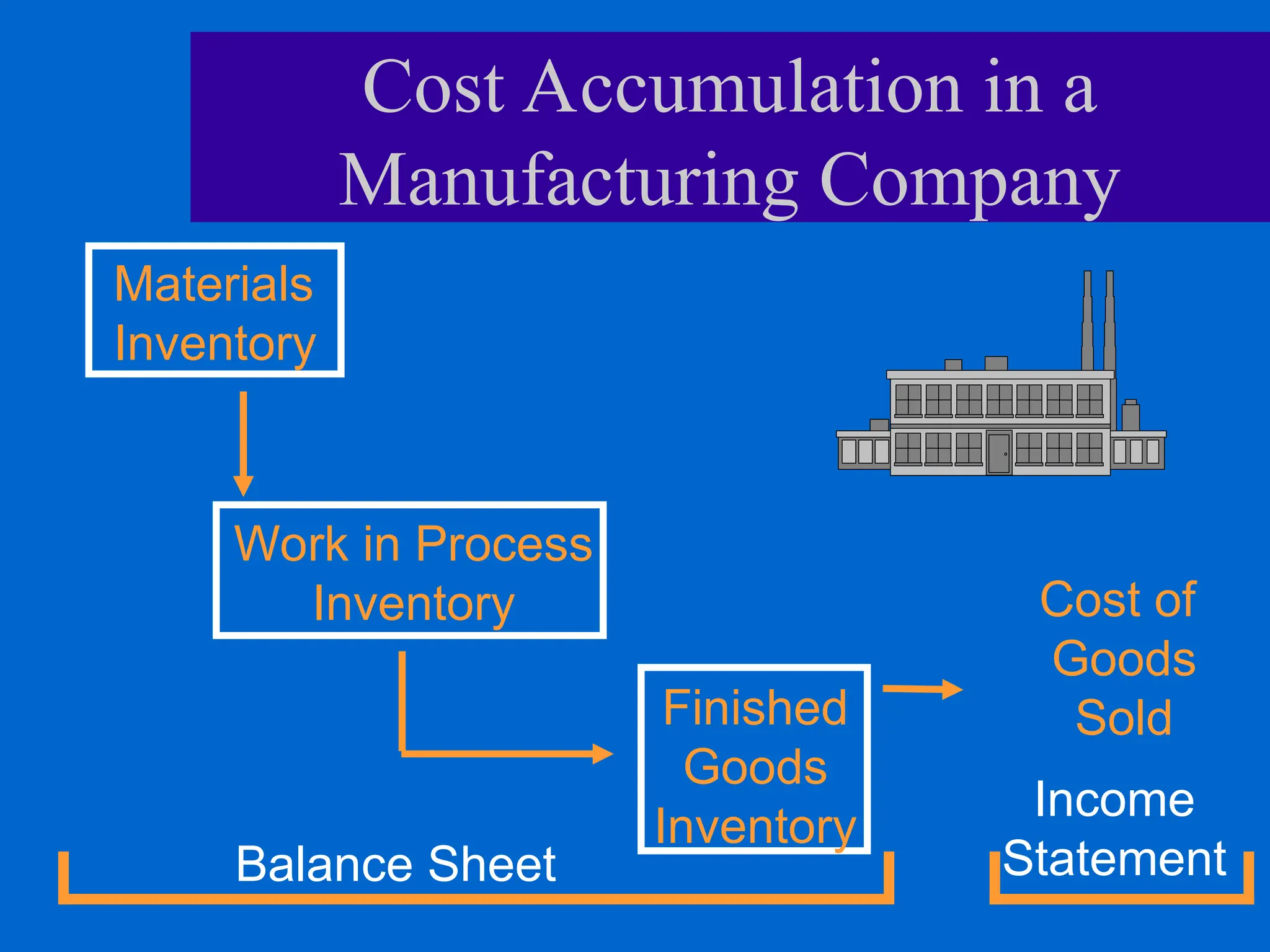

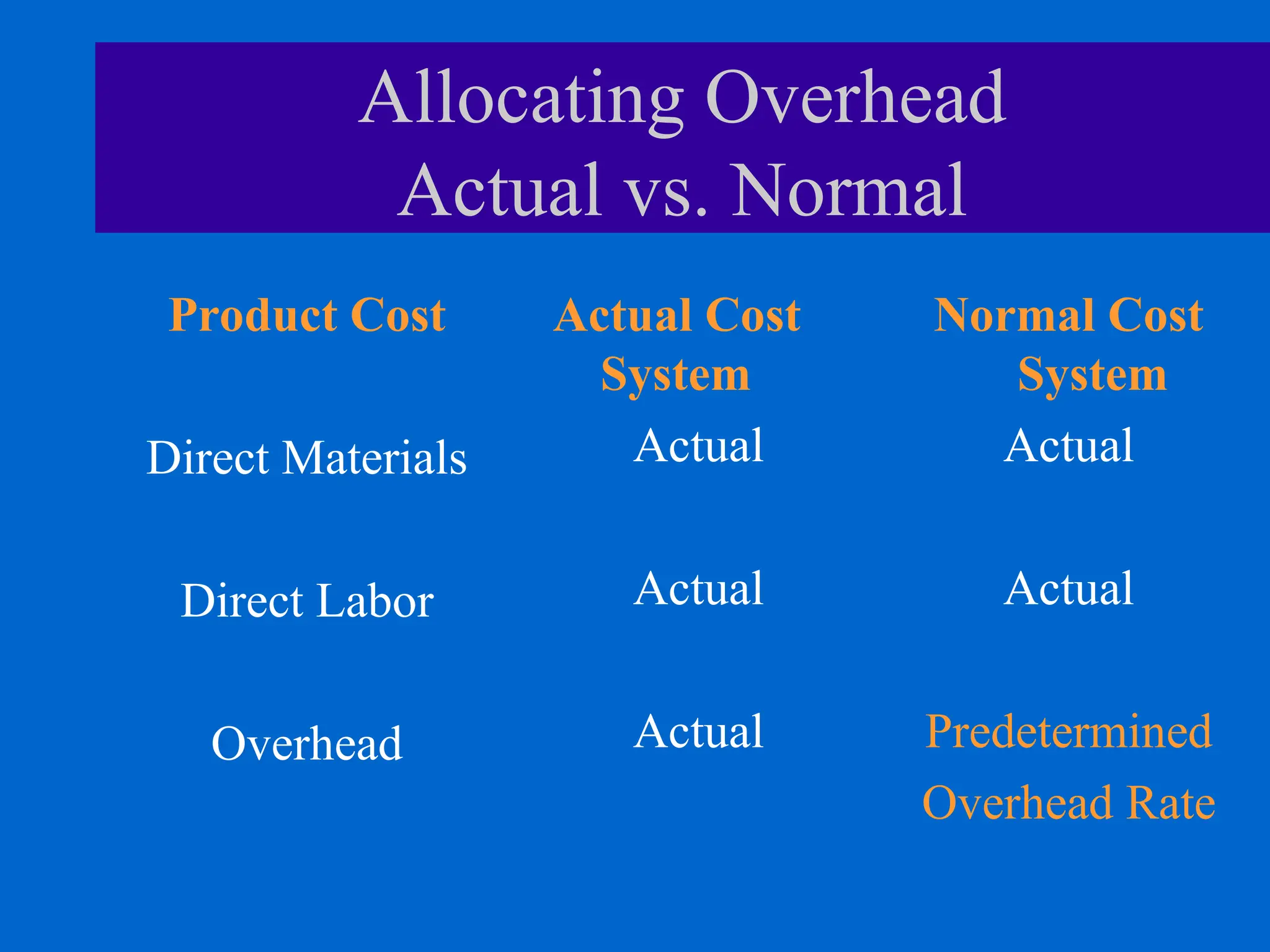

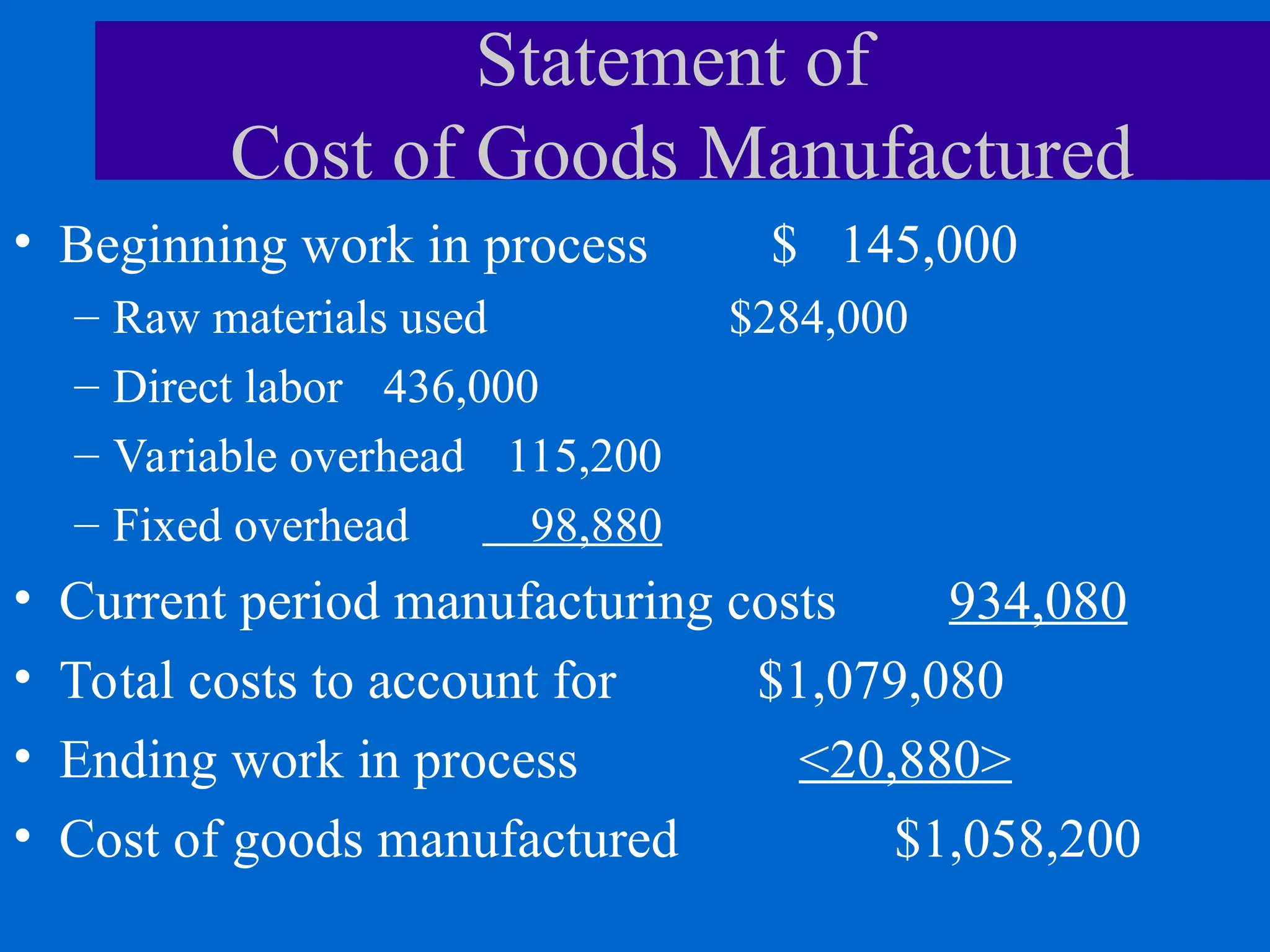

