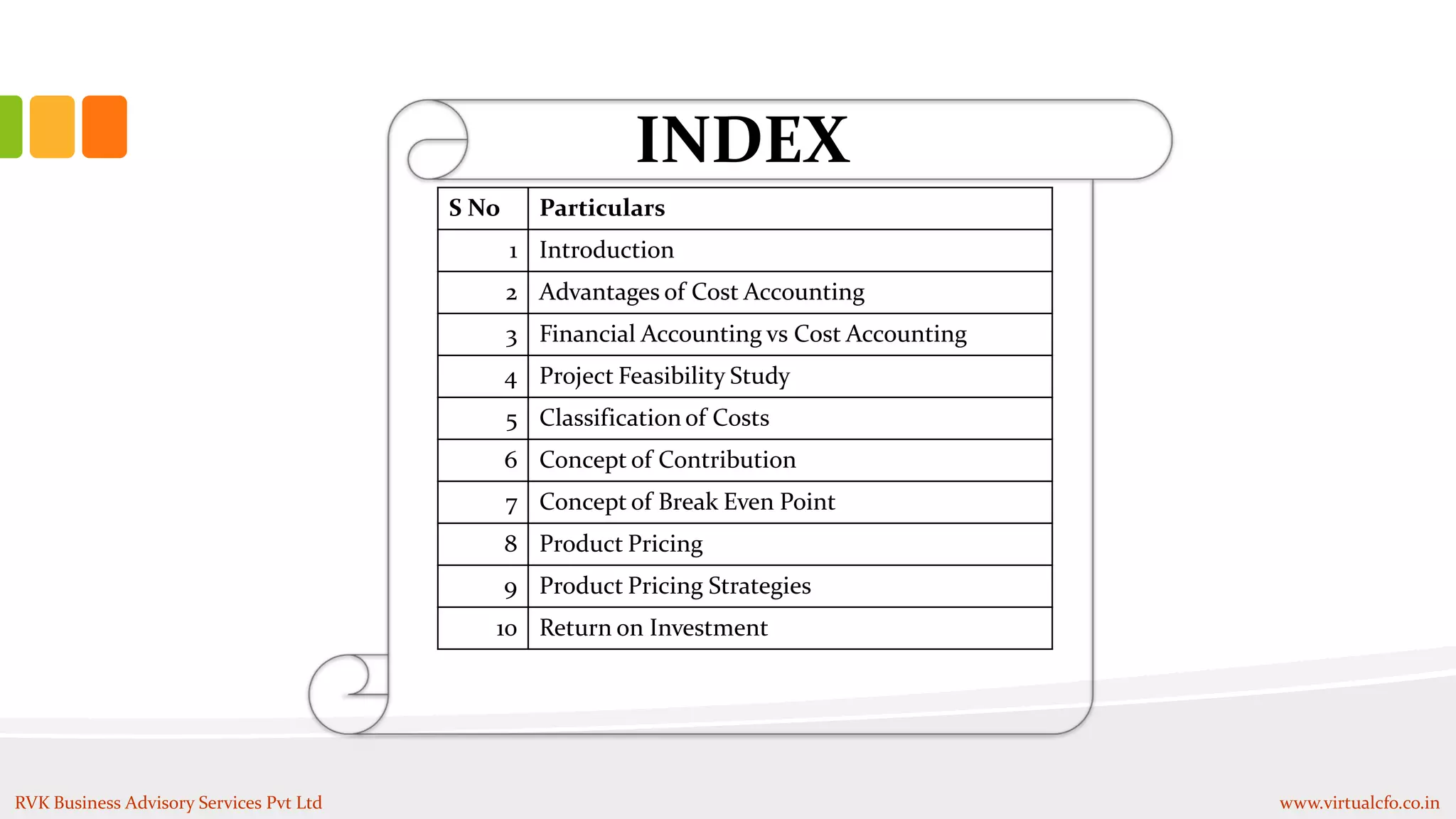

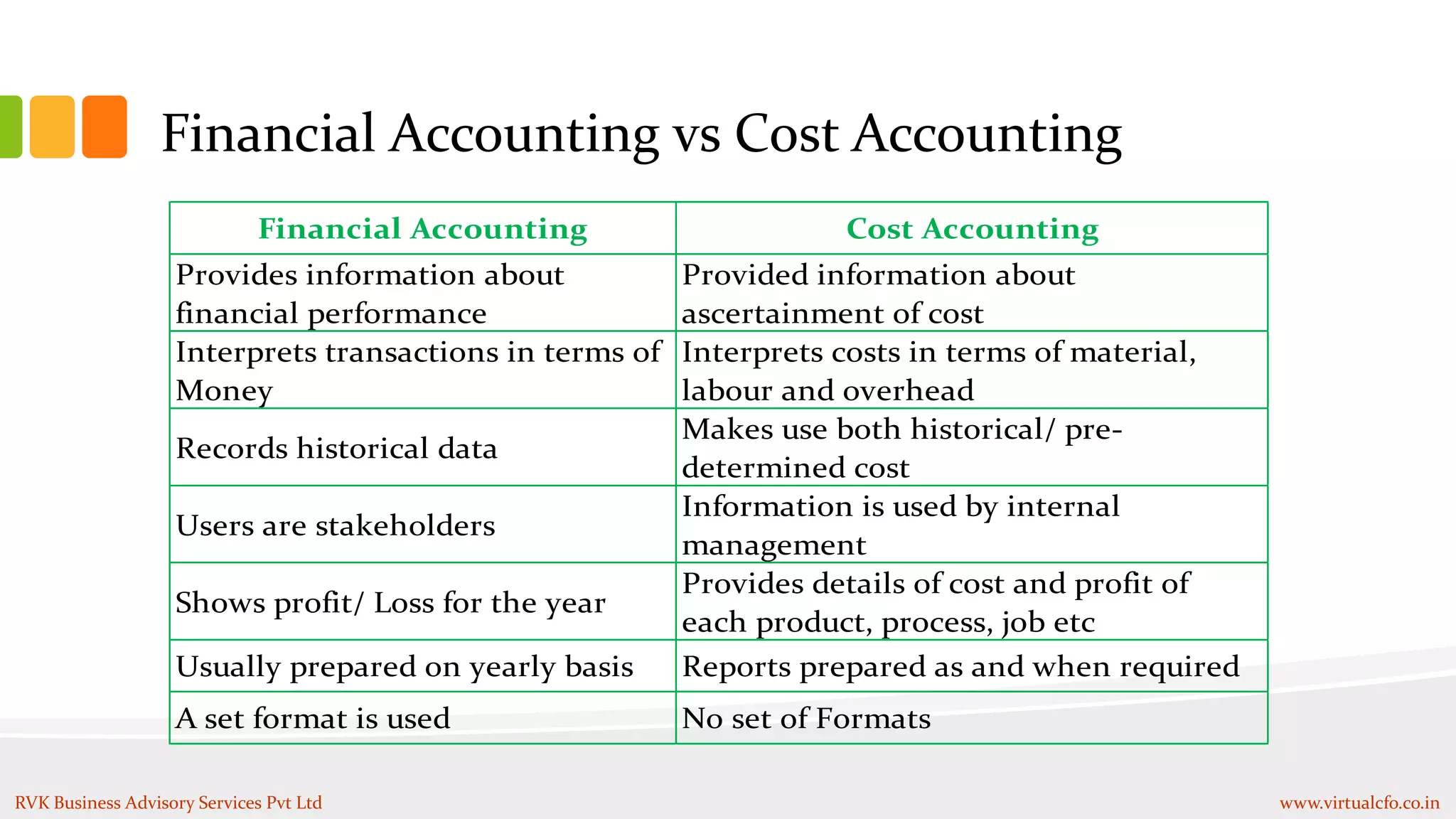

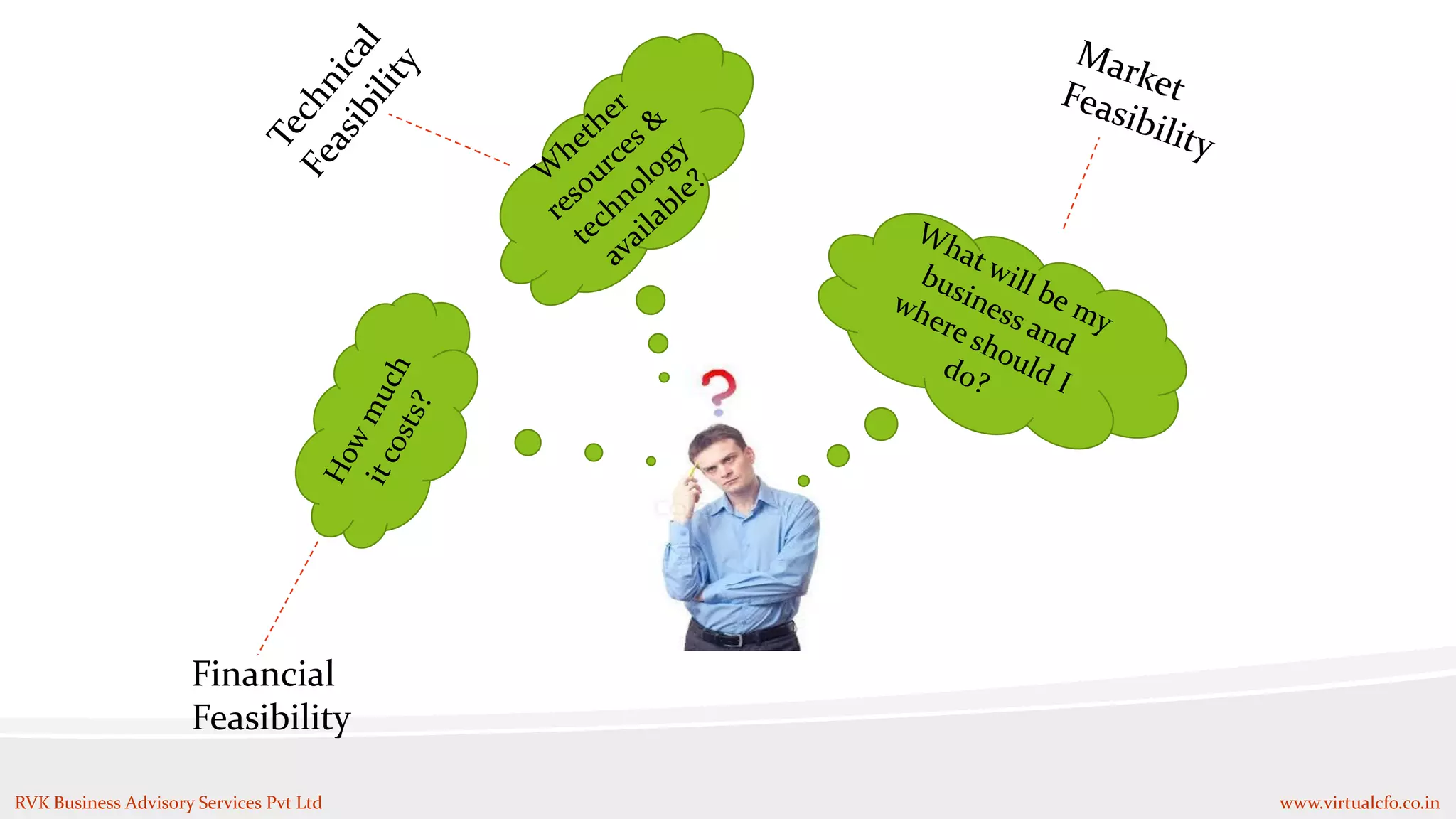

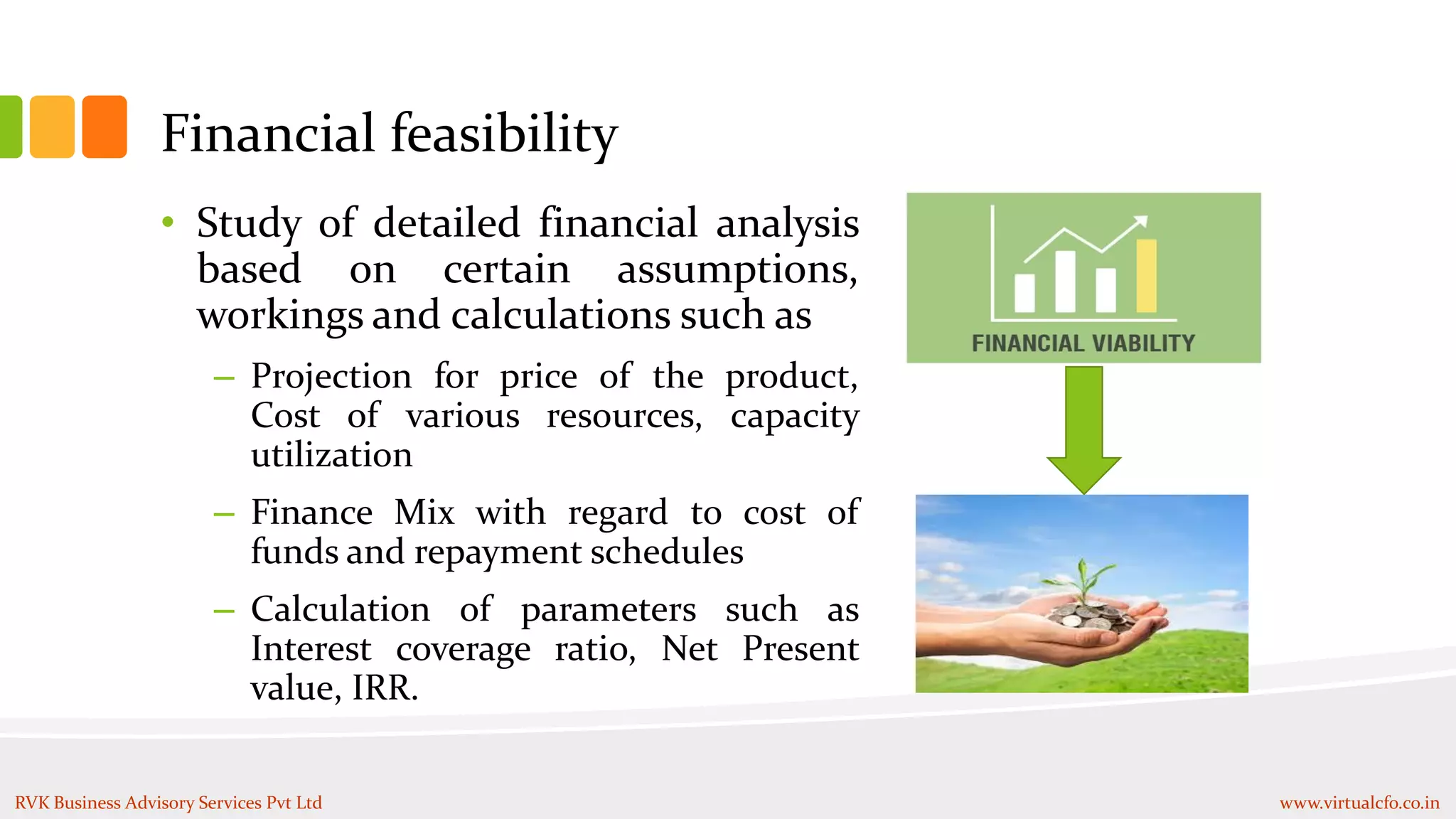

