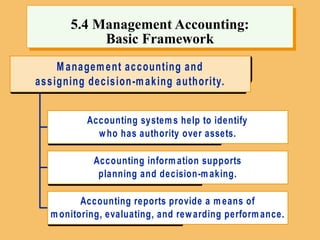

An accounting system is a formal mechanism for gathering, organizing, and communicating information about an organization’s activities.

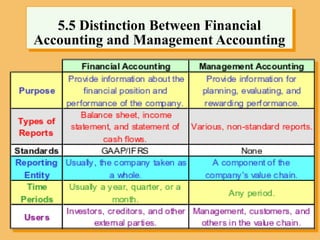

Using one accounting system for both financial and management purposes sometimes creates problems. External forces (for example, tax authorities and regulatory bodies such as the U.S. Securities and Exchange Commission) often limit management’s choices of accounting methods for external reports

An accounting system is a formal mechanism for gathering, organizing, and communicating information about an organization’s activities.

Using one accounting system for both financial and management purposes sometimes creates problems. External forces (for example, tax authorities and regulatory bodies such as the U.S. Securities and Exchange Commission) often limit management’s choices of accounting methods for external reports

An accounting system is a formal mechanism for gathering, organizing, and communicating information about an organization’s activities.

Using one accounting system for both financial and management purposes sometimes creates problems. External forces (for example, tax authorities and regulatory bodies such as the U.S. Securities and Exchange Commission) often limit management’s choices of accounting methods for external reports

An accounting system is a formal mechanism for gathering, organizing, and communicating information about an organization’s activities.

Using one accounting system for both financial and management purposes sometimes creates problems. External forces (for example, tax authorities and regulatory bodies such as the U.S. Securities and Exchange Commission) often limit management’s choices of accounting methods for external reports

An accounting system is a formal mechanism for gathering, organizing, and communicating information about an organization’s activities.

Using one accounting system for both financial and management purposes sometimes creates problems. External forces (for example, tax authorities and regulatory bodies such as the U.S. Securities and Exchange Commission) often limit management’s choices of accounting methods for external reports

An accounting system is a formal mechanism for gathering, organizing, and communicating information about an organization’s activities.

Using one accounting system for both financial and management purposes sometimes creates problems. External forces (for example, tax authorities and regulatory bodies such as the U.S. Securities and Exchange Commission) often limit management’s choices of accounting methods for external reports

An accounting system is a formal mechanism for gathering, organizing, and communicating information about an organization’s activities.

Using one accounting system for both financial and management purposes sometimes creates problems. External forces (for example, tax authorities and regulatory bodies such as the U.S. Securities and Exchange Commission) often limit management’s choices of accounting metho