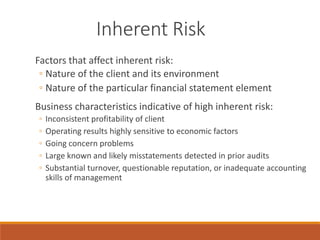

The document discusses audit evidence and procedures. It defines the components of audit risk as inherent risk, control risk, and detection risk. It explains that auditors must obtain sufficient appropriate audit evidence to reduce audit risk to a low level. The evidence should be relevant, reliable, directly obtained by the auditor when possible, and in documentary form. Audit procedures include risk assessment, tests of controls, analytical procedures, and tests of account balances, transactions and disclosures. Changing the nature, timing, or extent of procedures can alter the scope of the audit work performed.