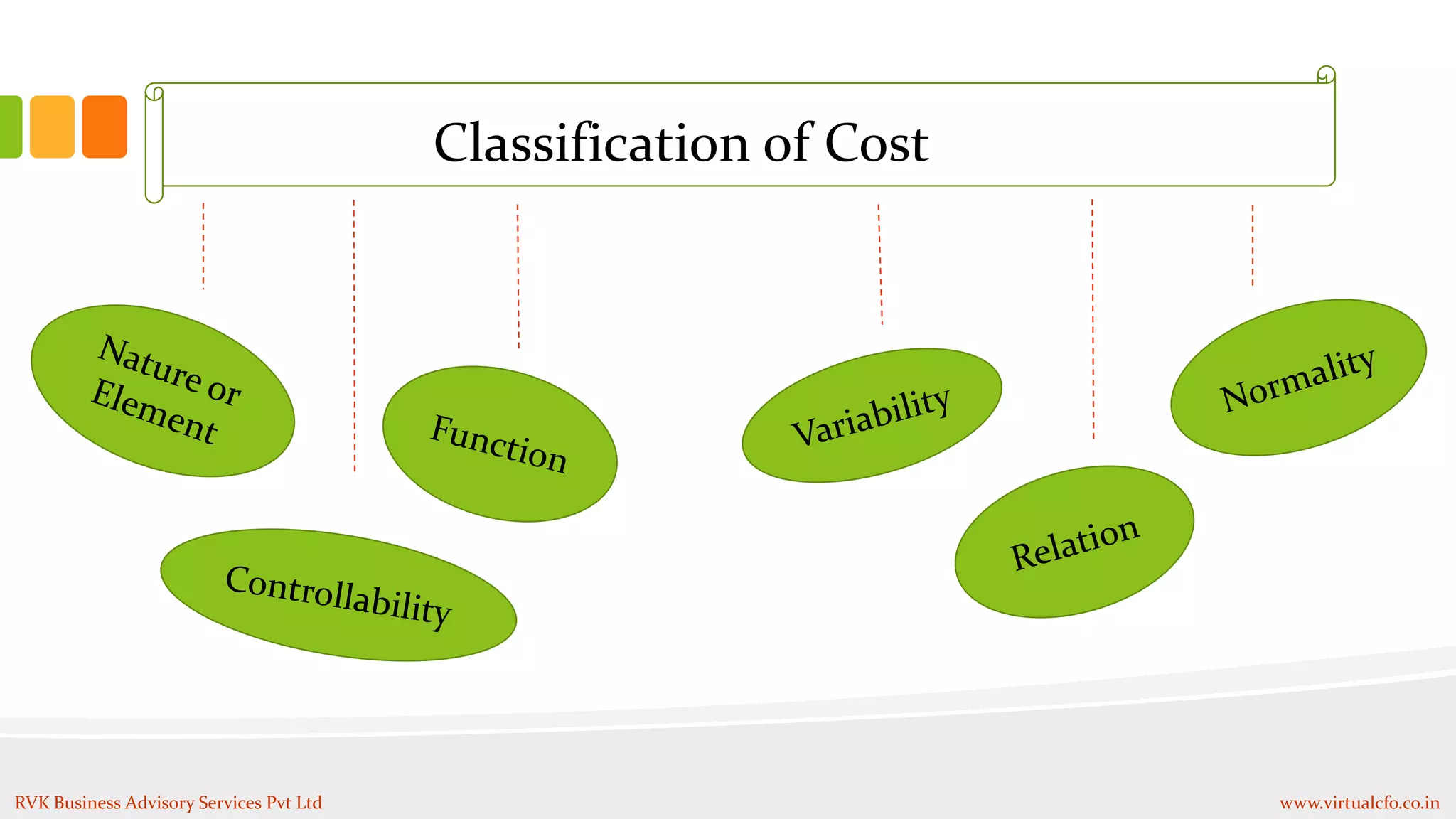

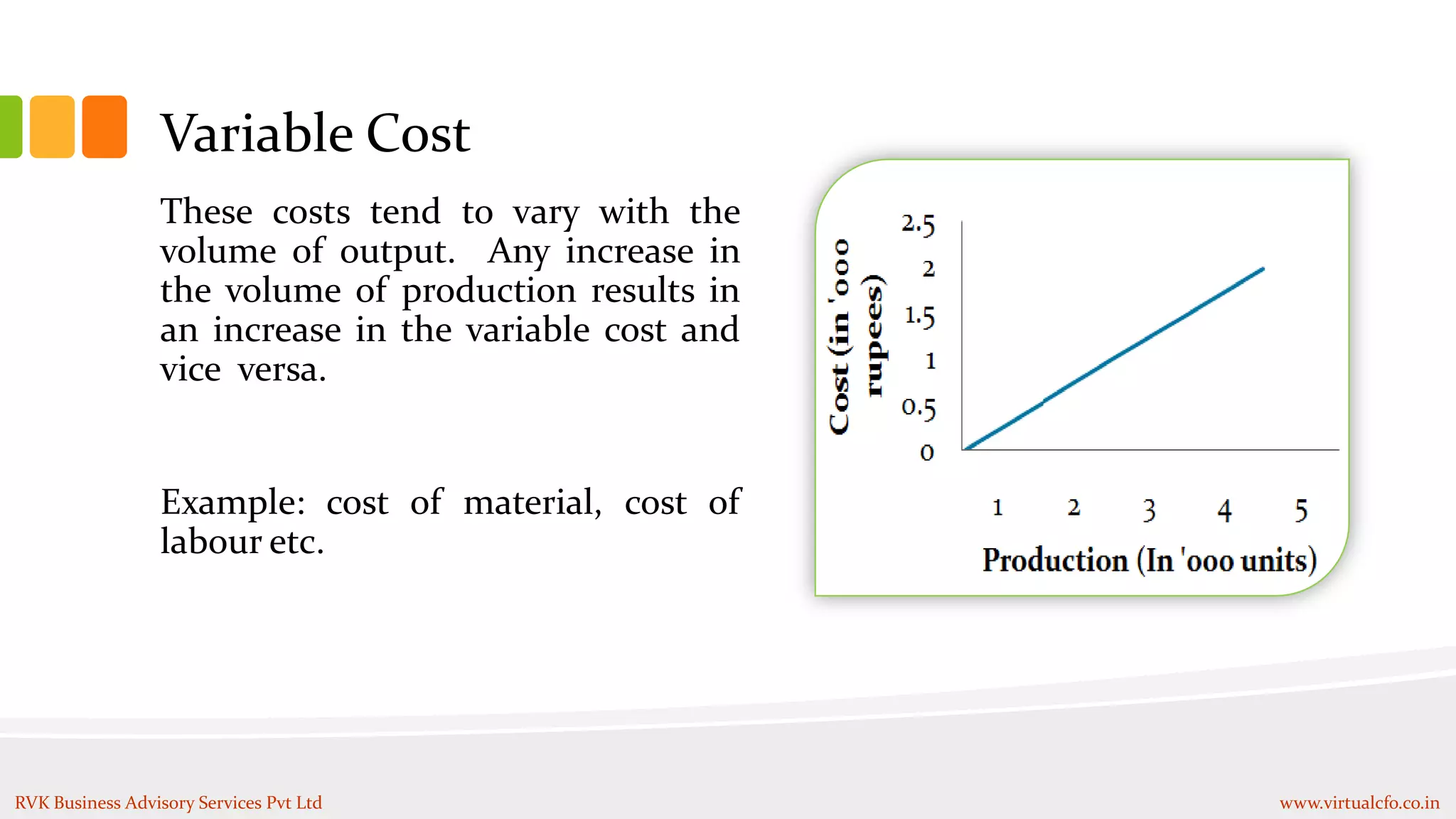

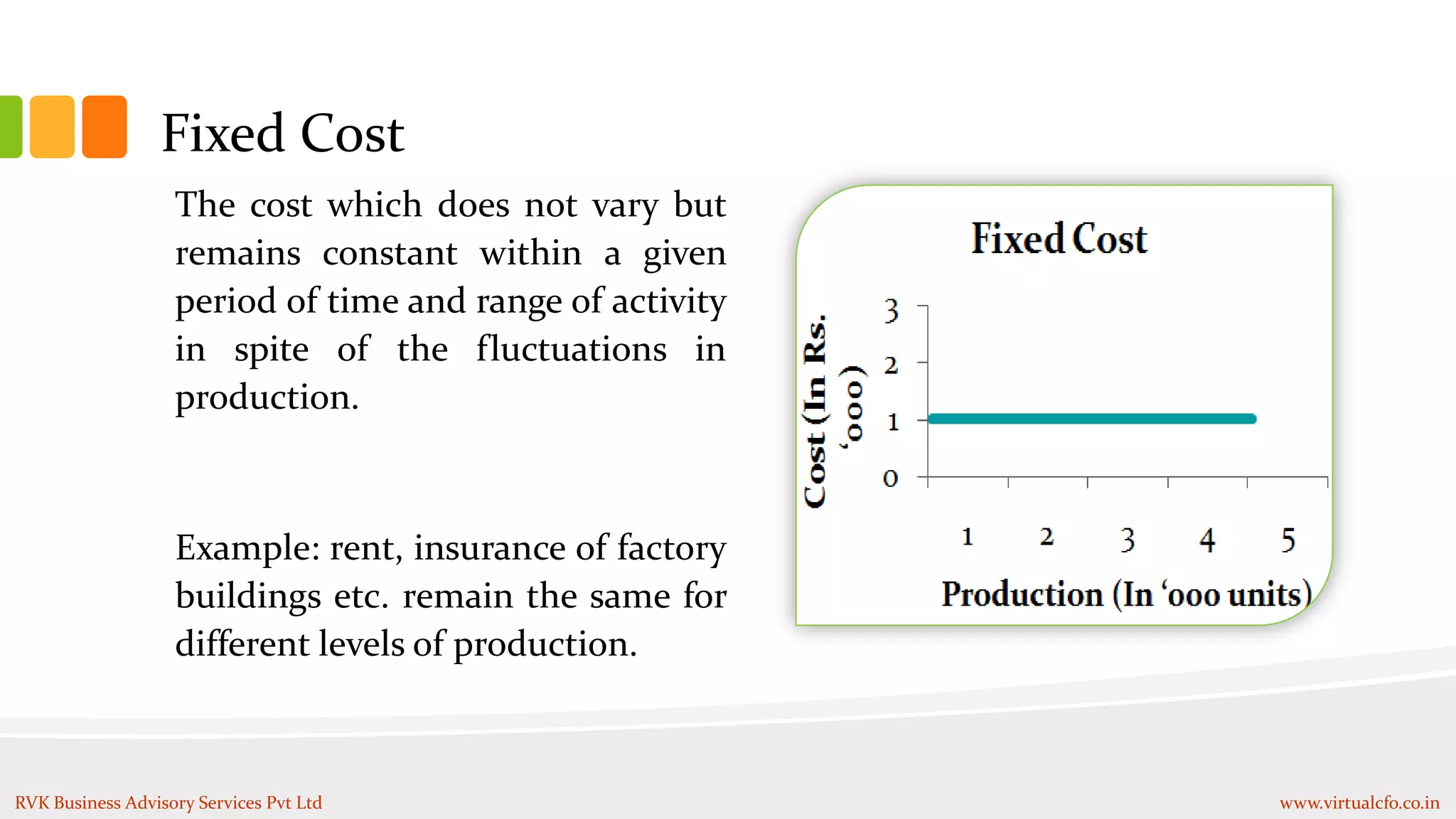

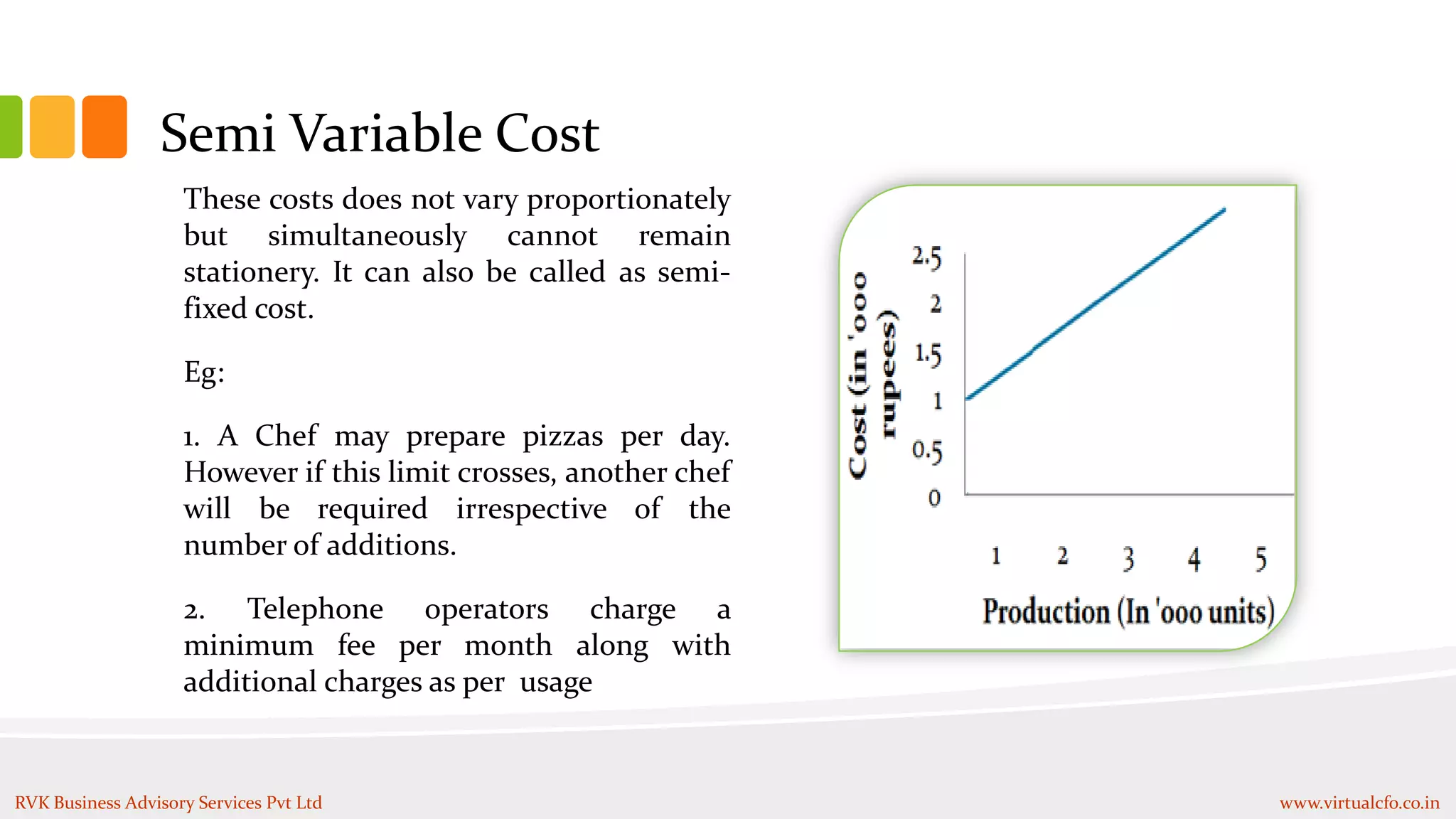

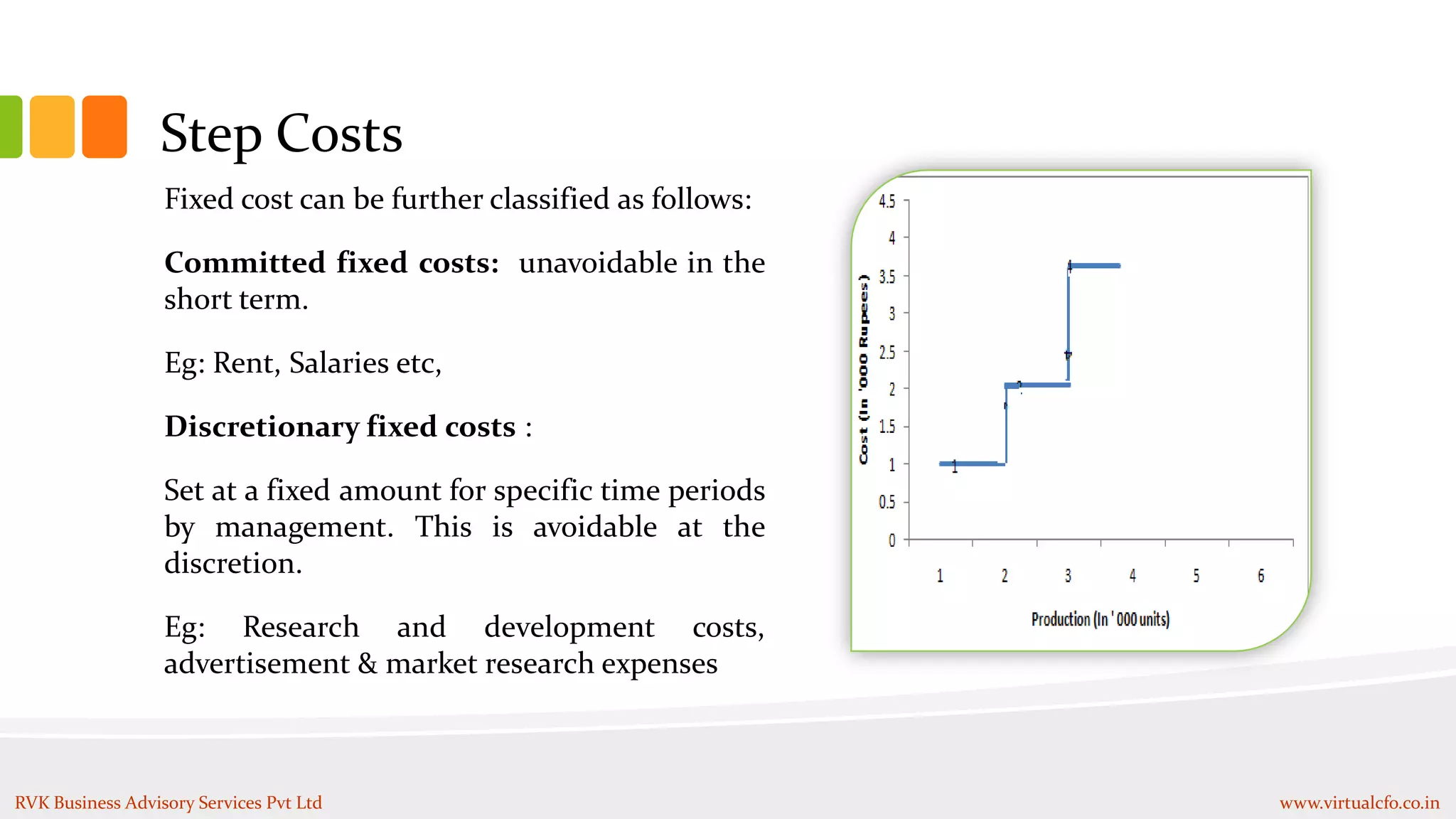

