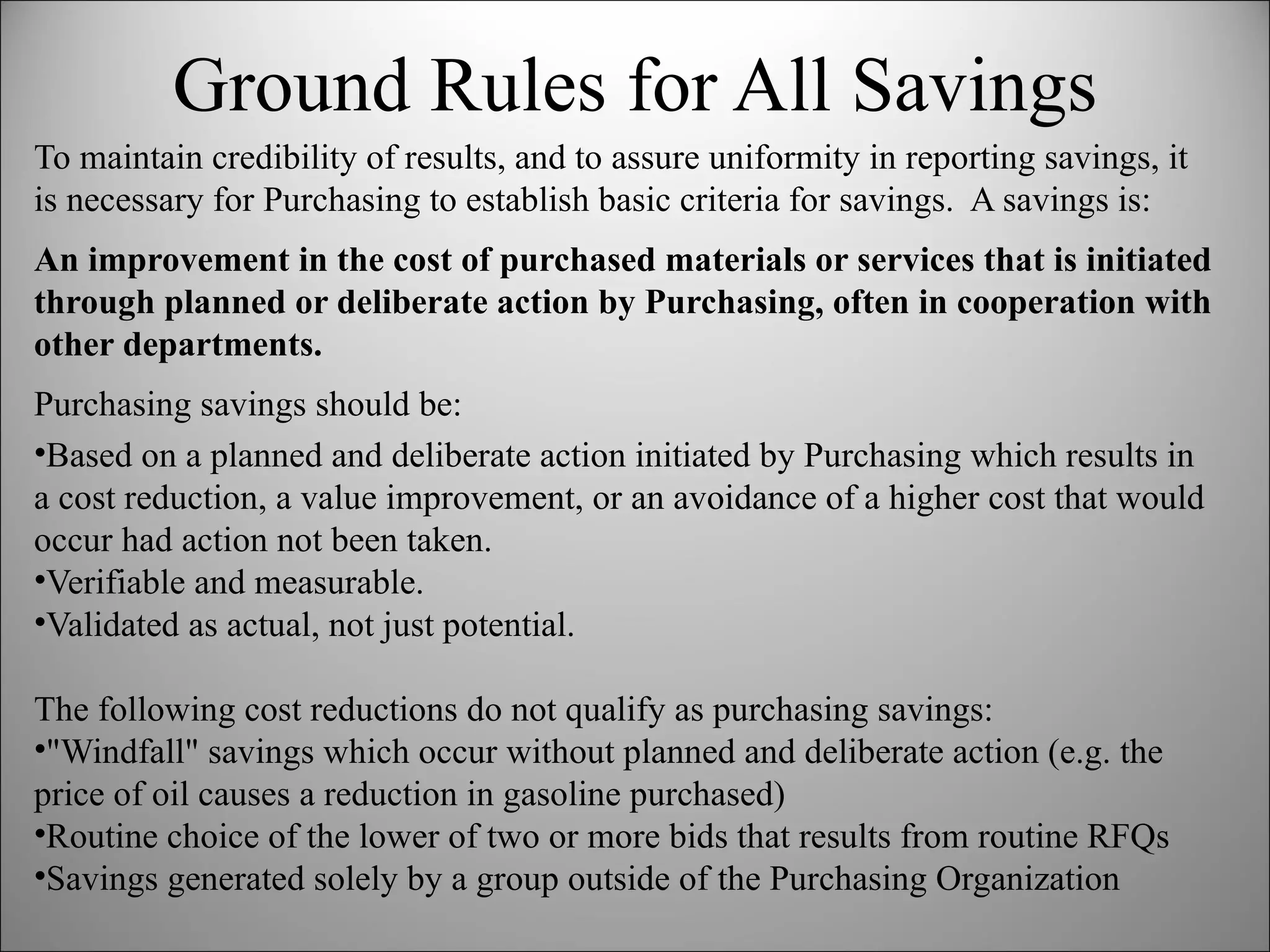

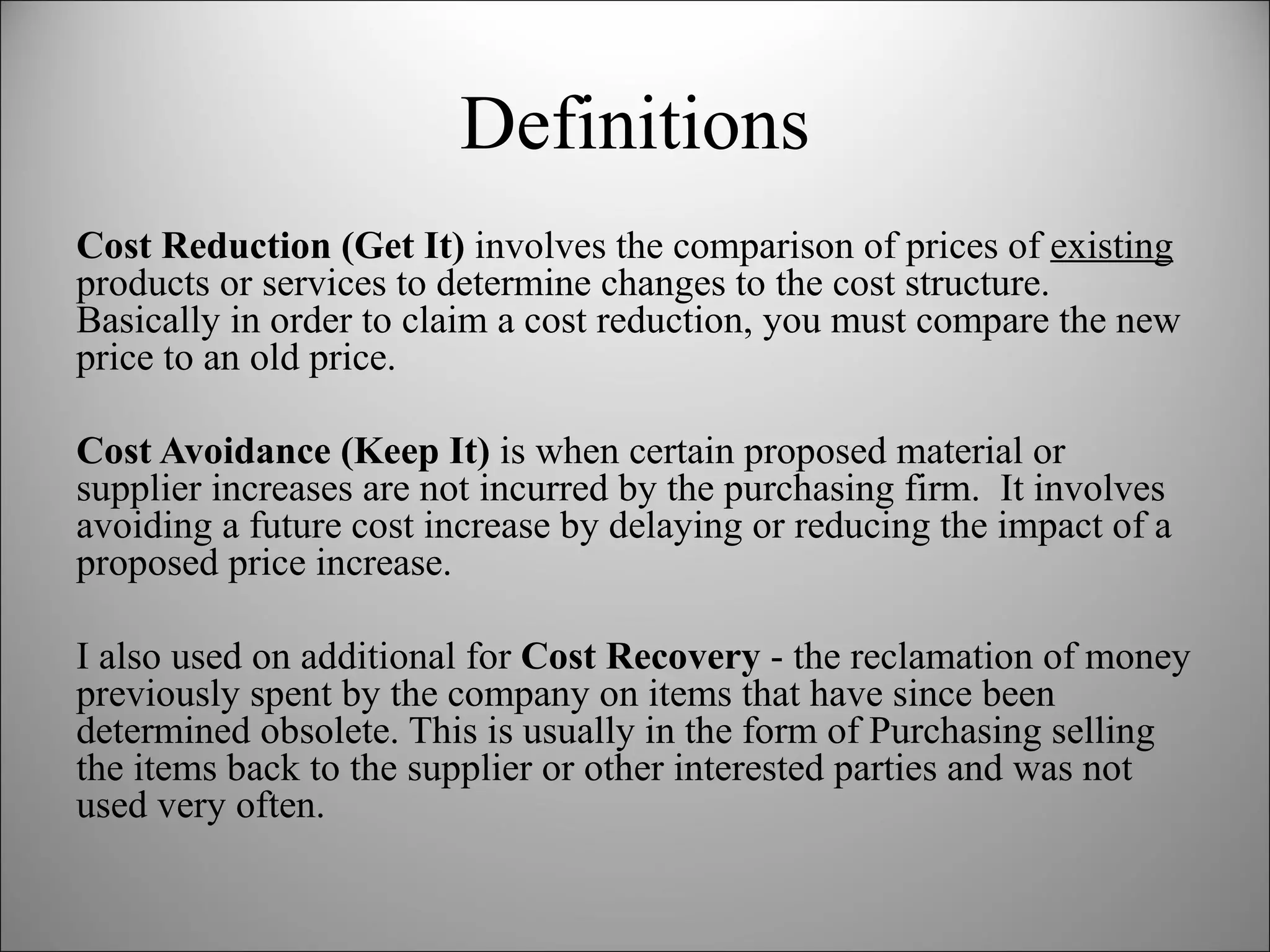

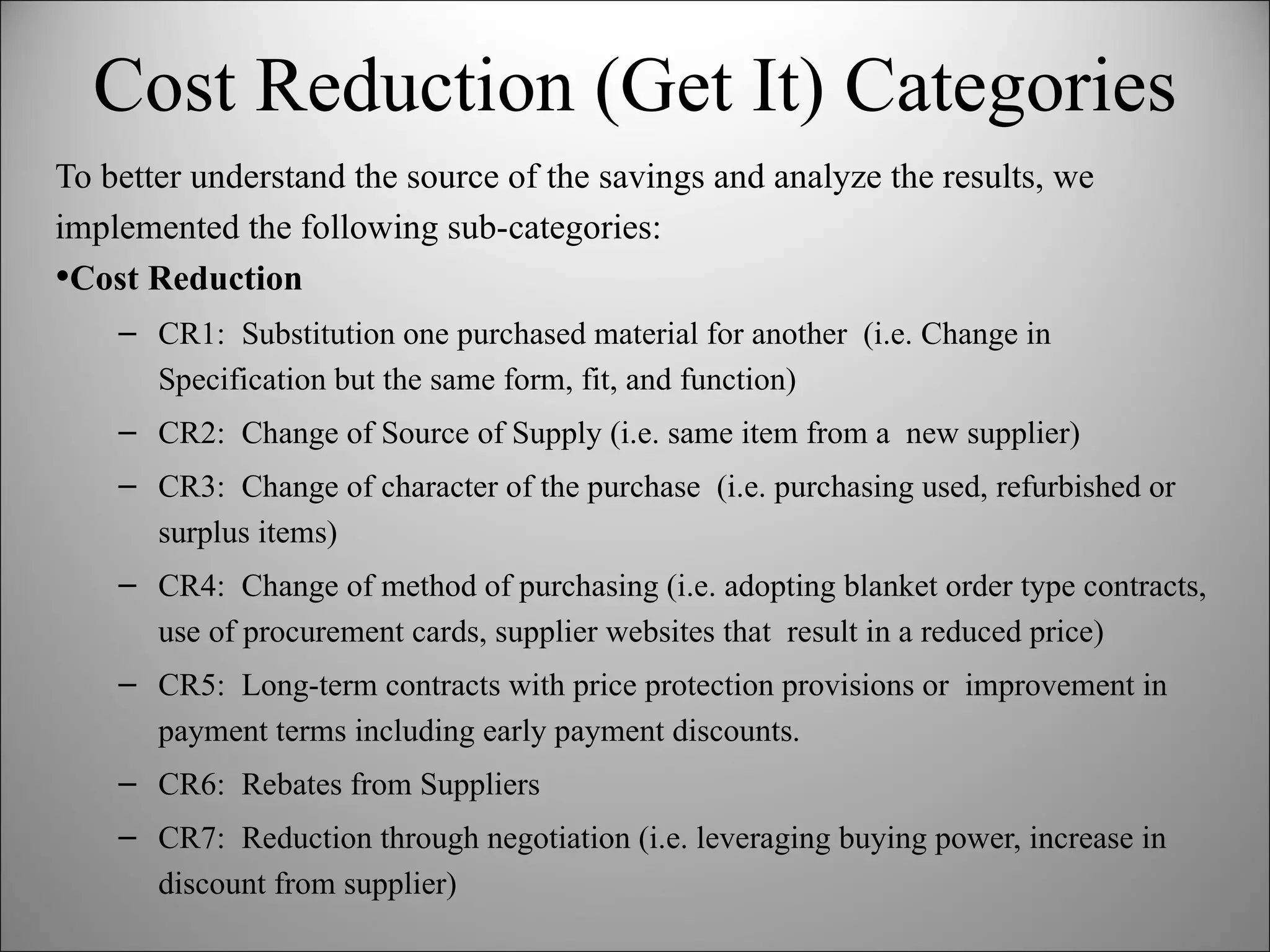

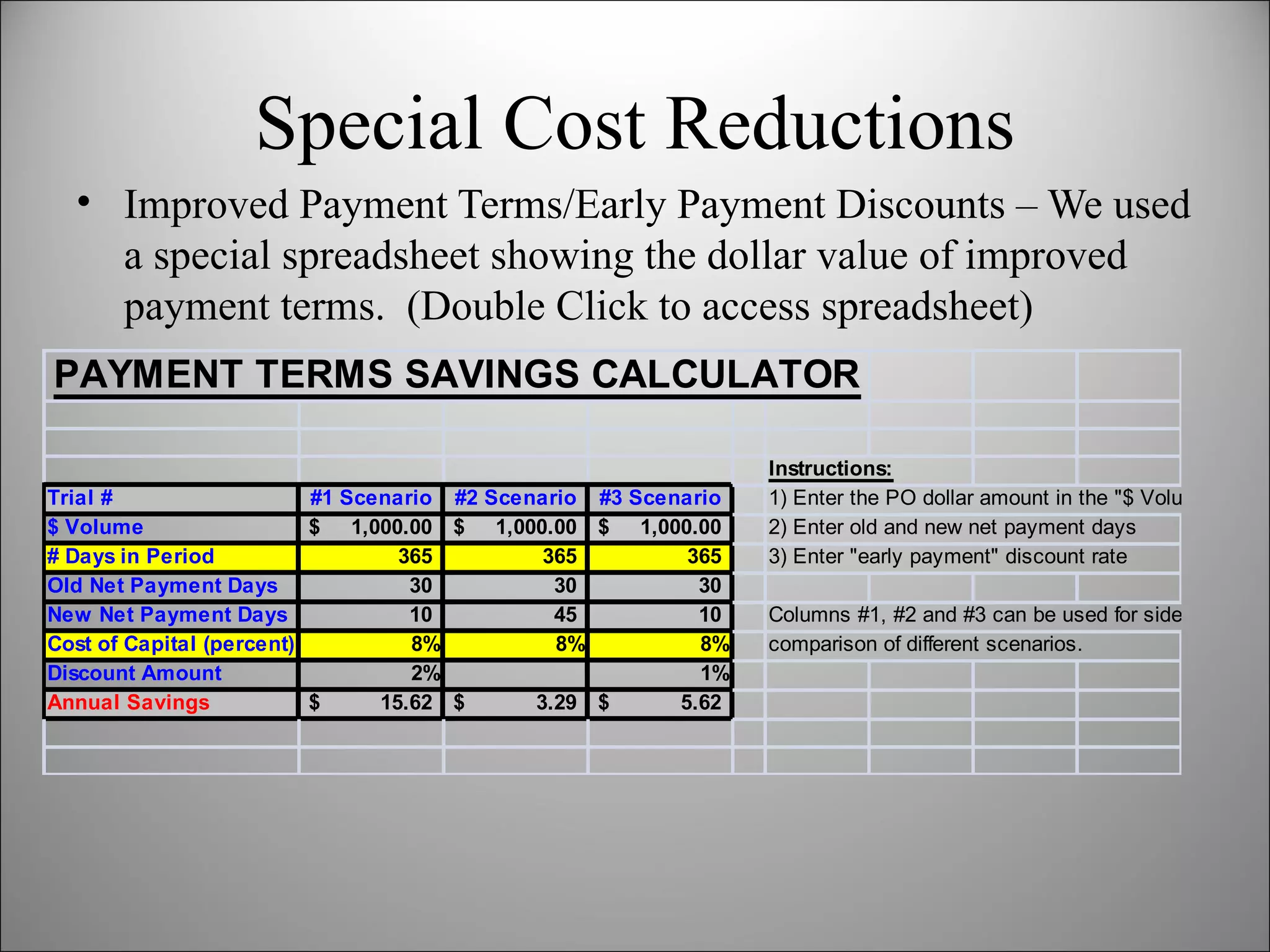

The document outlines the principles and methodologies for cost reduction and avoidance in purchasing, emphasizing the need for deliberate actions that lead to measurable savings. It defines purchasing savings as improvements in costs due to planned efforts, and distinguishes between cost reductions and cost avoidance strategies. Additionally, it discusses categories for measuring both cost reductions and cost avoidance, highlighting the importance of tracking these figures for organizational reporting.