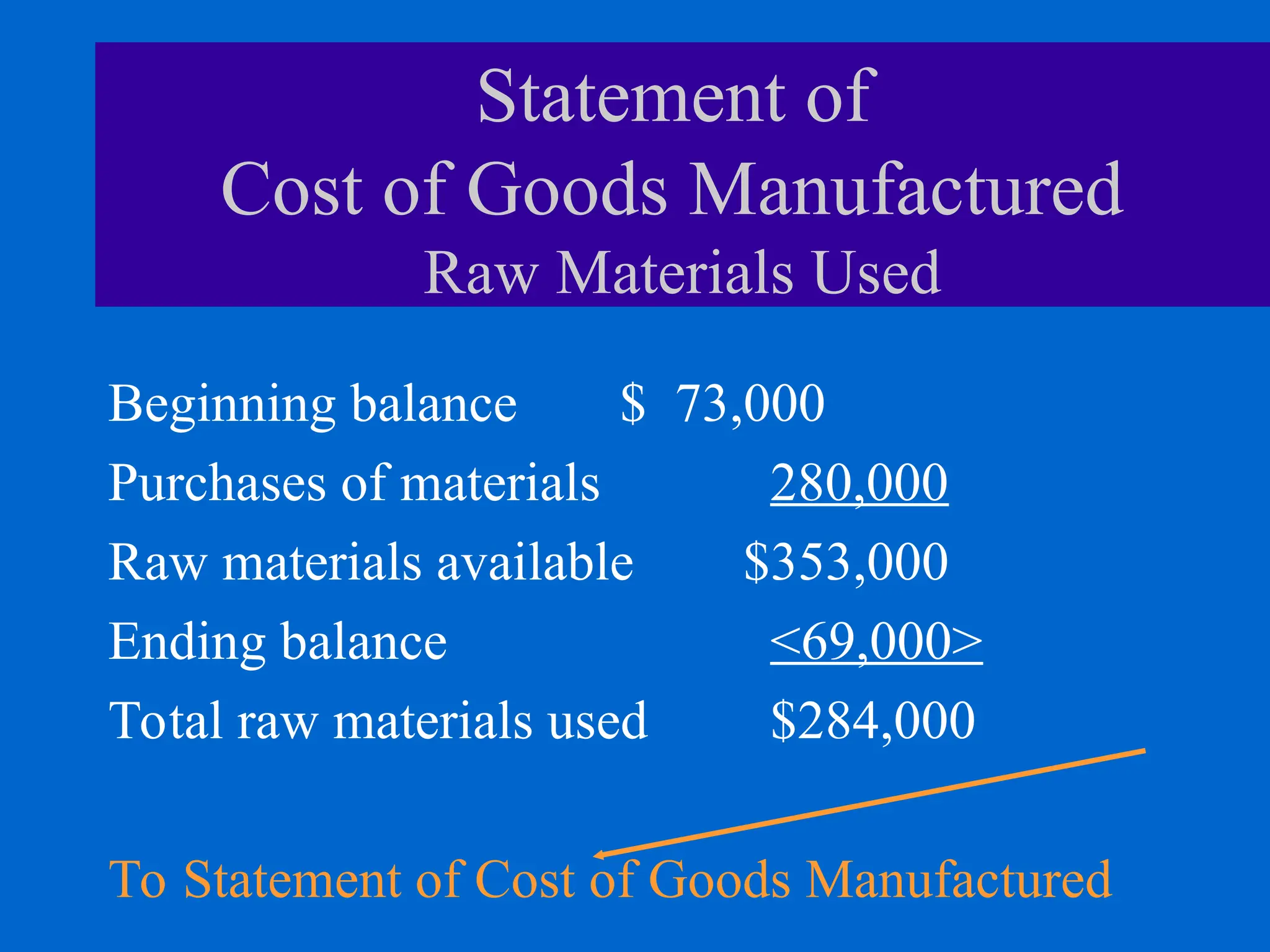

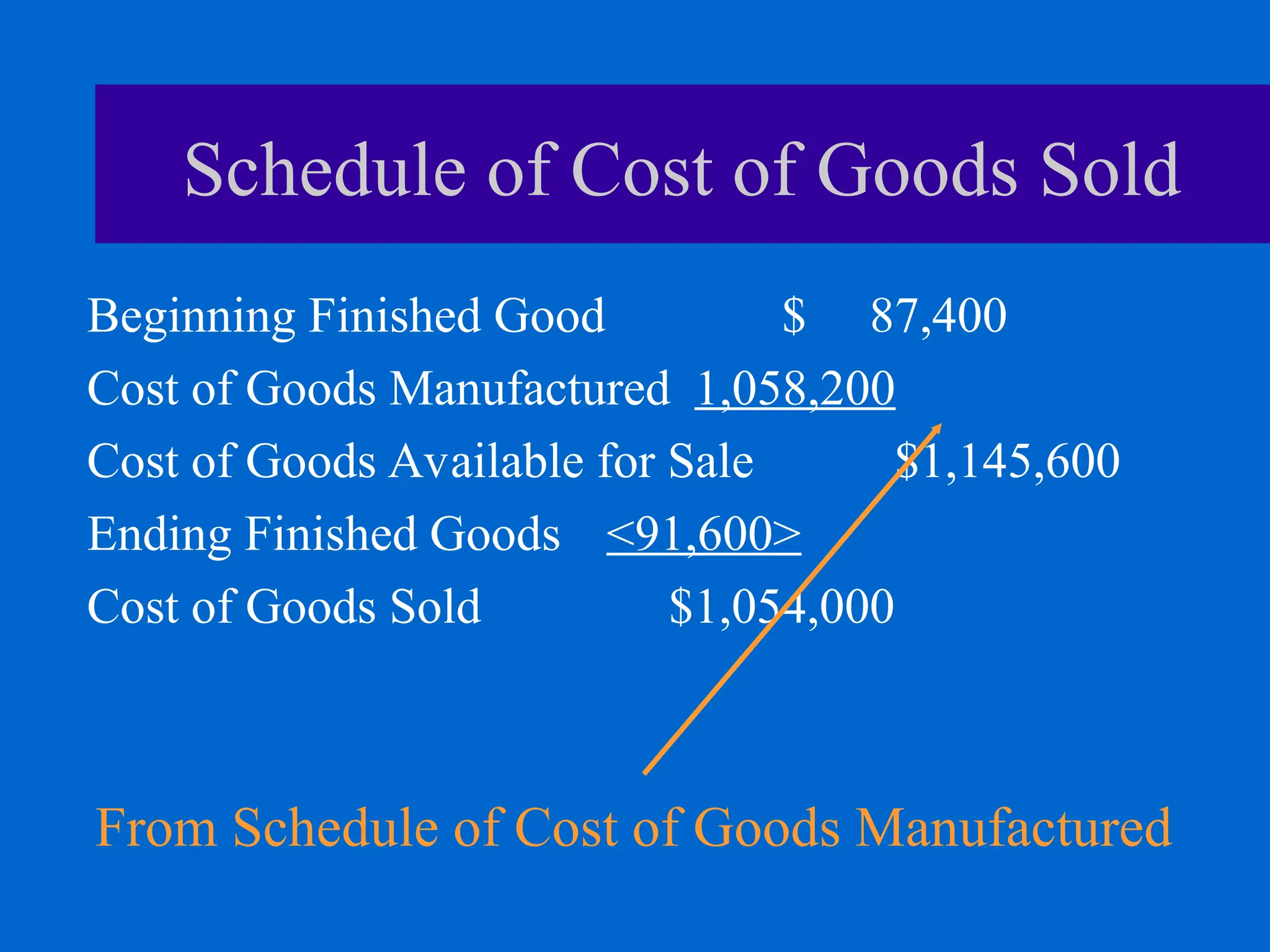

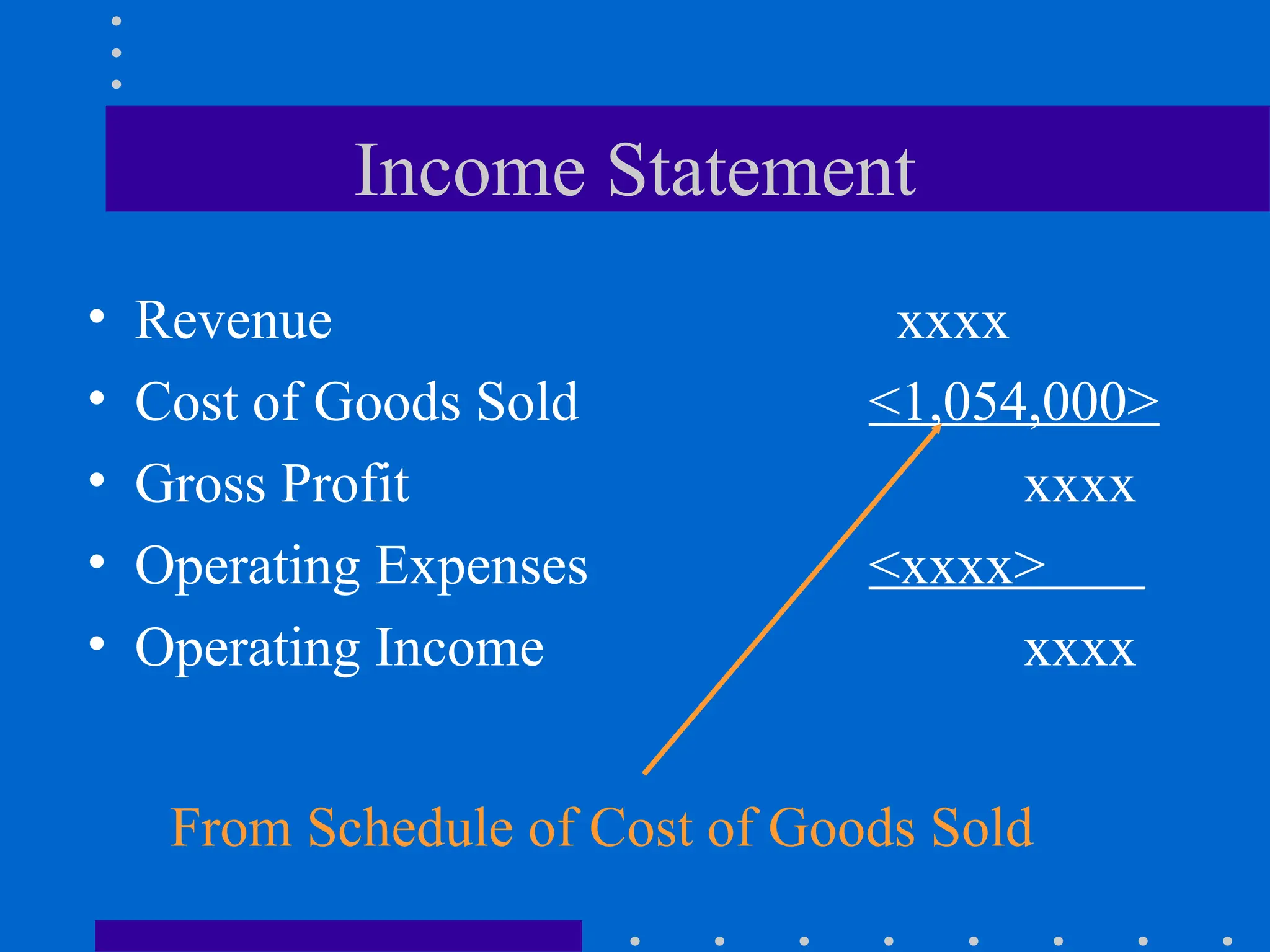

Chapter 2 discusses cost terminology and behavior in cost accounting, explaining the classifications of costs, their reactions to activity changes, and their roles in financial statements. It outlines the conversion process in both service and manufacturing companies, detailing product cost categories, cost behavior, and the cost accumulation process. Additionally, the chapter provides examples and calculations relevant to determining costs of goods manufactured and understanding fixed and variable costs.