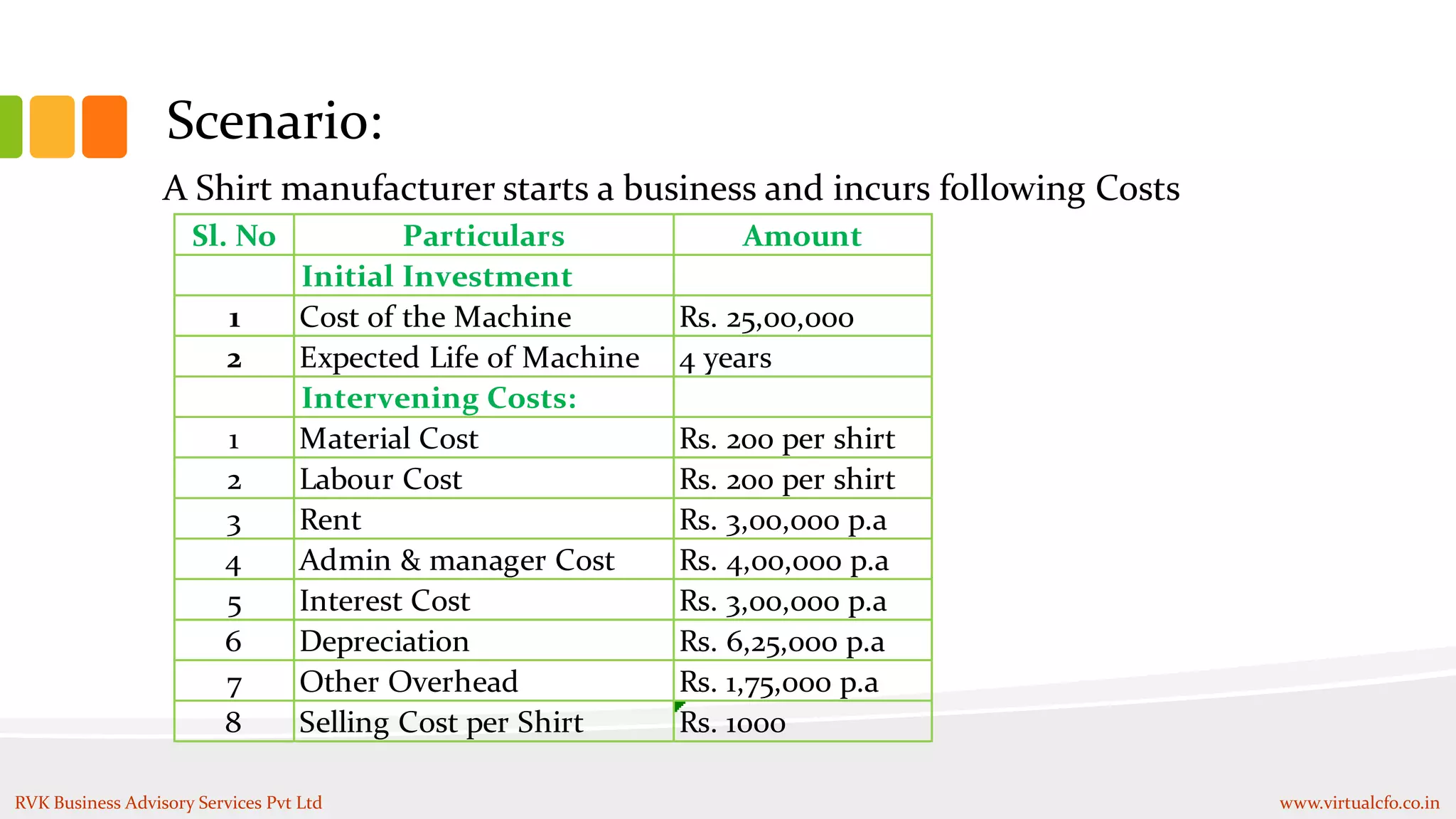

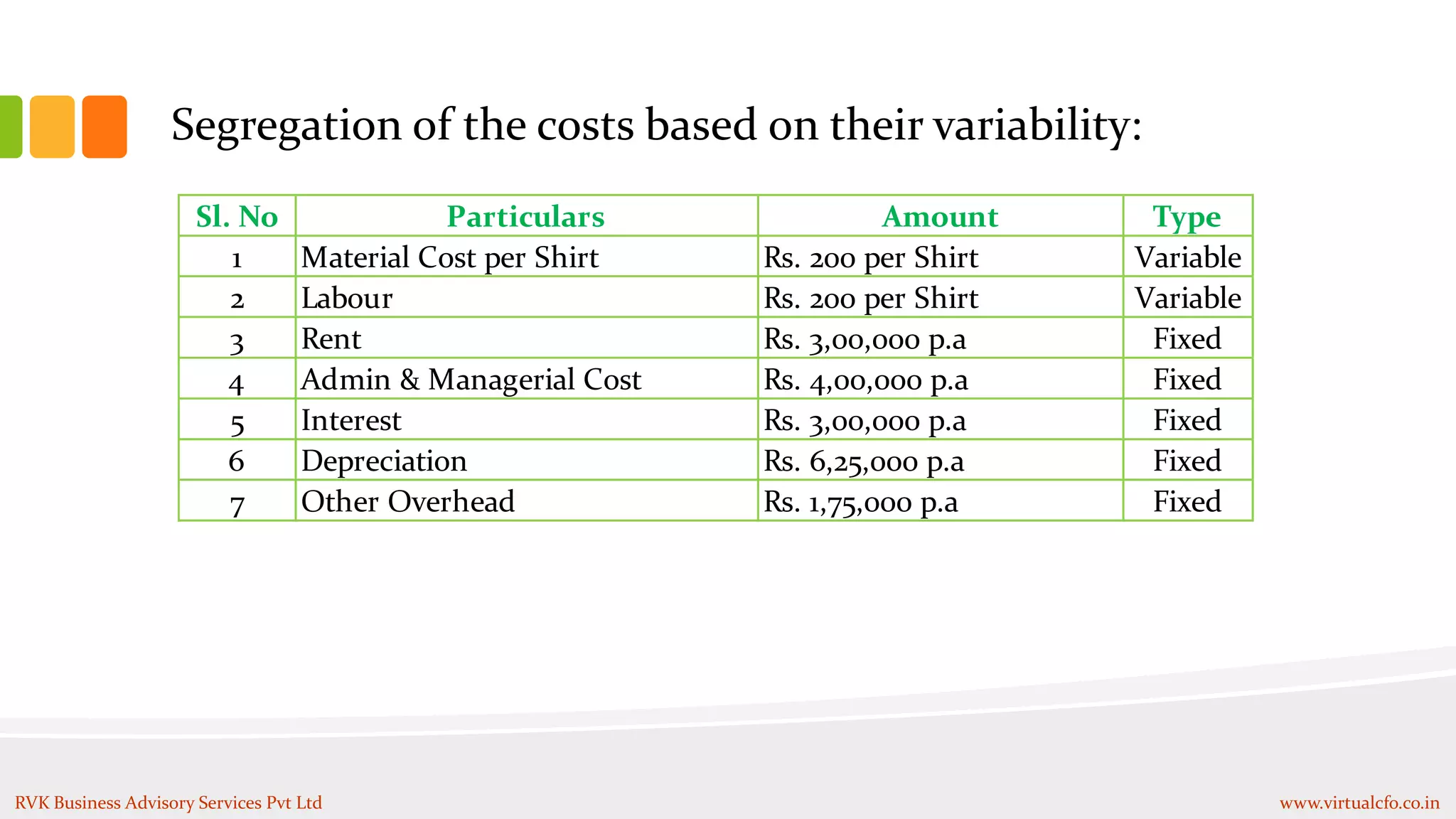

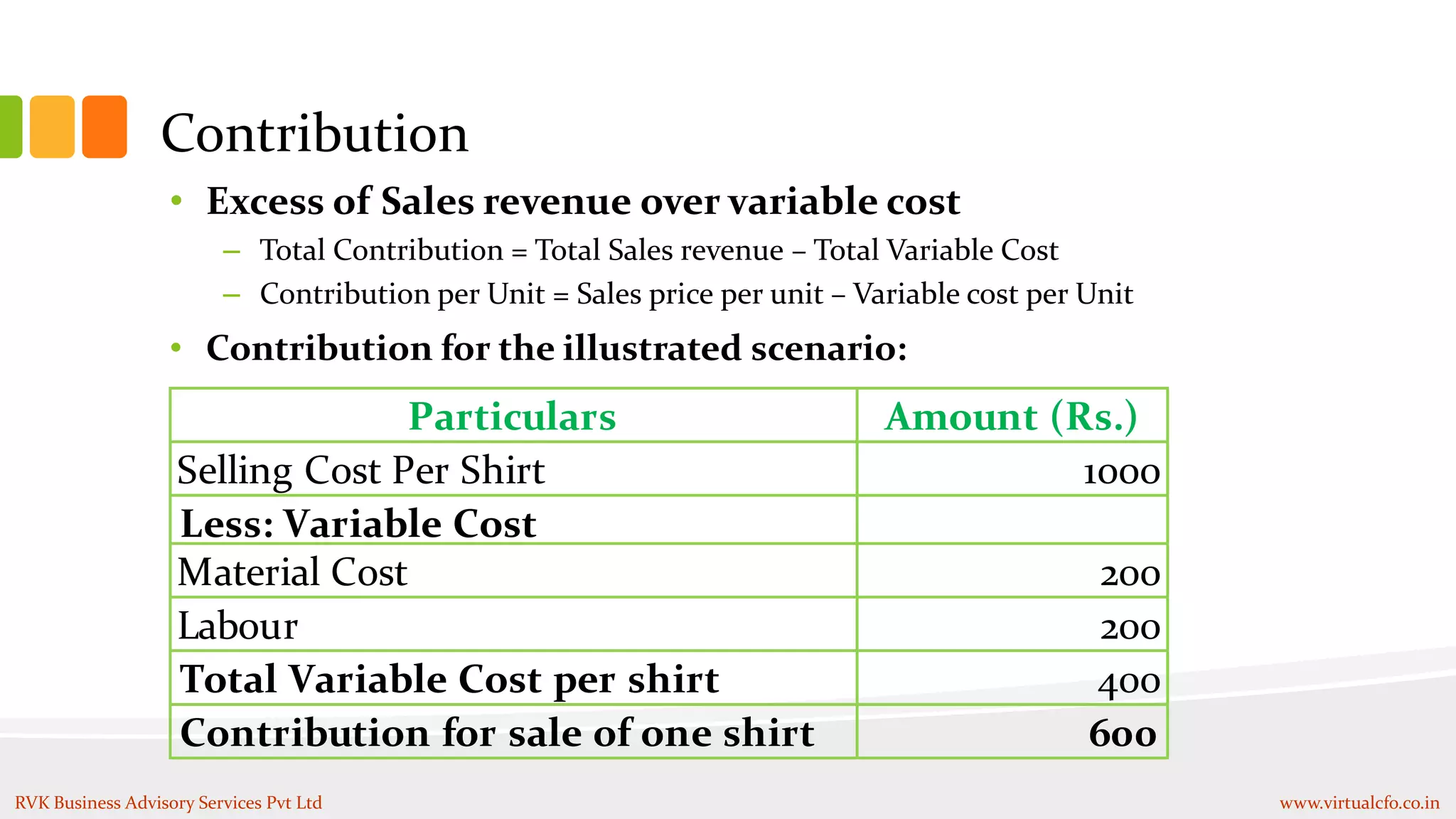

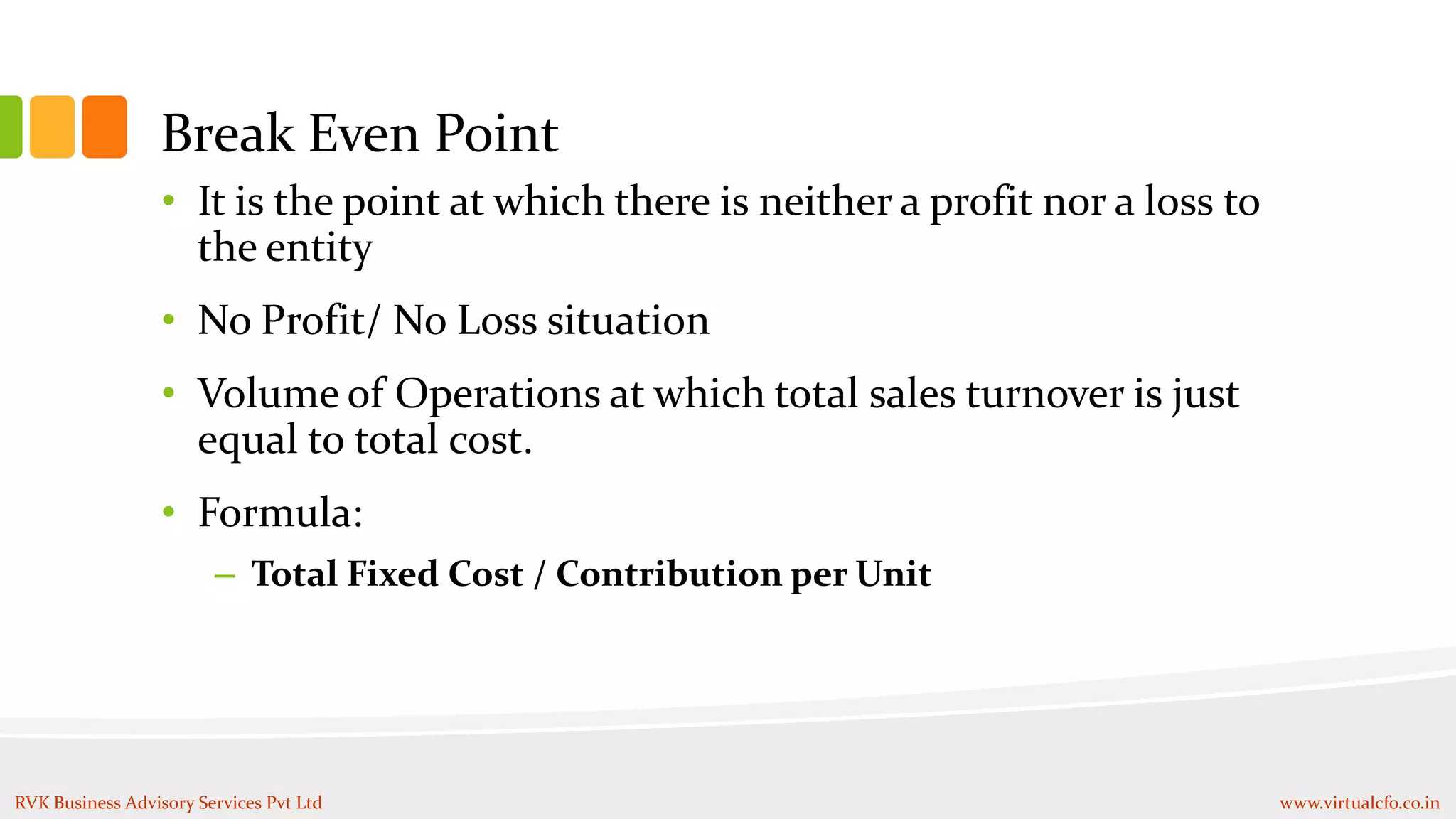