![Cost Reduction and Avoidance Barry Hedrick, C.P.M [email_address]](https://image.slidesharecdn.com/costreductionandavoidance9703version-12641920350972-phpapp01/75/Cost-Reduction-And-Avoidance-1-2048.jpg)

![Methods of Measuring Cost Reduction Preferred Method Nwe Total Delivered Price [minus] Previous Total Delivered Price = Reduction Amount Rules - The Previous Total Delivered Price should be no older than 18 months - Reductions are claimed on all purchases of that particular item for 1 year after the agreement is implemented or until the price is adjusted/renegotiated, whichever is shorter - Increases in price will be reported as a Negative Reduction and will result in a negative effect on the Purchasing Savings](https://image.slidesharecdn.com/costreductionandavoidance9703version-12641920350972-phpapp01/75/Cost-Reduction-And-Avoidance-8-2048.jpg)

![Methods of Measuring Cost Reduction Alternate Method New Total Delivered Price [minus] Adjusted Previous Total Delivered Price = Reduction Amount Rules If the Previous Total Delivered Price is more than 18 months old, an adjustment could be made using an approved index that legitimately reflects the fluctuations in cost. For North America, we used the Producer Price Index published by the Bureau of Labor and Statics and can be found at the website --> http://data.bls.gov/cgi-bin/dsrv?pc for Europe we used http://epp.eurostat.ec.europa.eu/portal/page/portal/eurostat/home/](https://image.slidesharecdn.com/costreductionandavoidance9703version-12641920350972-phpapp01/75/Cost-Reduction-And-Avoidance-9-2048.jpg)