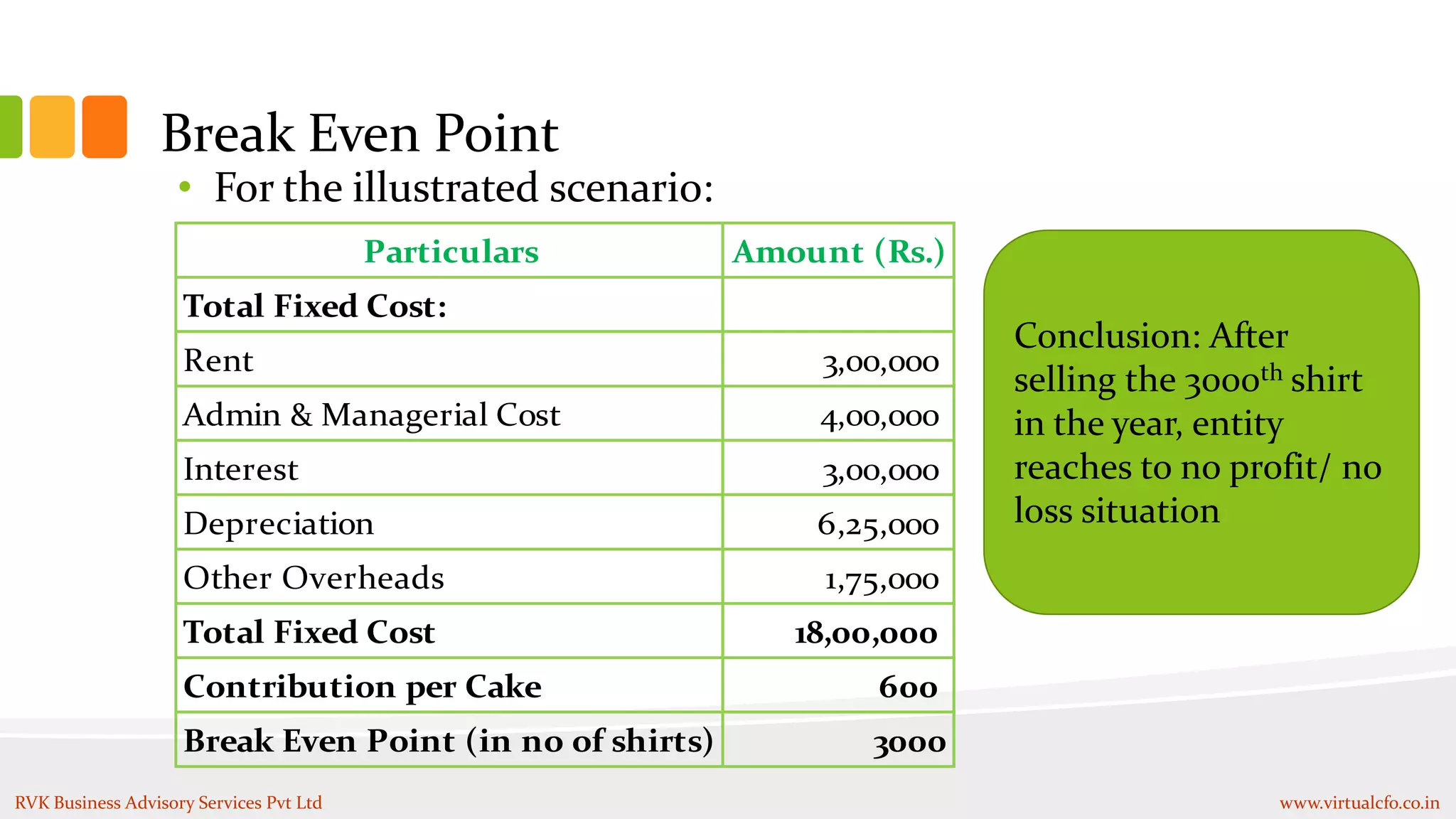

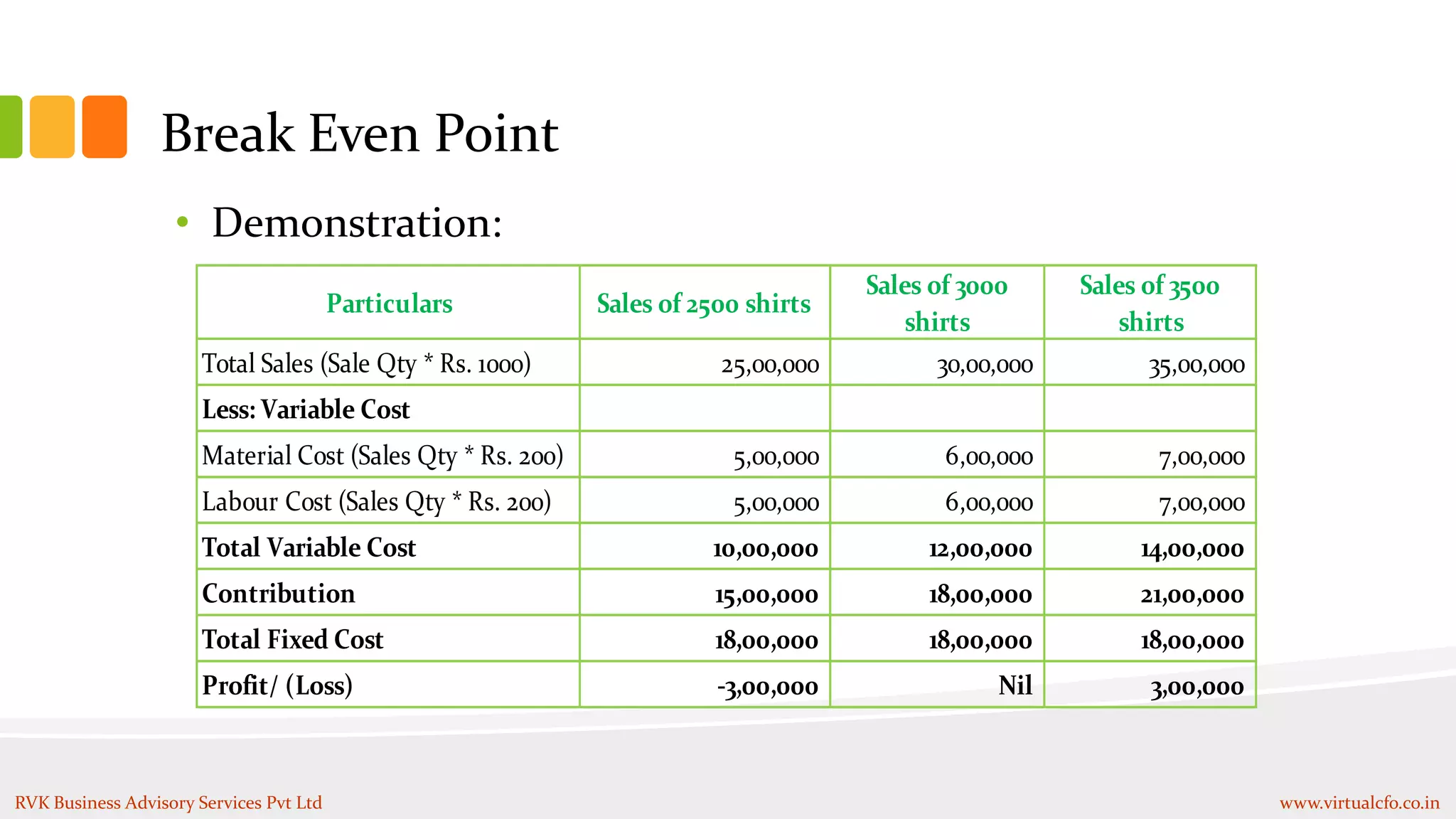

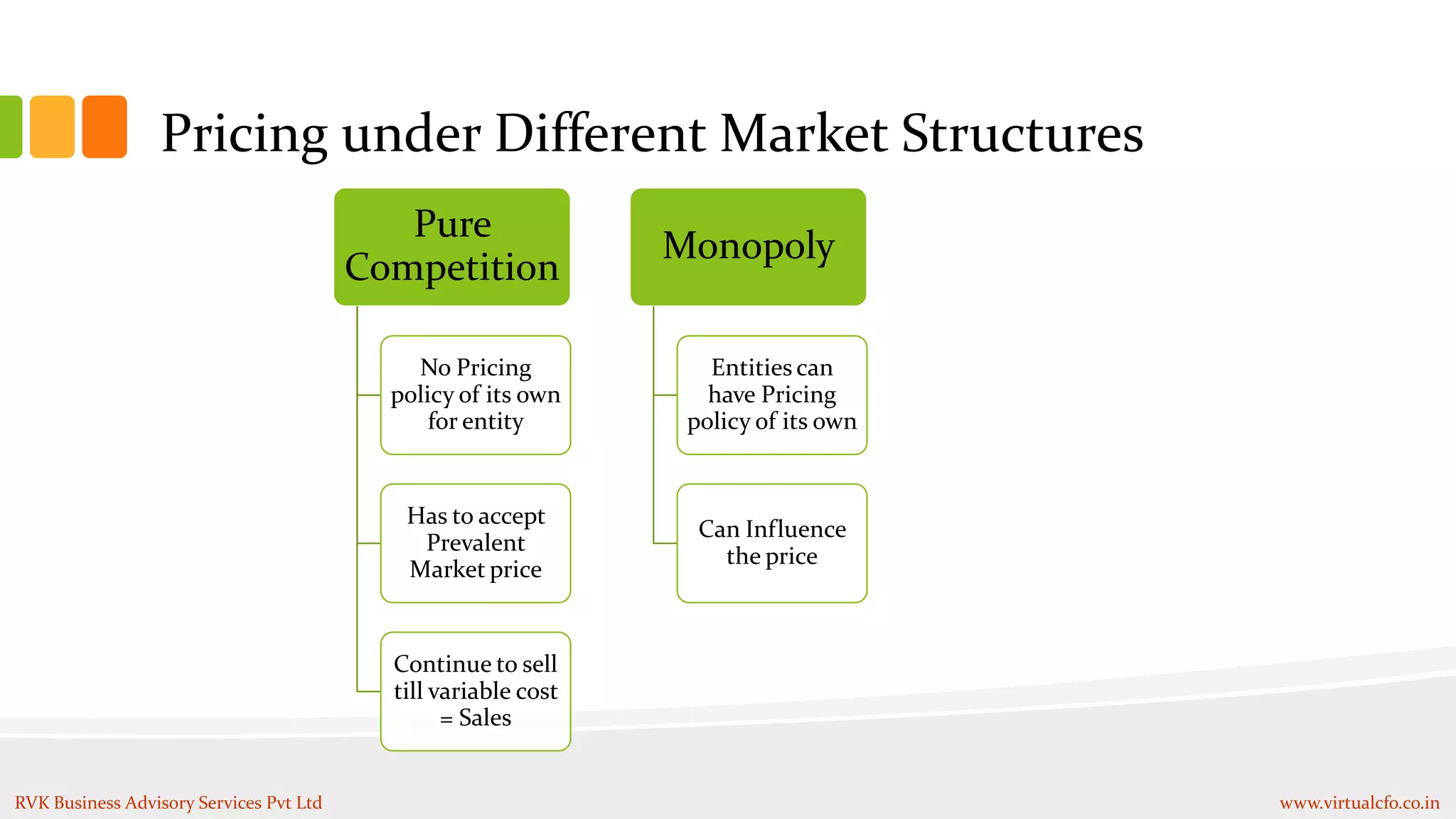

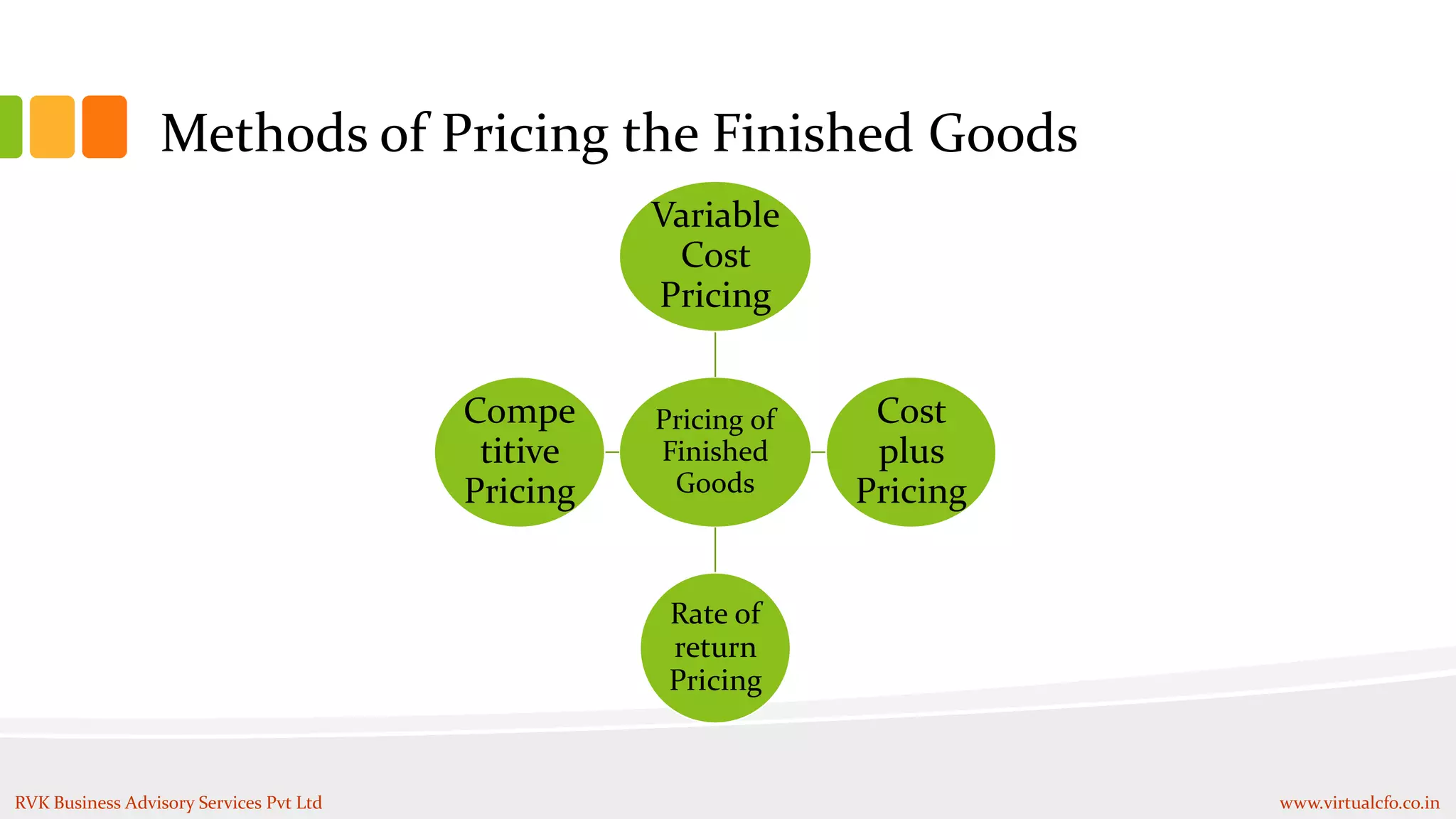

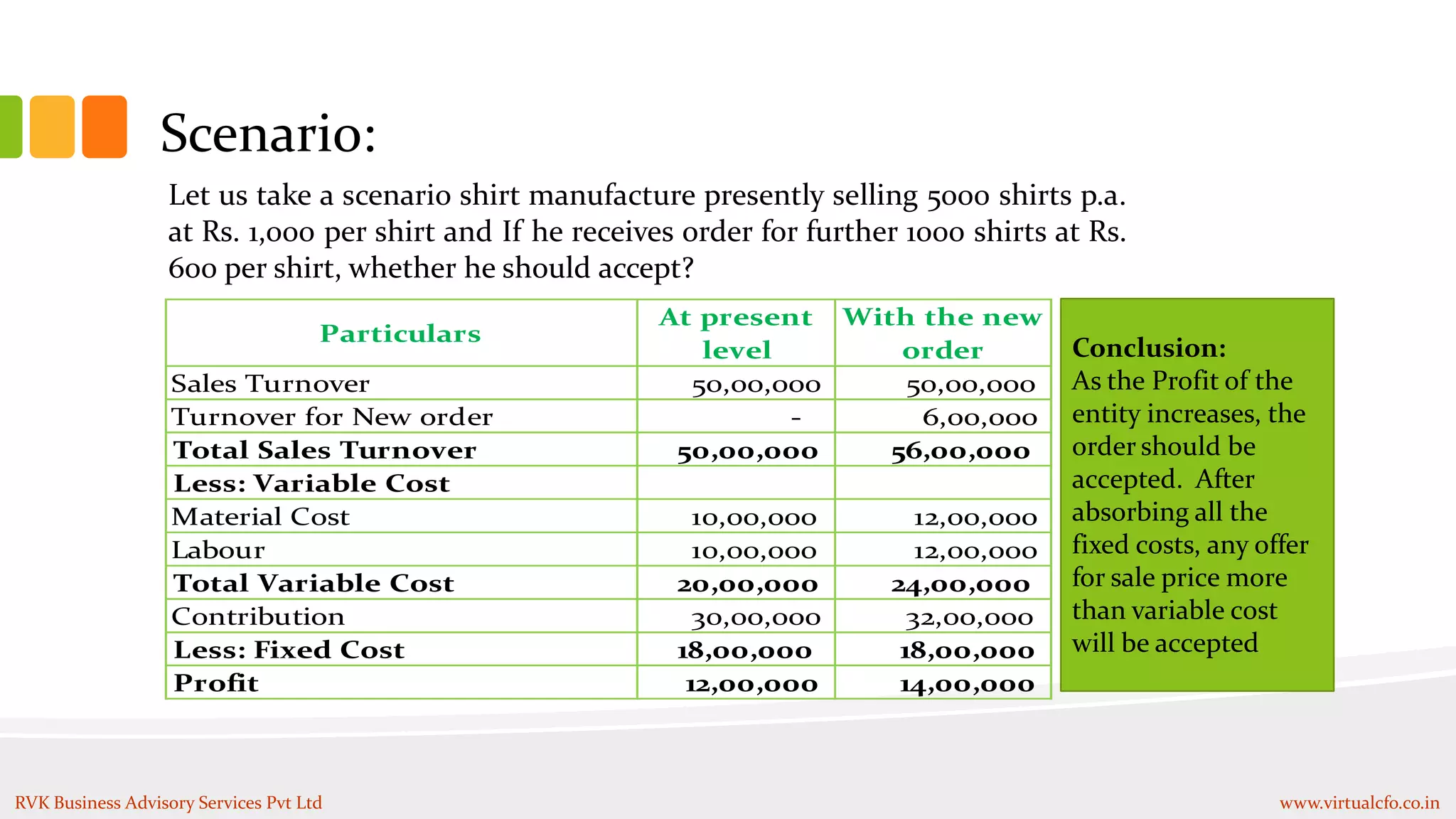

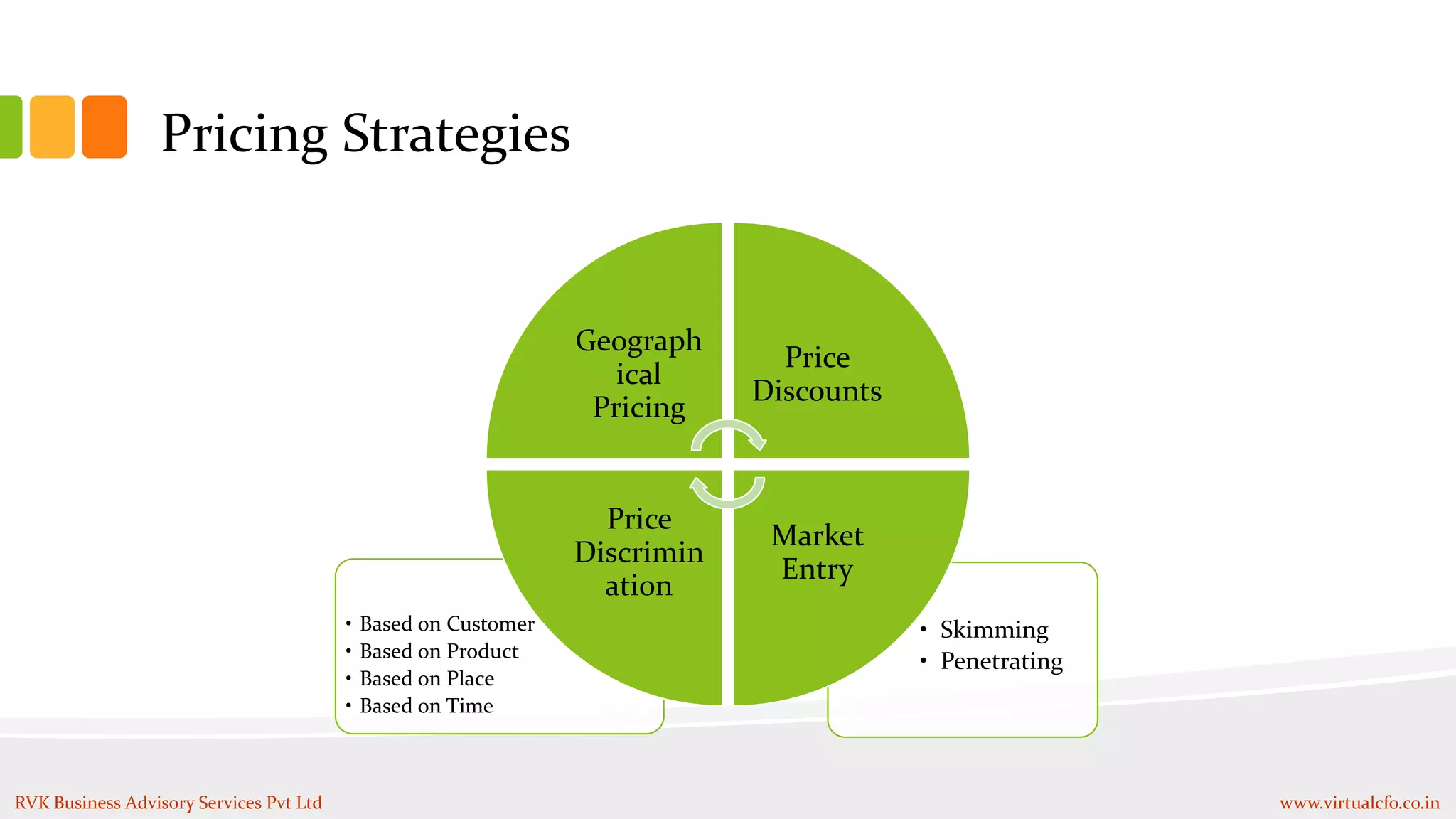

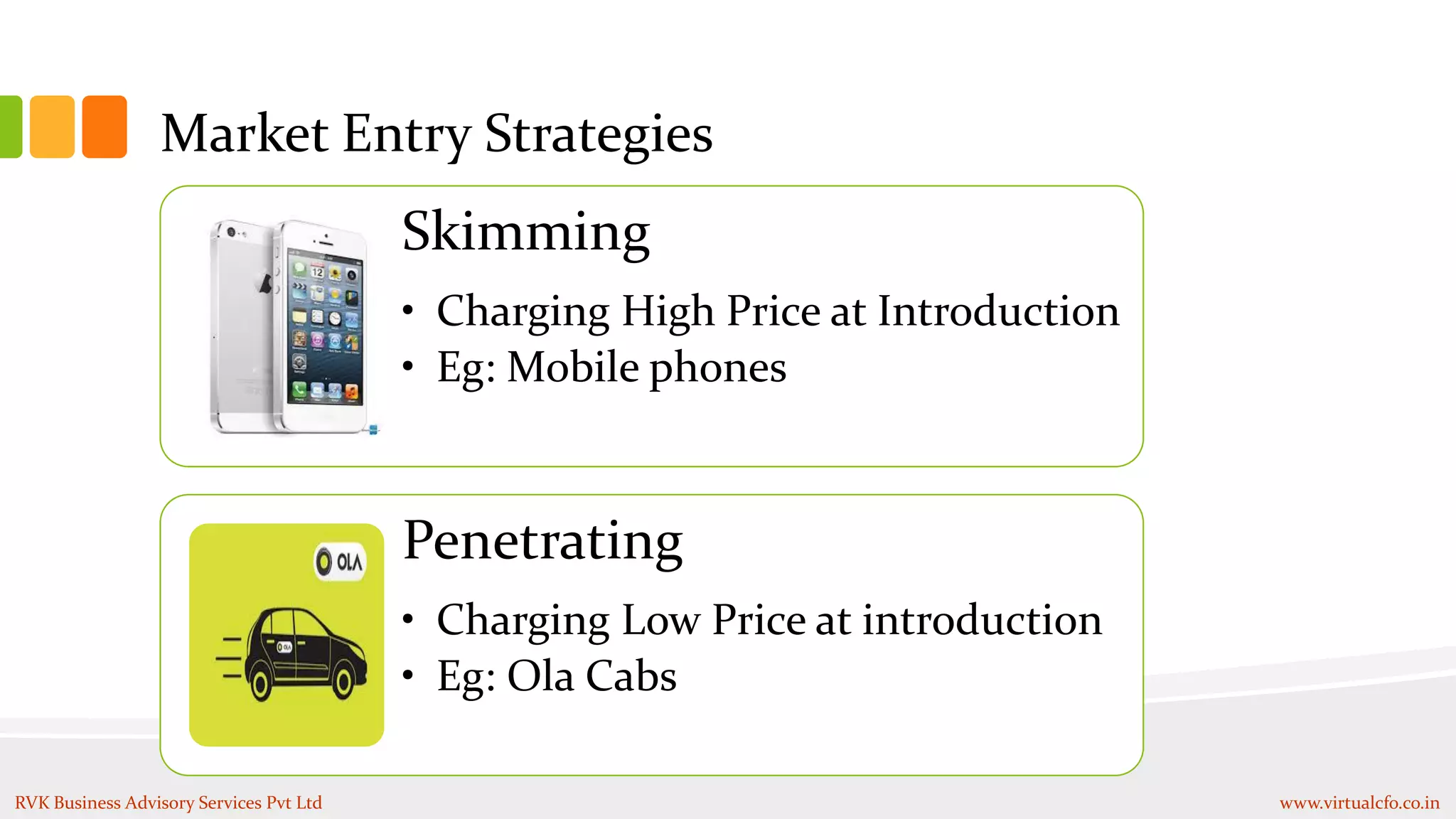

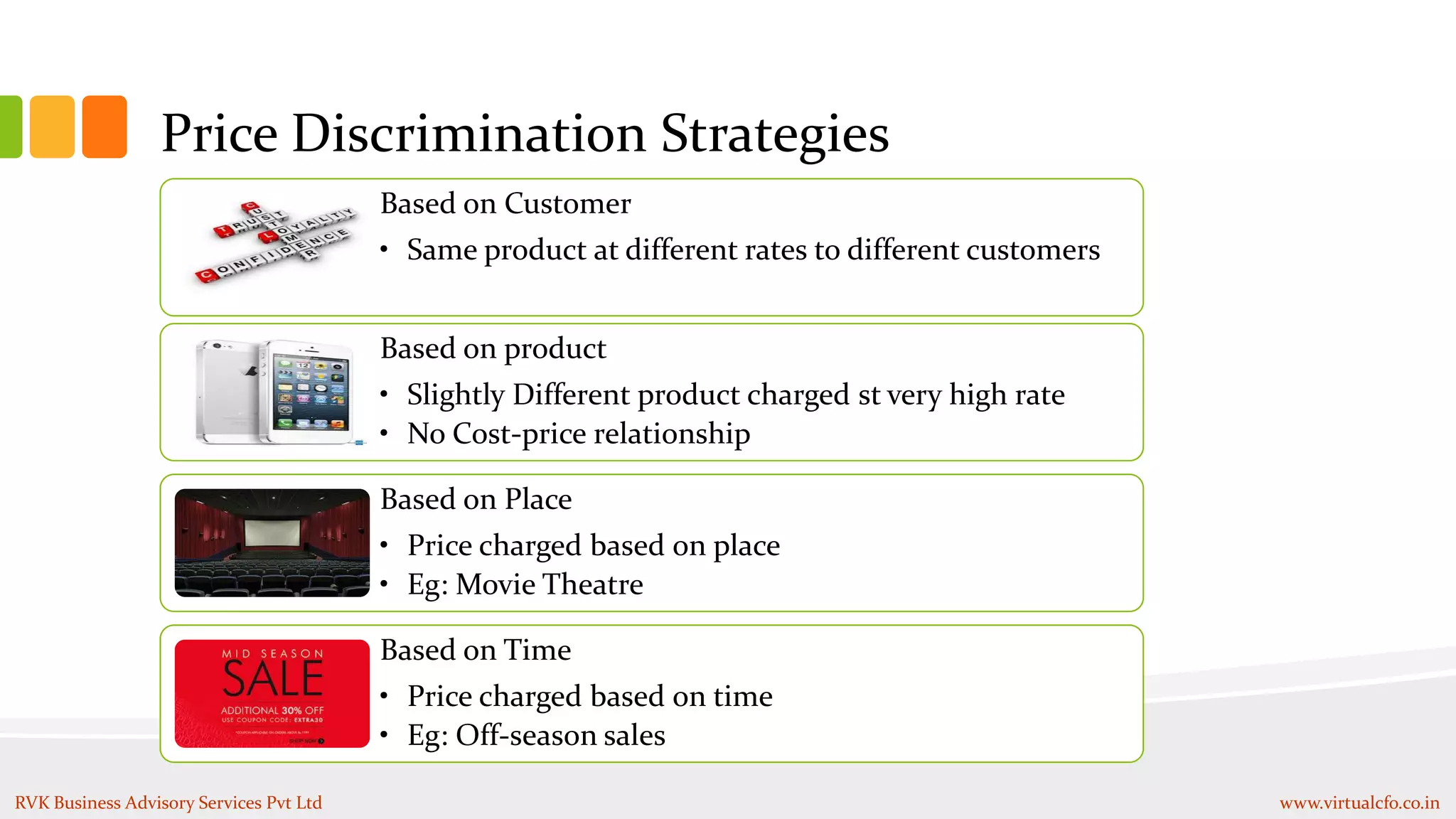

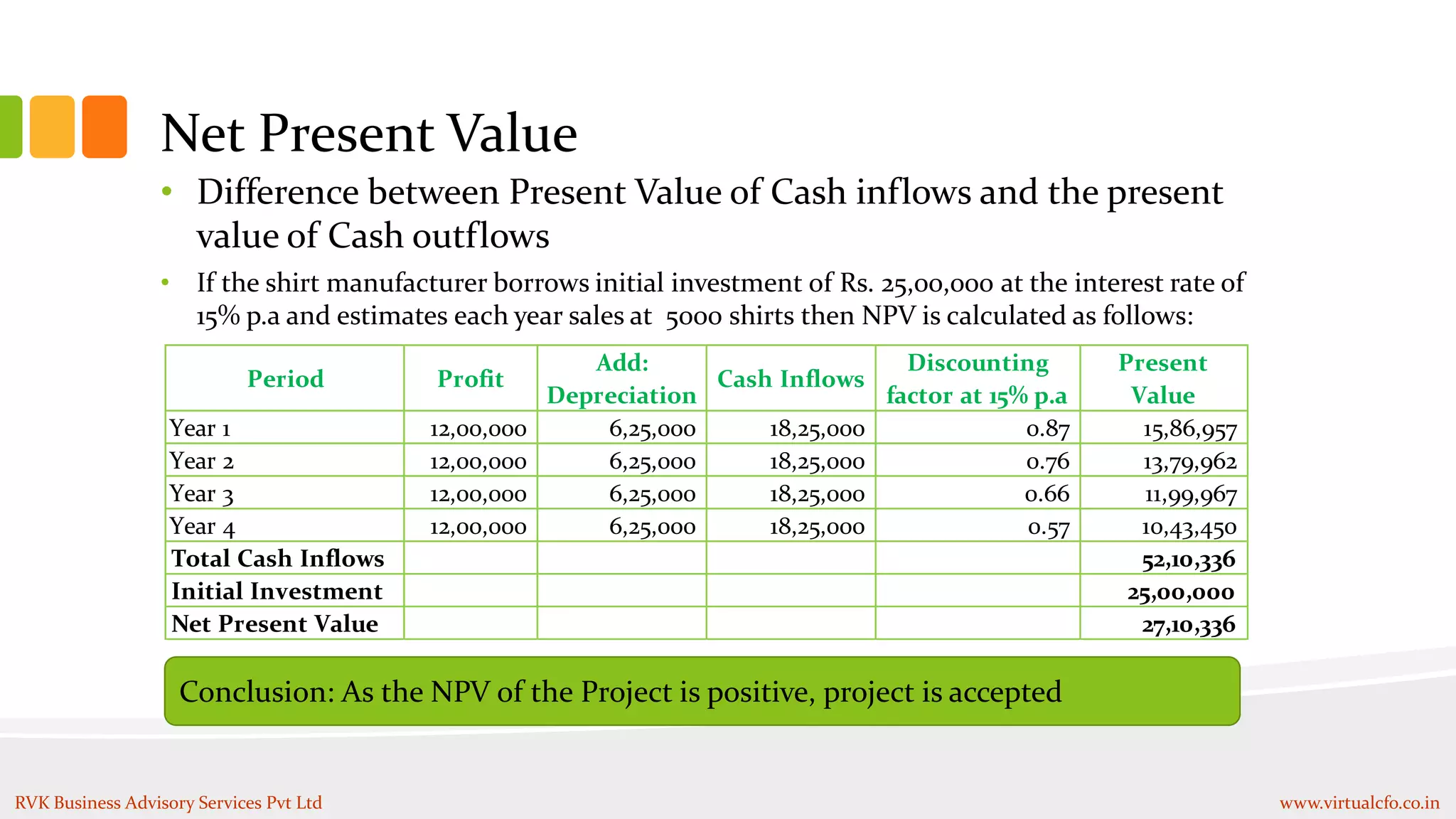