![Special Rule ONLY for Capital Expenditures: Alternate 2 New Total Delivered Price [minus] Established Market Price = Reduction Amount Rules - The Established Market Price is the total delivered price determined by the lowest of at least 3 legitimate, competitive bids . Reduction can occur when Purchasing negotiates a final price that is lower that the previously received low price offer. Methods of Measuring Cost Reduction](https://image.slidesharecdn.com/costreductionandavoidance9703version-12641920350972-phpapp01/75/Cost-Reduction-And-Avoidance-10-2048.jpg)

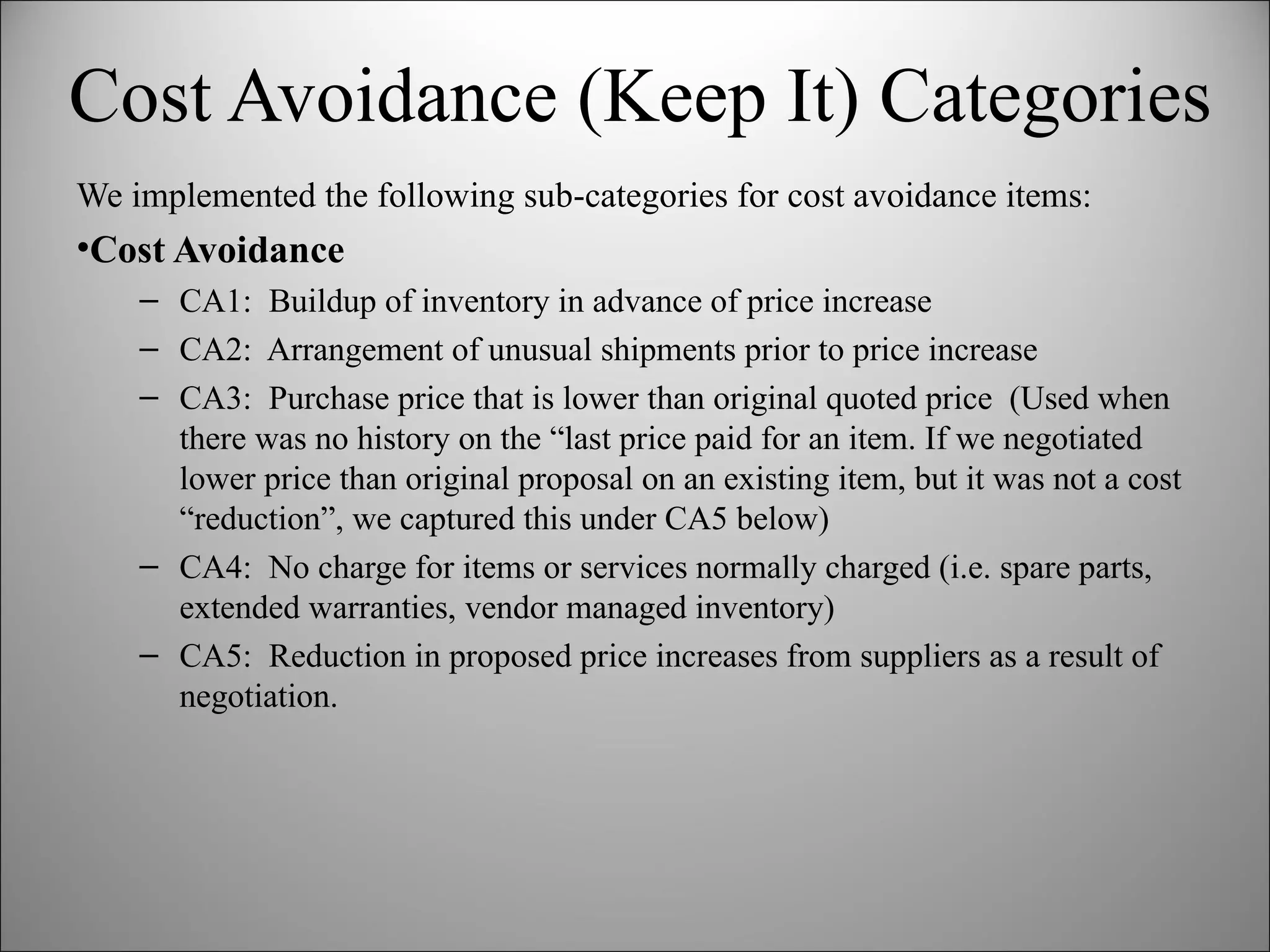

![CA1: Buildup of inventory in advance of price increase Future Total Delivered Price [minus] Current Total Delivered Price X Number of Units purchased in advance – inventory carrying costs = Avoidance Amount CA2: Arrangement of unusual shipments prior to price increase Future Total Delivered Price [minus] Current Total Delivered Price (including special shipment charges as applicable) X Number of Units purchased in advance = Avoidance Amount CA3: Purchase price that is lower than original quoted price (Used when there was no history on the “last price paid” for an item. If we negotiated lower price than original proposal on an existing item, but it was not a cost “reduction”, we captured this under CA5 below) CA4: No charge for items or services normally charged (i.e. spare parts, extended warranties, vendor managed inventory) Originally proposed price of parts, warranty or value of applicable inventory carrying costs for VMI CA5: Reduction in proposed price increases from suppliers as a result of negotiation. Negotiated Total Delivered Price [minus] Originally Quoted Total Delivered Price Methods of Measuring Cost Reduction](https://image.slidesharecdn.com/costreductionandavoidance9703version-12641920350972-phpapp01/75/Cost-Reduction-And-Avoidance-13-2048.jpg)