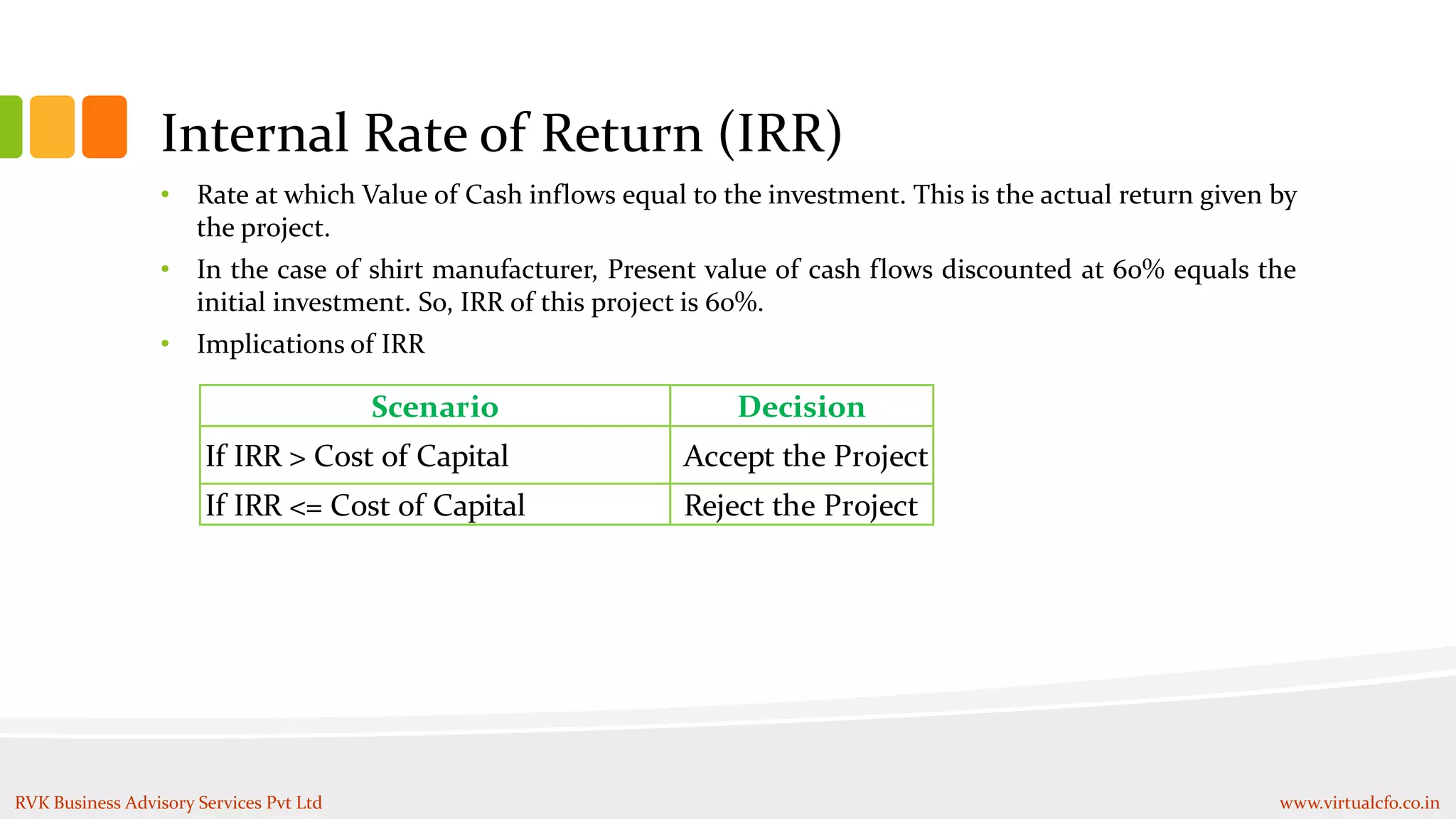

The document provides an overview of basic cost concepts. It defines key terms like cost, costing, cost accounting and cost accountancy. It describes the advantages of cost accounting such as cost determination, price determination, product profitability analysis, decision making, cost control and reduction, and statutory compliance. It distinguishes between financial accounting and cost accounting. It also covers concepts like classification of costs, contribution, break-even point, product pricing, and pricing strategies.